The Chinese mainland’s two major city clusters have displayed a stark contrast in their foreign trade performances in the first half of this year. While both the Guangdong-Hong Kong-Macao Greater Bay Area and the Yangtze River Delta region posted robust trade growth, their underlying dynamics reveal fundamentally different economic DNAs — differences that have shaped their distinct performances amid global uncertainties, experts said.

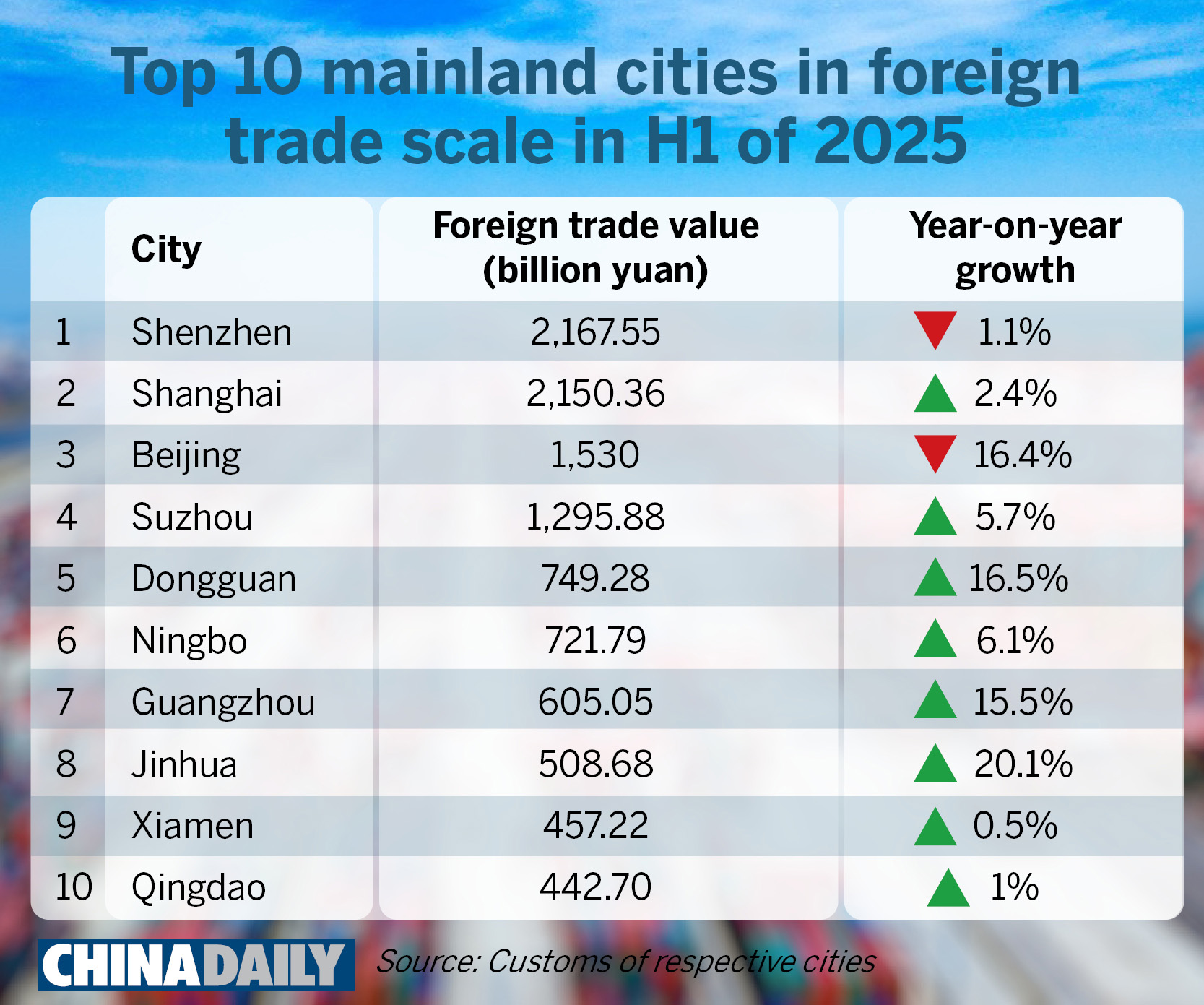

According to the latest data from China customs, the nine Guangdong cities of the Greater Bay Area reported a combined 4.38 trillion yuan ($610 billion) in foreign trade in the first six months, growing 4.3 percent year-on-year. The figure for the Yangtze River Delta region, which covers provinces of Zhejiang, Jiangsu and Anhui as well as the city of Shanghai, was 8.16 trillion yuan, up 5.4 percent on a yearly basis.

