Overseas customers flock to Chinese cross-border e-commerce platforms to enjoy better deals on products than back home

Shane Anderson, an office clerk from London, recently bought Chinese-made small household appliances, including a robotic vacuum cleaner and an air fryer, through Chinese e-commerce platforms.

A robotic vacuum cleaner usually sells for more than 350 pounds ($478) at a local store in the United Kingdom, but he purchased one for 160 pounds via Taobao, Alibaba’s online marketplace, during the recently concluded “618” online shopping carnival. “It is only about half of the price that I pay here,” Anderson said.

The product’s creative design and simple-to-use features, and steep discounts provided by the platform led to Anderson ordering without hesitation.

“I just downloaded Taobao for the first time, and the app is full of fun stuff that’s super cheap. The first time I used it, I was shocked. There are people (customer service staff) answering you 24/7,” he said, adding that Chinese-made products are good value, and excel in performance and design.

Anderson is among millions of overseas consumers who are flocking to Chinese online marketplaces to buy China-made products.

Experts said that despite changes in the international trade landscape, Chinese online retailers have provided global consumers with cost-effective premium products thanks to the nation’s complete industrial system, efficient digital infrastructure, and improved cross-border logistics networks.

This not only demonstrates that economic globalization is an irreversible trend, but also the irreplaceable role of China’s manufacturing industry in the global supply chain and the country’s advancing technological prowess, they added.

Smart devices for the home, intelligent hardware, niche sports products, and customized equipment from Chinese manufacturers have gained popularity among overseas consumers, whose demand for personalized merchandise is rising, according to a report released by Alibaba.com, Alibaba’s business-to-business platform that facilitates foreign trade.

The report said artificial intelligence technology has accelerated the popularization of intelligent products, with overseas consumers increasingly favoring consumer electronics and small home appliances with innovative technology.

Wearable devices, virtual reality glasses, smart speakers, and camping, hiking, and other outdoor sports equipment have also seen booming sales.

During the “618” shopping festival, a sales event spanning weeks that culminates on June 18, orders on the platform surged 42 percent year-on-year, data from Alibaba.com showed. The gross merchandise value increased nearly 30 percent compared with the same period last year.

Orders from JD Global Sales, JD’s cross-border e-commerce business division, soared 236 percent year-on-year during the mid-year promotional campaign. Sales of digital products increased nearly fourfold year-on-year, while the transaction volume of home appliances grew more than threefold, and orders for computers and office products increased 210 percent from a year earlier.

The company has optimized its direct-mail logistics network to include 37 countries and regions. These improvements ensure faster, more affordable delivery for global customers. Buyers across 17 markets — including Japan, South Korea, Southeast Asia, Australia, and New Zealand — can also enjoy free shipping promotions.

The e-commerce platform Taobao has expanded its free global delivery coverage to 12 countries and regions this year, including Southeast Asia, East Asia, Australia, Kazakhstan, and Mongolia.

Fee waivers

The program waives the shipping fees for orders over a certain amount. A convenient return service allows shoppers to return unwanted items at nearby collection points, Taobao said.

Wang Peng, an associate researcher at the Beijing Academy of Social Sciences, said the growing popularity of Chinese-made products in the global market shows: “Chinese factories, which depend on improved supply chains and supporting abilities related to production, can churn out high-quality commodities. The products have gained an upper hand in terms of cost and price compared with those of their counterparts around the world.”

Chinese e-commerce apps have been among the most downloaded and favored apps in many countries in recent months, Wang said. Global inflation has made Chinese e-retailers the preferred option for overseas consumers.

“An increasing number of made-in-China products are gaining popularity among overseas consumers, which is an affirmation of the country’s robust manufacturing capabilities, product quality, and homegrown brands,” said Hong Yong, an associate research fellow at the Chinese Academy of International Trade and Economic Cooperation.

“These commodities are very competitive globally for their good quality, and that comes from China’s mature and efficient supply chain system.”

To attract new foreign consumers, Hong said Chinese enterprises should step up investment in product research, development, and design. They should improve the added value and competitiveness of their merchandise by boosting innovation and brand building.

As the popularity of Chinese-made products is underpinned by logistics infrastructure, and the payment and operation services of e-retailers, it is vital for Chinese e-commerce platforms to explore new logistics and delivery models, he said.

This includes building overseas warehouses, expanding international cooperation in the payment domain, and enlarging their footprint in emerging markets, such as the Middle East and Africa.

