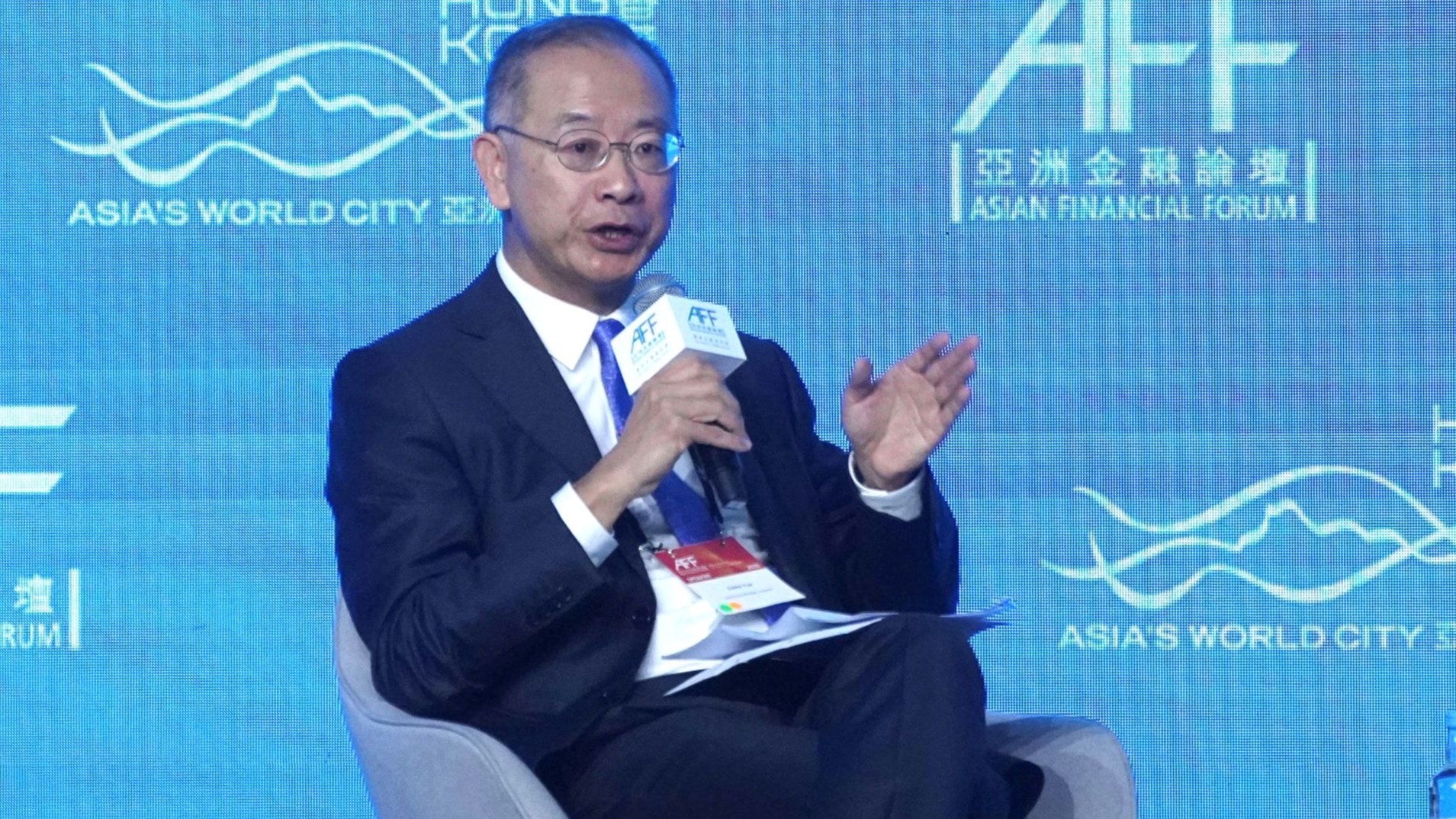

Hong Kong Monetary Authority (HKMA) Chief Executive Eddie Yue Wai-man warned the city’s business loan and mortgage loan borrowers to be prepared for the possibility of an increase in Hong Kong interest rates, when Hong Kong dollar interbank interest rates more sensitive to changes in market liquidity.

In an HKMA insight article published on Friday, the HKMA chief executive said when the aggregate balance drops to a level where the supply of and demand for Hong Kong dollars is roughly balanced, then the Hong Kong dollar interbank interest rates will rise and move closer to the US interest rate level, and this will make Hong Kong dollar interbank interest rates more sensitive to changes in market liquidity.

“Amid the current uncertain global economic and financial environment and with frequent changes in capital flows, local residents need to carefully assess their financial situations and risk tolerance when considering home purchase, investment or borrowing decisions, and pay attention to the possibility that Hong Kong interest rates may rise in the future,” Yue said.

READ MORE: HKMA intervenes as currency hits weak end of trading range

The HKMA will, as always, closely monitor changes in the financial market and maintain Hong Kong's monetary and financial stability through the effective Linked Exchange Rate System, he pledged.

The HKMA intervened for the fourth time in two weeks to prevent the city’s currency from weakening beyond its official trading band of HK$7.75 to HK$7.85 per greenback. It purchased HK$13.3 billion ($1.7 billion) in local dollars on Friday. Its three previous rounds defending the currency cost it a total of HK$59 billion, according to Bloomberg’s calculations using official data.

The aggregate balance will decrease to about HK$101.2 billion on July 14 following the latest intervention, the HKMA said.

With dwindling liquidity, the city’s banking regulator added that the Hong Kong dollar interbank offered rates have begun to respond and rise moderately. The one-month interbank offered rate gradually rose to 1.08 percent on Friday, and the overnight interbank offered rate has been slightly adjusted upward from near zero to 0.09 percent.

From May to June, the market saw a huge demand for Hong Kong dollar funds along with ample market liquidity due to strong capital inflows. The aggregate balance has once surged to over HK$170 billion.

READ MORE: Strong Hong Kong dollar helping home sales, fueling hope

But since July, listed enterprises have been converting part or all of their Hong Kong dollar holdings into other currencies as the peak period of dividend payments comes to an end, and non-local companies recover or invest their Hong Kong dollar proceeds from share listings or bond issuances. In addition, the short-term demand for the Hong Kong dollar due to the half-year results announcement has also come to an end.

“The main policy objective of the LERS is to maintain the stability of the Hong Kong dollar exchange rate, not the interest rate, which is affected by the supply and demand of Hong Kong dollar as well as the US interest rate. The recent changes in the Hong Kong dollar exchange rate and interest rate just reflect the normal operation of the LERS,” Yue said.

Hong Kong has maintained the currency peg, which is an automatic mechanism, since 1983: the authorities absorb flows when the currency hits either side of the trading band, which drains or adds to the reserves that banks hold with the HKMA.