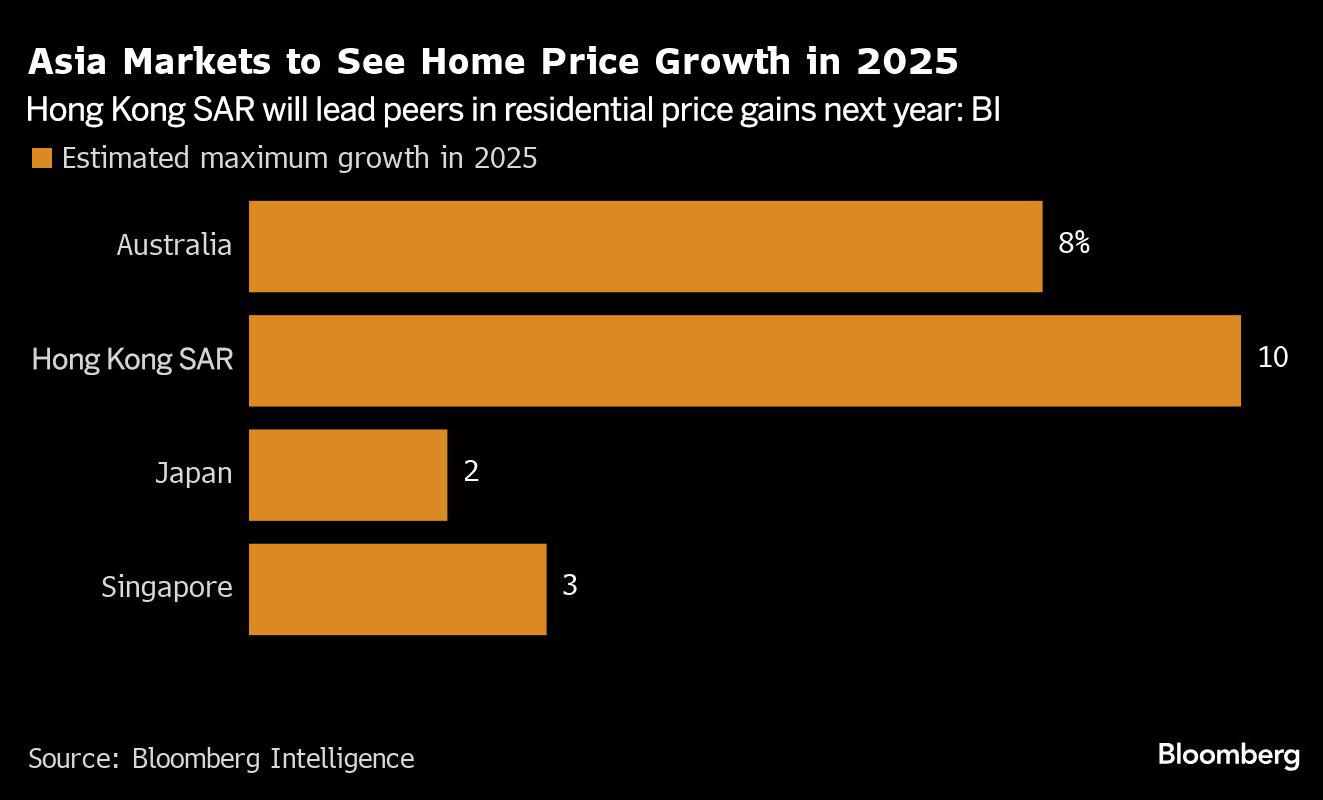

Property prices in Asia’s major markets are expected to rise over the next year with the Hong Kong Special Administrative Region leading the projected gains, according to Bloomberg Intelligence.

Beyond Hong Kong SAR, homes in Singapore, Australia and Japan will all become more expensive in 2025, a report from BI found.

For Hong Kong, the numbers reverse a years-long decline in home prices. Values are likely to climb as much as 10 percent, according to analysts including Ken Foong. Australia’s residential prices will gain between 7 percent and 8 percent, while Singapore and Japan are expected to record modest growth of 3 percent and 2 percent, respectively.

ALSO READ: HK property market improves amid rate cuts

Interest rate cuts and supportive economic policies are lifting Hong Kong’s property prices, which slumped almost 30 percent since peaking in 2019. The HKSAR government recently relaxed its mortgage rules to allow lower down payments, a move that should encourage more buyers to enter the market.

Australia’s uptick is driven by Perth and Brisbane. Gains of 15 percent and 10 percent are anticipated after already rapid rises this year. Property in Sydney will see only a 5 percent increase, because the average households remain priced out, BI said.

After a drop in the third quarter of this year, prices in Singapore should rise as interest rates fall. Housing demand will continue to be supported by inflation-hedging power, healthy household balance sheets, cheaper interest rates and the demand from public home owners upgrading to private apartments.

However, selective buyers, macroeconomic uncertainty, more property launches and unsold inventory may limit further growth, BI’s analysts wrote.

READ MORE: Midland, Centaline anticipate mild recovery in HK home prices

Meanwhile, potential inflationary pressure in Japan could underpin a further climb in home prices in major cities including Tokyo and Osaka.