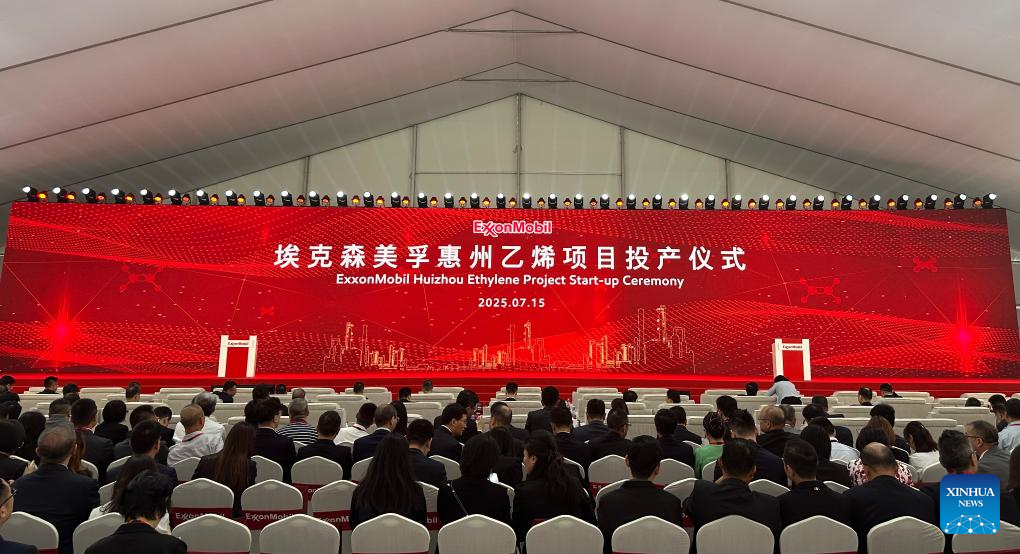

GUANGZHOU - Energy giant ExxonMobil on Tuesday began operation of its landmark chemical complex in southern China, the country's first major petrochemical project wholly owned by a US company.

The move highlights ExxonMobil's confidence in the world's second-largest economy and comes amid China's ongoing efforts to promote high-standard opening up and attract foreign investment.

ALSO READ: ExxonMobil breaks ground on chemical complex in China

Located in the Daya Bay Petrochemical Industrial Park in Huizhou, Guangdong province, the first phase of the project consists of a flexible feedstock steam cracker with an annual capacity of 1.6 million tonnes of ethylene, a key building block for plastics and fibers used in a wide range of products like packaging.

The site also houses production units for high-performance polyethylene and polypropylene.

Hailing the establishment of this complex as "the latest chapter" in the long story of ExxonMobil's presence in China, the company's senior vice-president Jack Williams said at the launch ceremony that the project will serve as an anchor for Guangdong to develop a robust petrochemical industry.

Construction of the Huizhou complex began in April 2020 and involves two phases. Remarkably, the project progressed from negotiations to groundbreaking in just 18 months, a process that typically takes five years.

READ MORE: LNG: ExxonMobil inks deal with Zhejiang Energy for 1m tons

Li Xingjun, chairman of ExxonMobil (Huizhou) Chemical Co, Ltd, attributed this rapid progress to Guangdong's pro-business environment, calling the province "one of the world's leading manufacturing hubs, with a strong industrial base, comprehensive supply chains, and a high degree of market openness."

"The easing of foreign investment restrictions and institutional innovation have created a more transparent, fair and predictable investment environment, which has strengthened our confidence in the Chinese market," he said.

READ MORE: Nvidia to resume H20 chip sales in China, unveils compliant GPU

Huizhou, a coastal city in southern China, is home to a cluster of major petrochemical companies, including Shell, BASF and Clariant. Within this ecosystem, the Daya Bay Petrochemical Industrial Park has become one of China's leading refining and chemical production centers, with an annual oil refining capacity of 22 million tonnes and ethylene production capacity of 3.8 million tonnes.

ExxonMobil's chemical complex is expected to boost China's ethylene production capacity and elevate the technological standards of its petrochemical sector, supporting key industries such as electronic chemicals, fine chemicals and biomedicine, said Ji Hongbing, vice president of the Guangdong Petroleum and Chemical Industry Association.

The launch comes amid China's ongoing efforts to improve access for foreign investors. The country has twice reduced its negative list for foreign investment since 2021. All restrictions on foreign access to the manufacturing sector have been lifted, and further liberalization has occurred in agriculture and services. Pilot initiatives in healthcare and value-added telecommunications have opened new opportunities for foreign businesses.

READ MORE: ExxonMobil eyes more 'clean fuel' opportunities

ExxonMobil is among a number of multinational firms investing in China, where GDP grew 5.3 percent year-on-year in the first half of 2025.

Earlier this year, Swiss pharmaceutical giant Roche announced a 2.04 billion yuan (about $285 million) investment in a new biopharmaceutical manufacturing facility in Shanghai's Pudong New Area, while German chemical company BASF also committed 500 million yuan to expand its Cellasto plant in the city.

In the first five months of 2025, 24,018 new foreign-invested enterprises were established on the Chinese mainland, up 10.4 percent year-on-year.