Hong Kong signed a comprehensive avoidance of double taxation agreement (CDTA), which is the 53nd that the city has concluded, with Jordan on Thursday, setting out the allocation of taxing rights between the two places.

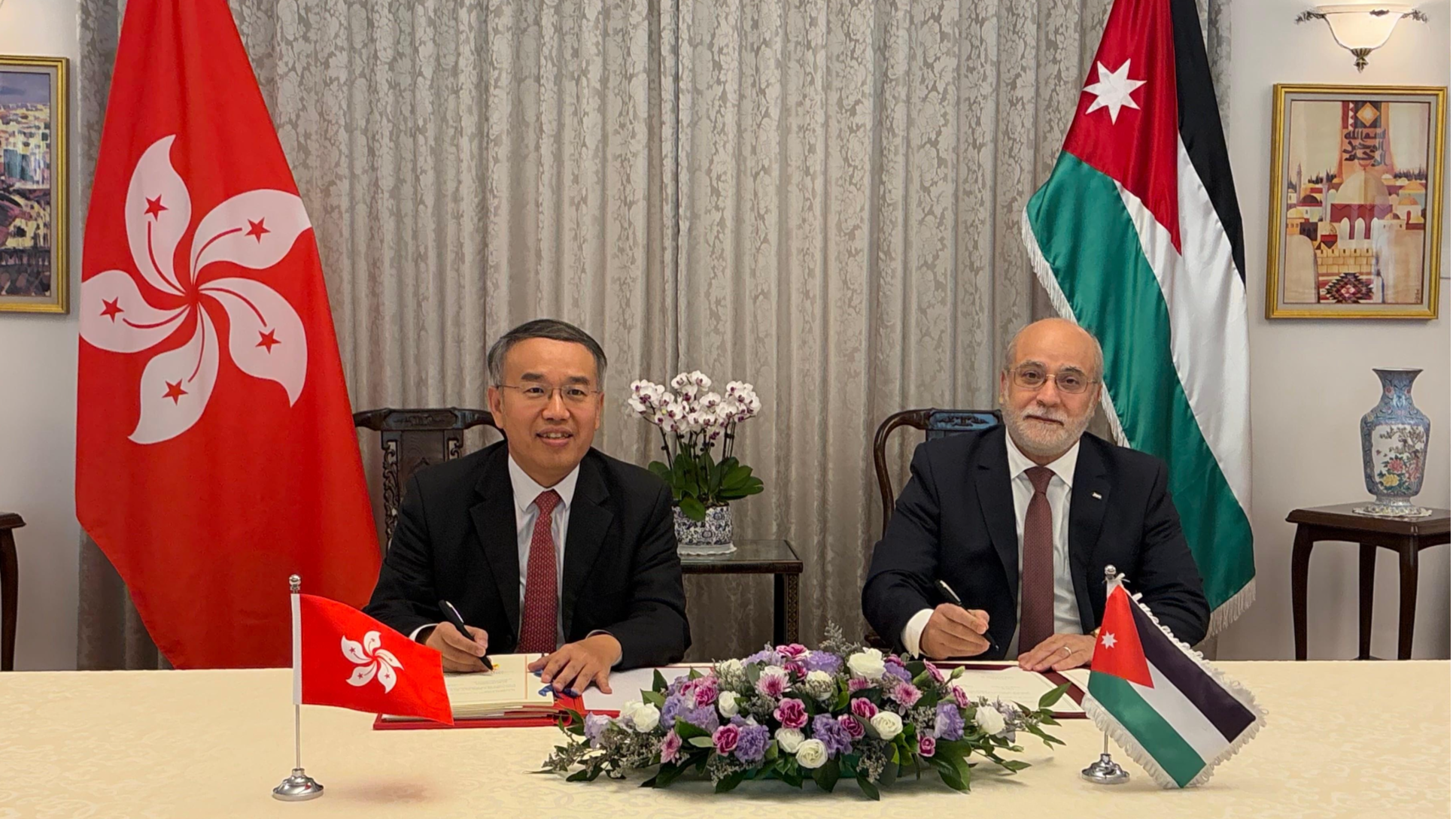

Secretary for Financial Services and the Treasury Christopher Hui Ching-yu signed the CDTA on behalf of the Hong Kong Special Administrative Region government during a bilateral meeting with the Ambassador of Jordan to China Hussam Al Husseini in Beijing, the SAR government said in a statement.

“The signing of the CDTA demonstrated Hong Kong's continuous efforts in deepening co-operation with Belt and Road countries, and is an excellent starting point to enhance the financial, economic and trade connections between Hong Kong and Jordan,” Hui said.

Noting that Jordan is a participant in the Belt and Road Initiative, Hui emphasized that the CDTA signifies the determination of the HKSAR government in expanding Hong Kong's CDTA network and its enhanced collaboration with tax jurisdictions participating in the initiative.

He pointed out that the CDTA sets out the allocation of taxing rights between Hong Kong and Jordan, which will help investors better assess their potential tax liabilities from cross-border economic activities.

"This CDTA is the 53rd one that Hong Kong has concluded. We will continue to expand Hong Kong's CDTA network to enhance the city's attractiveness as a business and investment hub, and consolidate Hong Kong's status as an international economic and trade center," Hui added.

ALSO READ: HK govt gazettes bills on use of seat belts, mobile devices for road safety

In accordance with the Hong Kong-Jordan CDTA, Hong Kong residents can avoid double taxation in that any tax paid in Jordan will be allowed as a credit against the tax payable in Hong Kong in respect of the same income under the tax laws of Hong Kong.

Moreover, Jordan's withholding tax rates for Hong Kong residents on dividends, interest and royalties, currently at up to 10 percent, will be capped at 5 percent.

The agreement will come into force after completion of ratification procedures by both jurisdictions. In Hong Kong, the Chief Executive-in-Council will make an order under the Inland Revenue Ordinance, which will be tabled at the Legislative Council for negative vetting.