Hannah Evans, a university student in New York, said she prefers buying Chinese-made commodities, such as apparel, kitchen utensils, and sporting equipment, on Chinese e-commerce platforms as she has access to a dizzying array of choices at much cheaper prices.

“Using these apps is amazing because it is like buying from the factory of the world. You are buying directly from China. My phone case is from Taobao and it’s only 9.9 yuan ($1.38),” she said.

The recent tariff increases by the US government have affected her shopping experience to some extent, she said. However, even with the “insane” tariffs on Chinese goods, if US consumers buy directly from China, it is still cheaper than buying at a local store like Walmart, she said.

The Trump administration has decided to end the duty-free de minimis treatment for small packages and low-value shipments worth $800 or less from China. However, these measures have not deterred US consumers from purchasing Chinese products. Instead, they have sparked a surge in popularity for Chinese shopping apps.

Taobao has hit the top of the Apple App Store’s free download charts in 16 countries, while

Chinese cross-border business-to-business e-commerce app DHgate is the second-most downloaded on the US Apple App Store, just behind OpenAI’s ChatGPT.

Experts said the meteoric rise of Chinese e-commerce apps in the US app marketplaces signals a potential paradigm shift in Americans’ shopping habits, as they increasingly bypass traditional retailers and turn to international platforms for their purchases in the face of rising prices at home.

Sales of home appliances, outdoor sports equipment, pet supplies, healthcare and beauty products, and electronic devices have witnessed rapid growth in overseas markets, according to DHgate.

Founded in 2004, DHgate has served over 100 million registered buyers across 225 countries and regions by connecting them with over 2.78 million sellers worldwide.

The company said its growth trajectory is not a temporary phenomenon, but the result of years of efforts to foster a trusted ecosystem with micro, small, and medium-sized enterprises, and source manufacturers.

Market observers attribute DHgate’s sudden popularity in the US to Chinese suppliers and manufacturers using the short-video platform TikTok to educate US consumers on the global luxury goods market amid increased US tariffs.

Global recognition

Many products, including clothing, handbags, and accessories that are assumed to be European-made, come from factories in China. Shoppers can buy these products directly from Chinese suppliers via e-commerce platforms like DHgate.

Cui Lili, a professor of digital economy at Shanghai University of Finance and Economics, said the popularity of Chinese e-commerce platforms in overseas markets indicates domestic brands have gained wide recognition abroad and will help the country move toward the high end of the value chain.

Fresh growth opportunities are emerging, Cui said, adding that Chinese enterprises should make full use of cross-border e-commerce platforms to meet overseas demand, learn more about relevant laws, regulations, and quality standards of other countries, and adjust supply chains to make products that meet local needs.

China’s cross-border e-commerce sector has seen robust growth in recent years. The sector’s imports and exports reached 2.63 trillion yuan in 2024, an increase of 10.8 percent year-on-year, said the General Administration of Customs.

Cross-border e-commerce has become an important driving force for China’s exports amid downward economic pressures and external uncertainties. Meanwhile, Chinese cross-border online retailers are speeding up their push into overseas markets amid a broader drive to cultivate new users and diversify revenue sources.

