Zijin Mining Group Co’s public spin-off of its international gold business could fetch more than $3 billion, according to people familiar with the matter, putting the planned listing in the Hong Kong Special Administrative Region on course to be the world’s second-biggest this year.

The value and timing of Zijin Gold International Co’s initial public offering could still change as deliberations are ongoing, the people said, asking not to be identified discussing a private matter. The listing could come as soon as this month and investor interest in the offering has been exceptionally strong at a time of record-high prices for the precious metal, one of the people said.

A $3 billion IPO would be the biggest globally since Chinese mainland's battery giant Contemporary Amperex Technology Co Ltd raised $5.3 billion in a blockbuster HKSAR offering in May. Zijin is the world’s third-biggest metals miner company by market value, and wants to boost output from gold mines that span Central Asia to Africa and Latin America.

“Zijin needs a large pool of offshore money to invest and expand production in their assets,” said Li Xiaofeng, senior partner at Beijing Dentons who is experienced in advising Chinese natural resource firms on overseas deals.

Zijin Mining and Zijin Gold International didn’t immediately respond to requests for comment. IFR earlier reported that the IPO target was raised to at least $3 billion, from about $2 billion.

Gold has surged by more than a third this year on the back of central-bank buying, rising geopolitical risks and the prospect of US interest-rate cuts. Several Wall Street banks have forecast more gains, with Goldman Sachs Group Inc seeing gold climbing to $4,000 an ounce next year, from just above $3,500 now.

The rally has bolstered investor interest in gold miners worldwide, and also encouraged a wave of the mainland's gold producers to raise funds. Shares in Zijin Mining, among the mainland’s top producers of both copper and gold, rallied to a record this week and the group is now valued at about $88 billion. It posted record profits for the first half.

READ MORE: HK reigns as global IPO leader in the first seven months of 2025

The Zijin IPO would also mark another trophy for the Hong Kong Exchange, which is having a banner year for new listings — especially by mainland companies. Total proceeds are poised to more than double to above $26 billion, according to Bloomberg Intelligence estimates.

Growth ambition

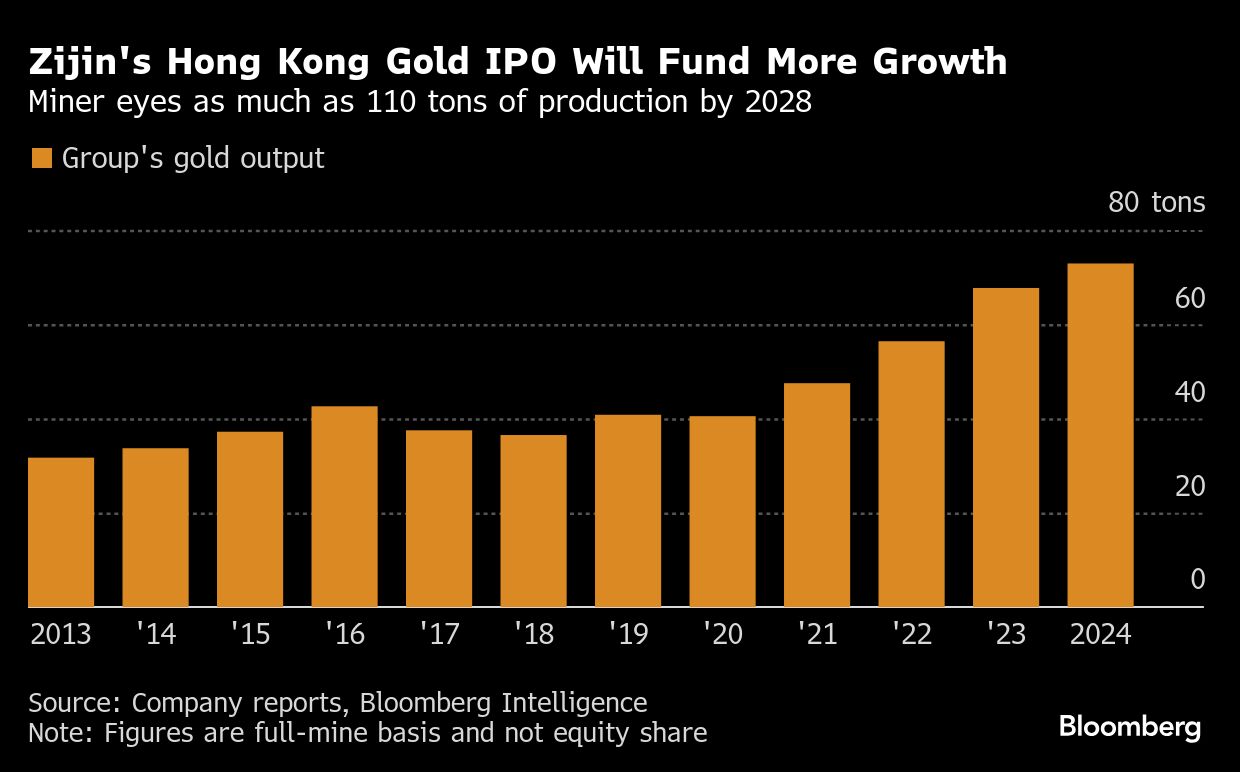

Zijin has proved one of the world’s most aggressive mining companies, pursuing rapid expansions and numerous acquisitions across gold and copper. It wants annual gold output of between 100 tons and 110 tons by 2028, measured by total production of all mines in which it has a stake. The figure last year was 73 tons, of which 60 percent was outside the mainland, according to Bloomberg calculations.

Its latest addition was gold mine in Kazakhstan worth $1.2 billion, which follows last year’s acquisition of the Akyem gold project in Ghana from the world’s top producer Newmont Corp.

“Given Zijin’s track record, they should be able to increase output quite quickly,” said Li from Dentons. Zijin’s management “may choose to focus on their existing projects rather than buying new ones”.