WASHINGTON - The Federal Reserve held interest rates steady on Wednesday but said the risks of higher inflation and unemployment had risen, further clouding the US economic outlook as its policymakers grapple with the impact of President Donald Trump's tariffs.

At this point, Fed Chair Jerome Powell said, it isn't clear if the economy will continue its steady pace of growth, or wilt under mounting uncertainty and a possible coming spike in inflation. With so much unsettled about what Trump will ultimately decide and what of that survives possible court and political battles, "the scope, the scale, the persistence of those effects are very, very uncertain," Powell said in a press conference at the end of a two-day policy meeting. "So it's not at all clear what the appropriate response for monetary policy is at this time ... It's really not at all clear what it is we should do."

"I don't think we can say which way this will shake out."

ALSO READ: Fed chair warns of persistent inflation resulting from tariff hikes

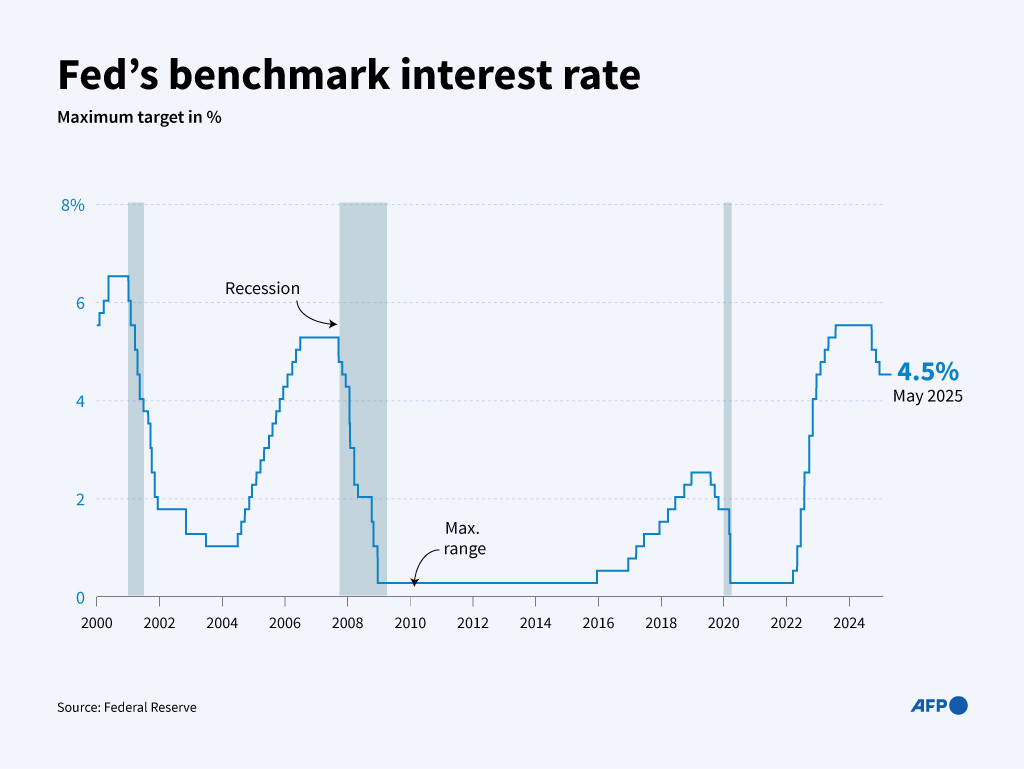

It was Powell's subtle way of saying the US central bank, a key actor in shaping the economy, was effectively sidelined until Trump's sweeping policy agenda takes full effect. The Fed's policy statement, which held the benchmark overnight rate steady in the 4.25 percent- 4.50 percent range, noted that since the central bank's last meeting in March "uncertainty about the economic outlook has increased further," and that risks were increasing that both inflation and unemployment could increase. Thomas Simons, chief US economist at Jefferies, said the language downplayed just how much disruption had occurred since the Fed's March 18-19 meeting, and how unpredictable the outlook had become.

"All of the 'Liberation Day' tariff news, the April 9 announcement of a 90-day delay, the back and forth on trade deals and tariff exemptions in the headlines, and the resultant negativity expressed in business and consumer surveys make it impossible to judge what the economic outlook is, let alone whether the skew of risks around it has changed," Simons wrote, calling Powell "predictably noncommittal" given the situation.

