The Hong Kong Monetary Authority intervened for the fourth time in two weeks to prevent the city’s currency from weakening beyond its official trading band.

The HKMA purchased HK$13.3 billion ($1.7 billion) of the local dollar on Friday. Its three previous rounds of currency defense had cost it a total of HK$59 billion, according to Bloomberg’s calculations of official data.

The continued intervention shows the pressure on the HKMA to maintain the local dollar in a trading range of HK$7.75 to HK$7.85 per greenback as it deals with the repercussions of its earlier efforts to restrain the currency. Its earlier sales of the Hong Kong dollar flooded money markets and caused local rates to tumble versus those in the US, putting even more pressure on the currency.

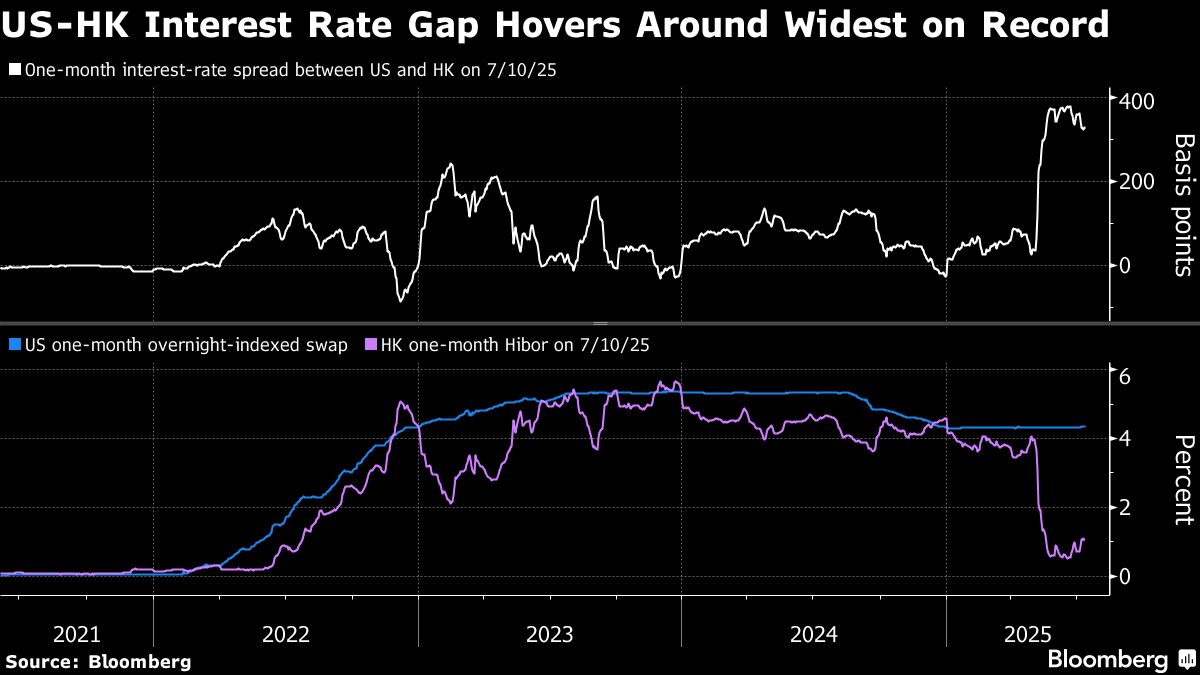

The difference between one-month interbank rates in the Hong Kong dollar and US dollar markets is currently near the widest on record, making it attractive for traders to short the local currency in favor of the higher yielding greenback. The HKMA is now seeking to dampen such trades by withdrawing liquidity from the financial system.

“The large gap between the Hong Kong Interbank Offered Rate (HIBOR) and the Secured Overnight Financing Rate (SOFR) means the Hong Kong dollar will continue to test the weak side of the convertibility undertaking, prompting more HKMA intervention,” said Khoon Goh, head of Asia research at Australia & New Zealand Banking Group.

Hong Kong maintains the peg through the Linked Exchange Rate System, an automatic mechanism: authorities absorb flows when the currency hits either side of the trading band, which drains or adds to the reserves banks hold with the HKMA.

Although draining liquidity supports the Hong Kong dollar, it also puts upward pressure on rates since there is less money for banks to lend.

The latest intervention amount is “pretty tiny” as the aggregate balance — a measure of how much cash banks hold with the HKMA — will still be above HK$100 billion, said Stephen Chiu, chief Asia FX and rates strategist at Bloomberg Intelligence. The HKMA "just needs to keep going till the aggregate balance shrinks below the HK$70 billion-HK$80 billion and there is a more meaningful jump in the HIBORS".

The aggregate balance will decrease to about HK$101.2 billion on July 14 settlement on the latest intervention, according to HKMA data.

READ MORE: Hong Kong steps up defense of FX peg as fixed range tested again

The overnight HIBOR inched up two basis points to 0.09 percent while the three-month rate rose five basis points to 1.85 percent on Friday. Both rates touched their highest levels since May. The city’s currency was little changed at 7.8498 per greenback.

The latest moves in the Hong Kong dollar and interest rates reflect the normal operation of the dollar peg, HKMA Chief Executive Eddie Yue Wai-man says in a statement. The HKMA will maintain the city’s monetary and financial stability through the effective linked exchange rate system, he said.