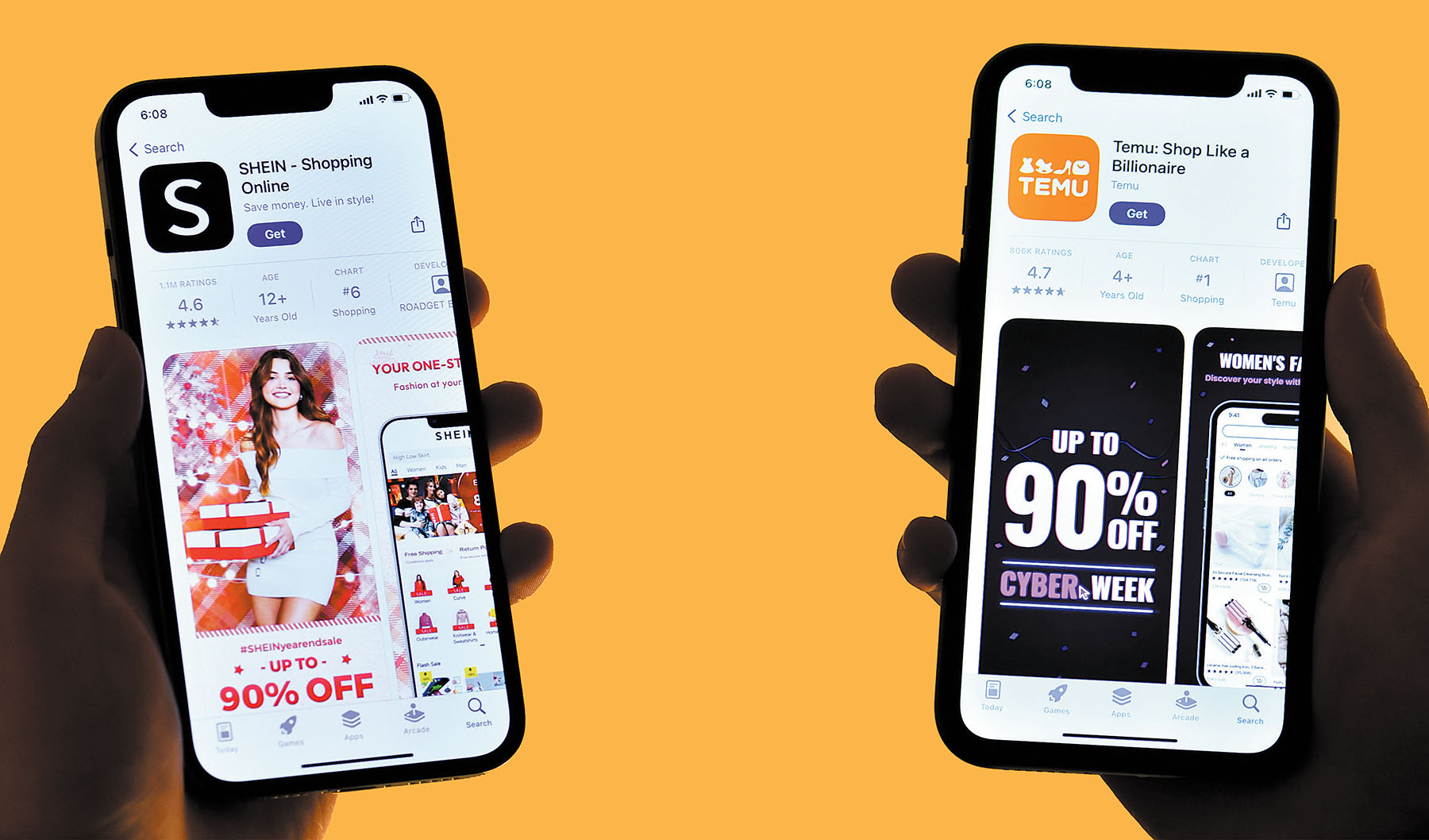

Temu, the cross-border e-commerce platform launched by Chinese online discounter PDD Holdings, is accelerating its expansion into new markets. Launched in the US in September 2022, it has entered more than 70 countries across North America, Europe, Asia, and Oceania.

Temu offers a wide selection of merchandise, with deep discounts and coupons as part of its strategy to attract price-conscious consumers. Most of the products are shipped directly from factories or warehouses in China.

Fast-fashion online retailer Shein is ratcheting up resources to help Chinese manufacturers and brands expand their presence abroad and boost the transformation of traditional industries by using its digital and flexible supply chains.

Shein said it provides one-stop services for sellers who are good at designing and producing products, but have no overseas sales and operations experience. These included commodity operations, warehousing, logistics, customer service, and after-sales service.

“In recent years, Chinese e-commerce platforms have taken active steps to make forays into overseas markets by offering shopping subsidies, expanding free shipping services and launching promotional campaigns, thus increasing their influence abroad,” said Zhang Zhouping, an independent analyst who has been tracking the cross-border e-commerce sector for more than a decade.

As a new form of foreign trade, cross-border e-commerce has served as a vital channel for Chinese enterprises to expand overseas, Zhang said.

“A core advantage of Temu and Shein lies in products with competitive prices and fast delivery, which is highly reliant on the establishment of supply chains,” he said, adding that platforms that provide good shopping experiences and after-sales services will gain an upper hand amid increasingly fierce international competition.

Zhu Keli, founding director of the China Institute of New Economy, said to mitigate the impact of the tariff hikes, Chinese e-commerce platforms should invest more in establishing overseas warehouses, accelerate steps to expand their footprint in more diversified and emerging markets, and strengthen cooperation with international logistics companies to improve delivery efficiency and lower logistics costs.

Contact the writer at fanfeifei@chinadaily.com.cn