On a recent afternoon at the BYD Tsuen Wan store, office worker Stephen Lam committed to buying his first elective vehicle — a new five-seater SUV — after two hours of consideration and a four-month search.

He could become one of the model’s first buyers worldwide ahead of its official launch on Friday, joining a growing number of Hong Kong residents placing their trust and confidence in mainland EVs.

BYD Sales Manager Dicken Lam Tik-hang said the 20,000-square-foot (1,858-square-meter) Tsuen Wan store receives around 30 visitors daily, with over 100 on peak days.

ALSO READ: HK starts building city’s first public hydrogen charging system for EVs

The rise in local interest and purchases stems from years of efforts by mainland EV giants to expand their footprint in the Hong Kong Special Administrative Region. The companies aim to tap into the evolving local market driven by government incentives and consumer demand, while using Hong Kong as a springboard to grow globally.

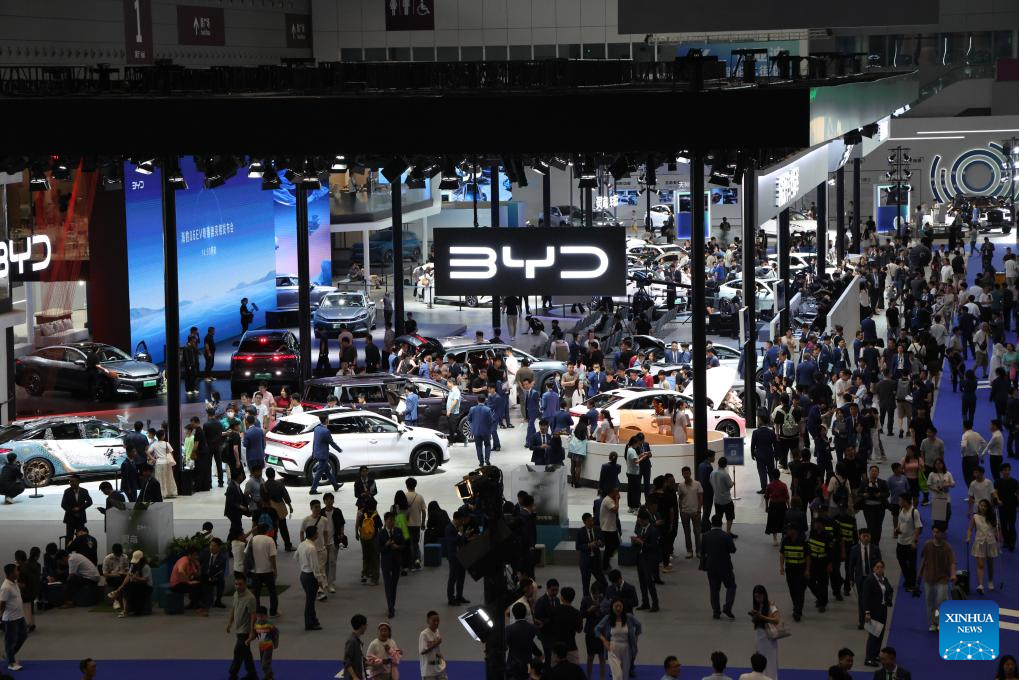

In the first half of 2025, BYD — recently ranked 91st on the Fortune Global list and a four-year member of the Top 500 — accounted for 27 percent of Hong Kong’s new electric private car registrations, selling 4,902 units out of 18,356. Tesla followed with 21.1 percent, while Zeekr, an EV brand from Hangzhou-based Geely, and XPeng, a Guangdong province company, also finished in the top six.

Taken together, BYD, Zeekr and XPeng commanded over 35 percent of Hong Kong’s private EV market.

A government census last year showed that private EV registrations in Hong Kong have surged sevenfold over the past five years, totaling more than 100,000 so far. By late 2023, EVs had emerged as a common sight on the city’s roads, capturing over 11 percent of the private car fleet.

Hong Kong has been supercharging its EV transition with tax incentives and multiple license fee sweeteners, aiming to end new gasoline car sales — including hybrids — by 2035.

These measures include the One-for-One Replacement Scheme. Drivers who scrap and de-register their private cars to switch to new EVs can enjoy a first registration tax concession cap of HK$172,500 ($21,975) under the program. From 2018 to late 2023, the program prompted the scrapping of 60,700 gasoline-powered private cars in favor of EVs. Over the same period, the number of private EV registrations climbed sixfold.

Currently, the annual license fee for a private EV, based on the car’s weight, is also significantly lower than that of a gasoline-powered car, which is calculated by its engine size.