On the exports front, the Yangtze River Delta region maintained robust growth momentum of 9.9 percent, outpacing the Greater Bay Area’s 1.2-percent expansion. Imports, meanwhile, showed a different picture: the Greater Bay Area’s nine mainland cities saw a 10.2-percent import growth, in contrast to the Yangtze River Delta region’s 1.7-percent decline.

ALSO READ: Construction of Shenzhen's Luohubei high-speed rail station set to begin in Sept

Wang Zhen, director of the Department of Regional Development and Planning at Shenzhen-based think tank China Development Institute, pointed out three major factors that have led to the divergent foreign trade performances between the Greater Bay Area and the Yangtze River Delta region in the first half — differences in market structure, products for import and export, and enterprise composition.

While the Yangtze River Delta region’s exports are mainly dependent on the European market, the Greater Bay Area exports less to that market. Instead, the southern region relies more on the US market, including re-exports through Hong Kong, making it more vulnerable to the US tariff policy and thus impacting its exports performance, he said.

The Yangtze River Delta region’s strong exports growth in the first half was driven by its exports of ships and new energy vehicles, with electric vehicle manufacturing giant BYD producing models for the European market in the region. Meanwhile, the high imports growth of the Greater Bay Area is attributable largely to its imports of integrated circuits and other high-end electronic components, as enterprises rushed to import and stock up during the policy window period in place before the Sino-US tariff policies came into full effect, Wang said.

READ MORE: Experts urge boosting synergy between GBA and Hainan

The customs’ data shows that Jiangsu province’s ship exports rose by 27.6 percent year-on-year, Zhejiang’ province’s electric vehicle exports surged by 86.3 percent and Anhui province’s exports of “new three items” — new energy vehicles, lithium batteries and solar products — grew by over 60 percent in the first half.

For the Greater Bay Area, imports of integrated circuits, computers and their components, and semiconductor manufacturing equipment expanded by 14 percent, 87.4 percent and 46.3 percent, respectively.

The senior researcher added that the Yangtze River Delta region has a higher proportion of foreign-funded enterprises that can transfer orders through their global networks, but the Greater Bay Area, which is home to a large proportion of private enterprises, may have less flexibility when it comes to global supply chain adjustments amid US tariff measures.

Analyzing the structural characteristics of the two economic regions, Dai Zhipeng, assistant professor at the Faculty of Economics at Shenzhen MSU-BIT University, described the Greater Bay Area as “a pioneering adventurer” and the Yangtze River Delta region “a high-tech engineer”.

“In the first half of the year, the Greater Bay Area pushed to explore new growth engines, while the Yangtze River Delta region strived to consolidate its existing industrial strengths,” Dai said.

“This divide stems from their inherent regional strengths. The Greater Bay Area, positioned to face the Association of Southeast Asian Nations (ASEAN) and anchored by the Pearl River waterway, is geographically primed for market diversification, while the Yangtze River Delta, bolstered by the Yangtze River Economic Belt and industrial clusters, boasts a more pronounced scale effect in technological upgrading,” Dai explained.

The economies of the two major city clusters in the Chinese mainland have shown strong resilience in their foreign trade performances in the first half of the year, at a time when the global economic landscape has been defined by lingering China-US trade frictions, fractured supply chains and a patchy recovery across major economies.

READ MORE: Foreign businesses banking on GBA as ‘heart of economic miracle’

Mao Yanhua, dean of Institute of Regional Openness and Cooperation at Sun Yat-sen University in Guangzhou, attributed the two regions’ sustained foreign trade growth to a mix of strategic adjustments and structural strengths.

“The shift toward a broader global network of partnerships has proven critical as it reduces reliance on any single trading partner and cushions the economy against uncertain international conditions,” he said.

“An optimized export mix, with high-tech products like mechanical and electrical goods, the ‘new three items’ and high-end equipment taking a larger share, has enhanced the regions’ competitiveness.”

Mao also pointed to robust import growth in the Greater Bay Area, fueled by policies to expand domestic demand, as a sign of a resilient domestic market.

Looking ahead, the three experts said the international trade environment would remain challenging in the coming months, driven by China-US trade tensions, the EU’s protectionist policy agenda and uncertainty over major economies’ monetary policies.

But they took a cautiously optimistic outlook over the foreign trade performance of the Greater Bay Area in the second half of the year. In their view, the dividends of the Regional Comprehensive Economic Partnership will continue to unfold, strengthening the region’s ties with the ASEAN markets.

Further integration and deeper synergies within the Greater Bay Area, particularly breakthroughs in rule alignment and the flow of elements, could also unlock more room for new foreign trade formats and models, they added.