Student dormitories have become the fastest-growing real estate play in the Hong Kong Special Administrative Region, with local developers, universities, and global funds piling in, betting on a steady stream of Chinese mainland students.

SAR government efforts to cement the city's reputation as a premier international center for higher education are fueling demand for student accommodation, creating a new revenue channel and stoking investor appetite for this niche asset class.

“It’s the sector that everyone is most enthusiastic about,” said Reeves Yan, head of capital markets for Hong Kong at CBRE Group Inc. “Newly built ones get rented out almost immediately.”

The strong demand and cash flow — tenants tend to pay rent for a full year — have attracted all sorts of investors including global funds and foreign investors, he added.

ALSO READ: HK to boost global hub ambitions with education pushes

In his Policy Address in September, Chief Executive John Lee Ka-chiu said the scope of the Hostels in the City Scheme, which was launched to increase student accommodation, will be expanded to redevelopment projects to further increase the supply of student dormitories.

The initiative, which began accepting applications in July, waives rezoning requirements for commercial buildings expected to be converted into student hostels, and allows developers to retain a high plot ratio.

Lee also said the government will earmark new sites for dedicated hostel development and invite market proposals this year.

At a recent conference in Singapore, Pak Man-yuen, managing director for real estate at Blackstone Inc, called the prospect of converting hotels into student housing or other residential uses “one of the most interesting opportunities” in the HKSAR. He highlighted struggling hotels, where one can pursue multiple strategies, including student housing and multifamily dwellings.

The city recorded HK$3.2 billion ($412 million) worth of transactions for dorm purposes in the first nine months this year, almost double the amount from the same period last year, data from Colliers International show. It is also going more mainstream — it accounts for 15 percent of the total number of property investments valued at HK$100 million or more so far this year, compared with 7 percent in 2024.

Mainland students

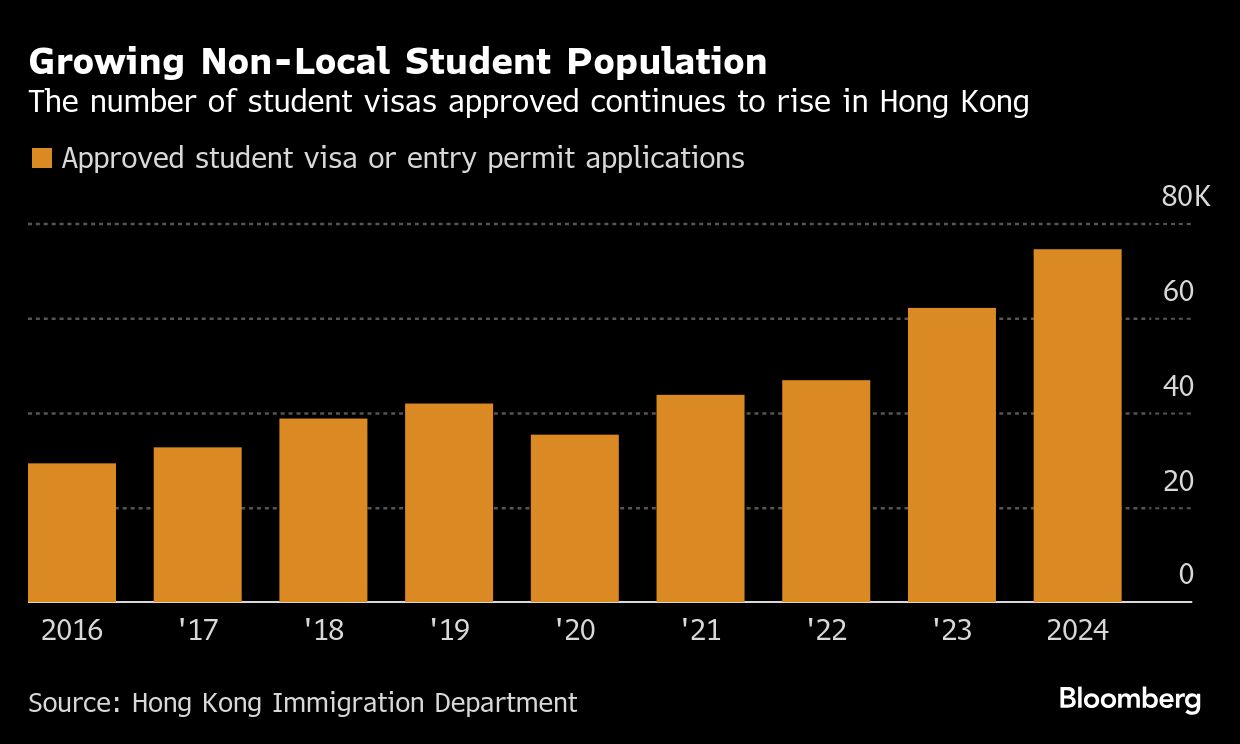

The HKSAR has seen a surge in non-local students, mostly from the mainland, over the past few years. Approved student visas more than doubled to 74,466 in 2024 from 2020, government data show. By the 2027/28 academic year, the city could face a shortfall of about 120,000 student beds, according to estimates from Colliers.

Nick Tang, chief executive director at Wang On Properties Ltd, sees the gap in the market as an opportunity. The local developer has partnered with Angelo Gordon & Co to turn a hotel into a 720-unit student rental housing property called Sunny House targeting students, which started operating last year. It has an occupancy of 98 percent, said Tang. The partnership purchased another hotel in July to add to their portfolio in the sector.

Angelo Gordon, AEW Capital Management and PGIM Real Estate are institutional investors involved in student housing projects worth HK$4.6 billion since 2021, according to Colliers.

READ MORE: Leaders aim to turn HK into higher education hub

Investor enthusiasm is being fueled by the HKSAR’s push to position itself as a higher-education hub. Lee said in his Policy Address that the SAR government would raise the cap on non-local undergraduate enrollment at public universities to 50 percent from 40 percent. It has also earmarked land in the city’s flagship tech development, the Northern Metropolis, for a planned “university town” aimed at attracting leading institutions and research centers from the mainland and overseas.

Visa and immigration restrictions in the US may also boost demand for the HKSAR’s universities. “Some places are becoming less welcoming toward newcomers,” making the city a more competitive destination, said Gordon Tse, senior director at Midland Holdings, which offers immigration and student visa consulting services.