Hong Kong’s notable progress in EV popularization was lauded by Chen Qingquan, known as “the father of Asian EVs” for his innovative application of the alternating current motor driving system to electric vehicles. Chen is now an academician at the Chinese Academy of Engineering and a professor at the University of Hong Kong.

He credited Chinese EVs’ superior price-performance ratio as the primary pillar of their conspicuous rise in the city.

This cost efficiency, Chen said, stems mainly from the well-established and efficient supply chains for EVs’ key components on the mainland — from batteries and power trains, to vehicle bodies.

READ MORE: Explosive growth being achieved in global technology and innovation

Another potential BYD owner, retiree Stella Ou cited BYD’s competitive pricing, body design, leather soft trim, and lifetime battery warranty as key draws. The model she chose recently was Hong Kong’s best-selling EV in the first half of 2025 with nearly 3,700 units sold, according to the Transport Department.

Ou cited BYD’s competitive pricing, body design, soft leather trim, and lifetime battery warranty as key draws.

Affordability aside, it is mainland carmakers’ broad product lineup in Hong Kong — from value-oriented people-movers to luxury models — that makes their prominence in the EV race “nearly inevitable”, said Zeng Zhiling, director of LMC Automotive Consulting.

Similarly, these advantages have helped mainland-made EVs gain favor overseas. In 2024, China became the world’s largest car exporter with over 5.85 million exported vehicles, including over 2 million electric ones.

Tackling ‘charger anxiety’

Yet amid the export boom, Zeng stressed that BYD and other mainland EV-makers must proactively develop localized support ecosystems — particularly charging infrastructure — across Hong Kong and international markets.

He cautioned that, as new entrants, their reliability remains under intense scrutiny, especially regarding the resilience of their support and service networks.

Stephen Lam, the new buyer, admitted that a visceral “charger anxiety” initially daunted him from switching from a gasoline to an electric vehicle, after witnessing EV owners jostling at public charging stations.

After a three-year negotiation with the government, Lam’s residential estate was granted a HK$15 million subsidy to build more EV chargers. In April, Lam invested over HK$16,000 to install a personal-use charger after subsidies.

Lam insisted that the city’s public EV charging network remains underpowered to sway gasoline holdouts without a home charger.

ALSO READ: BYD raises $5.59 billion in share sale, Hong Kong's largest in four years

As of March, Hong Kong had nearly 100,000 charging-equipped parking spaces, including 11,180 public chargers — only about 2,000 of which are fast chargers recommended for daily EV use.

The authorities plan to deploy 220 rapid chargers at 180 gasoline stations by 2026, benefiting over 11,000 EVs.

In his Policy Address last year, Chief Executive John Lee Ka-chiu pledged HK$300 million to incentiveize the installation of 3,000 private fast chargers by the end of 2028, supporting charging for some 160,000 additional EVs.

In a written reply to China Daily, BYD’s Hong Kong branch said its strong sales performance in the first half of the year reflects recognition from Hong Kong consumers.

With EVs becoming mainstream, the company believes that more resources will be directed toward building and upgrading the charging infrastructure, citing its new “megawatt flash charging” technology — which can deliver a driving range of up to 400 kilometers with just a five-minute charge.

BYD is willing to collaborate with more partners to build charging facilities and achieve mutual benefit, the company said.

LMC Automotive’s Zeng said Hong Kong’s ability to elevate brands into broader markets. One finds examples in the meteoric rise of Toyota Alphard — a hybrid model that became a coveted status symbol among mainland business elites after first gaining traction on Hong Kong’s elite transportation scene, Zeng said.

‘Ideal gateway platform’

Mainland EV brands’ success in Hong Kong — a right-hand-drive market — facilitates their future expansion into markets like Thailand, the United Kingdom, Australia, and New Zealand. Hong Kong can also act as a strategic testing ground for mainland companies aiming to enter new markets, Zeng said.

Data from LMC showed a turbocharged global drive. BYD’s overseas deliveries in the first half of 2025 notched up over 460,000 — marking a 125 percent year-on-year increase — with its full-year exports well on track toward 800,000.

READ MORE: China, EU discuss EV anti-subsidy case, brandy probe, export controls

Looking ahead, Chen said he hoped that Hong Kong can play a ubiquitous role in mainland EV makers’ going-global — beyond exporting vehicle units — by relocating production capacity and deploying the entire industrial chain.

In tandem with overseas expansion are risks, Chen said. Navigating different legal, regulatory, cultural, and business landscapes requires exhaustive diligence, he said, and this is where Hong Kong — with its integrated strength spanning professional consultancy, transnational legal and regulatory expertise, as well as financial solutions — is well-positioned as a “critical risk mitigator”, “ideal gateway platform”, even “an end-to-end steward”.

Contact the writer at wanqing@chinadailyhk.com