Hong Kong’s short-term funding costs have come off their highs this week, with analysts saying local interest rates look to be peaking after they spiked higher last month.

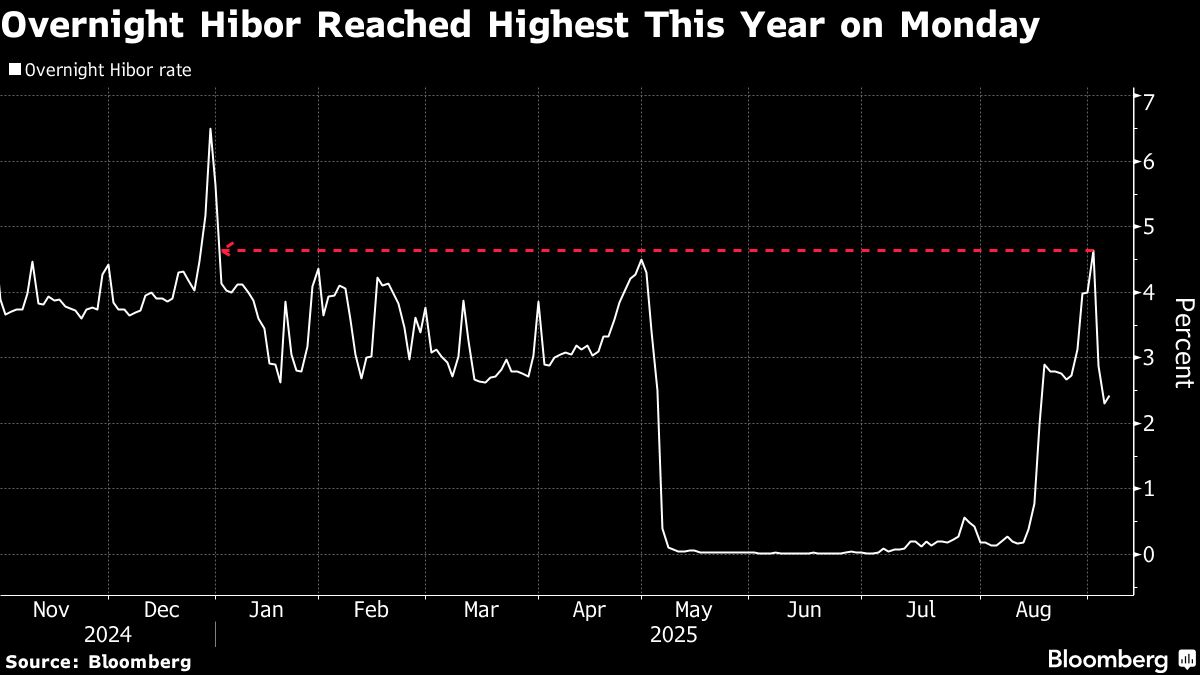

The overnight Hong Kong interbank offered rate, the shortest tenor of so-called Hibor, has tumbled 158 basis points for this week through Thursday, heading for the steepest weekly decline since May. The gauge had climbed to this highest level this year on Monday.

The swift reversal in Hibor is helping to support the Hong Kong dollar as the extra volatility has increased the uncertainty of trades betting against the currency. That’s offering a respite to the authorities who have fought in recent months to defend the currency’s peg to the US dollar.

ALSO READ: Hong Kong’s key rate climbs above 3% to 'pose risks for economy'

“It looks like Hibor rates are peaking out,” said Samuel Tse, a senior economist at DBS Bank in the Hong Kong Special Administrative Region. The increase in Hibor was “somewhat a result of overshooting due to the unwinding of carry trades,” and now this impact is easing, Hibor should retreat, he said.

Overnight Hibor edged up 12 basis points on Thursday to 2.42 percent, but it is still down from this year’s high of 4.65 percent on Monday, based on data compiled by Bloomberg. The one-month gauge has fallen 33 basis points this week to 2.97 percent, while the three-month rate has slipped 22 basis points to 3.08 percent.

One of the drivers behind the rising volatility in local funding costs has been the Hong Kong Monetary Authority’s efforts to defend the currency peg. The HKMA has bought at least HK$120 billion ($15.4 billion) of the local currency since the start of June, and those interventions have shrunk the aggregate balance, which is the total amount of cash that banks hold at the authority, and a key measure of interbank liquidity.

This year’s rally in Hong Kong stocks is also having an influence on local funding costs. The equity gains are attracting money from Chinese mainland investors, who need to buy the local currency to finance their purchases, which is also reducing local liquidity levels.

READ MORE: Hong Kong dollar finally bounces from weak end after HKMA moves

The recent surge in Hibor tenors led to a brief inversion of the local rate curve last Friday with the one-month gauge rising about its three-month counterpart. At the same time, the spread between overnight Hibor and the one-month level expanded to the widest since December.

“The inverted curve means Hibor’s uptrend will ease,” DBS Bank’s Tse said. “Such a curve indicates liquidity is tighter in the short term and the market expects funding needs should fade soon.”