Risks to dual mandate

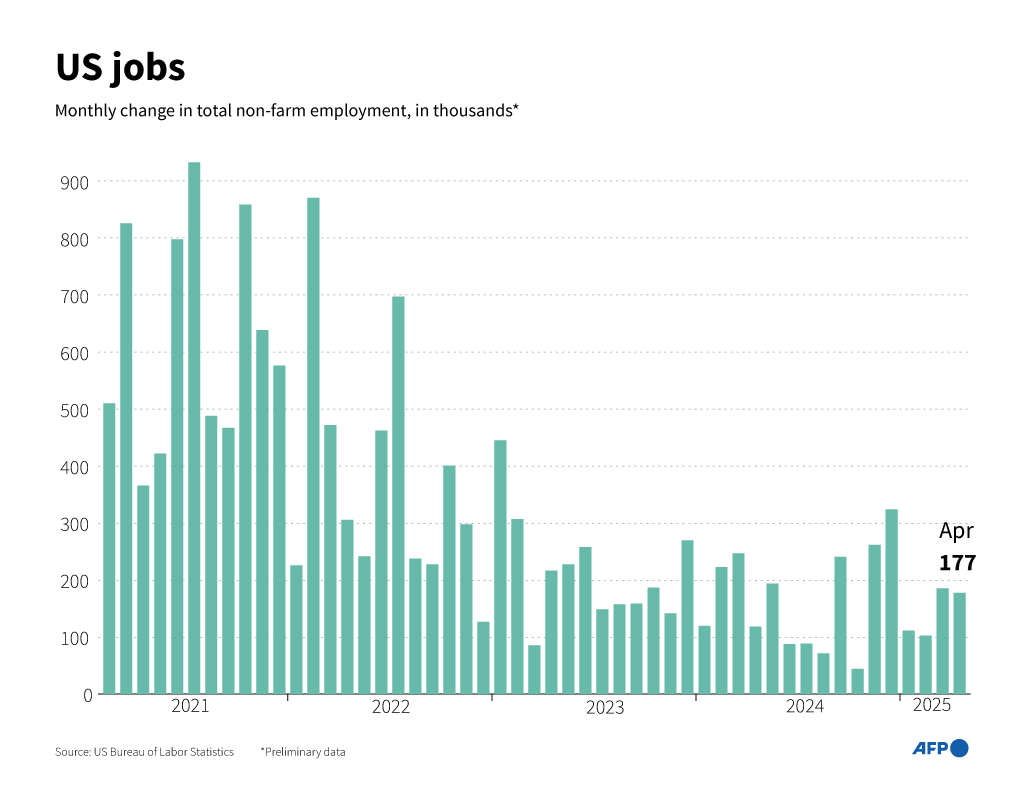

The Fed's statement, and much of Powell's comments to reporters as well, vouched for the economy's continued resilience, with job gains continuing and the economy still growing at a "solid pace." The recently reported decline in gross domestic product in the first quarter, Powell said, was skewed by a record rush of imports as businesses and households tried to front-run expected import taxes, with measures of domestic demand still growing. But even that data demonstrated the dilemma facing the Fed. The rush of front-loading to buy goods and stock shelves won't likely be repeated, and it is unclear whether underneath it all demand and investment are starting to weaken - and how that will eventually express itself in "hard" data on inflation and jobs. The Fed's own "Beige Book" of anecdotal reports about the economy recently gave a dour picture of suspended business deals, falling demand, and rising prices.

READ MORE: Fed official warns against recession risk

"Businesses and households are concerned ... and postponing economic decisions of various kinds," Powell said. "If that continues and nothing happens to alleviate those concerns, you would expect that to show up in economic data." The Fed can't respond, however, until it is clear which way the economy pivots, and how it assesses the risks to its two goals of holding inflation to 2 percent and sustaining maximum employment.

"The current stance of monetary policy leaves us well positioned to respond in a timely way to potential economic developments," Powell said, affirming a wait-and-see approach that has become the central bank's calling card in the first months of the Trump administration.

US stock prices extended gains after the release of the Fed's unanimous policy decision and ended higher on the day. Treasury yields fell, while the dollar gained against a basket of currencies.

'Holding pattern'

The direction of Fed policy will depend on which of the job and inflation risks develop, or, in the more difficult outcome, whether inflation and unemployment increase together and force the central bank to choose which risk is more important to try to offset with monetary policy.

A weaker job market would typically strengthen the case for rate cuts; higher inflation would call for monetary policy to remain tight.

READ MORE: US Fed keeps interest rates unchanged at 4.25-4.5% amid inflation concerns

"For the time being the Fed remains in a holding pattern as it waits for uncertainty to clear," said Ashish Shah, chief investment officer of public investing at Goldman Sachs Asset Management, adding that "recent better-than-feared jobs data has supported the Fed's on-hold stance, and the onus is on the labor market to weaken sufficiently to bring a resumption of its easing cycle."

The Fed's policy rate has been unchanged since December as officials struggle to estimate the impact of Trump's tariffs, which have raised the prospect of higher inflation and slower economic growth this year.

When policymakers last updated their economic and policy projections in March, they anticipated reducing the benchmark rate by half a percentage point by the end of this year.