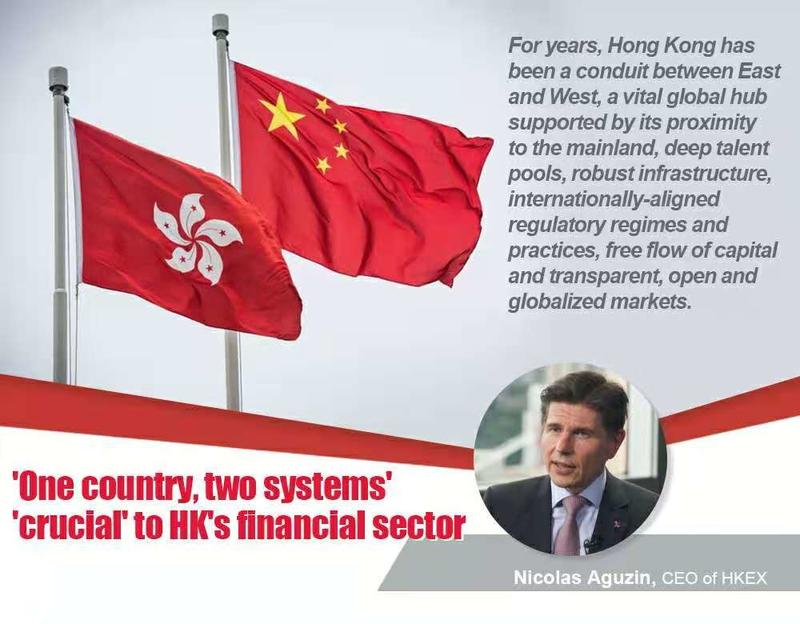

This screencap of a video posted on the website Hong Kong Exchanges and Clearing Limited shows the exchange's chief executive Nicolas Aguzin speaking in an interview.

This screencap of a video posted on the website Hong Kong Exchanges and Clearing Limited shows the exchange's chief executive Nicolas Aguzin speaking in an interview.

HONG KONG - The practice of "one country, two systems" in Hong Kong is critical to the future of its financial sector, said Nicolas Aguzin, chief executive officer of the Hong Kong Exchanges and Clearing Limited which has made connecting the Chinese mainland and the world a prioritized strategy.

The practice of "one country, two systems" has created a unique ecosystem whereby Hong Kong has evolved into a vital and valuable super connector between the Chinese mainland and the rest of the world, Aguzin said in an interview with Xinhua.

For years, Hong Kong has been a conduit between East and West, a vital global hub supported by its proximity to the mainland, deep talent pools, robust infrastructure, internationally-aligned regulatory regimes and practices, free flow of capital and transparent, open and globalized markets.

Nicolas Aguzin, CEO, HKEX

"For years, Hong Kong has been a conduit between East and West, a vital global hub supported by its proximity to the mainland, deep talent pools, robust infrastructure, internationally-aligned regulatory regimes and practices, free flow of capital and transparent, open and globalized markets," he said.

Aguzin spent most of April in mainland cities including Beijing and Shenzhen.

READ MORE: HKMA chief: Mainland push boosts HK financial sector

"I spent time with stock exchanges, regulators, and a lot of people. It was excellent to see how we have really a common objective of making sure that Hong Kong remains as an international financial center," he said.

Hong Kong, New York City and London are collectively known as "Nylonkong," an acronym of the top three financial centers in the world. In the latest edition of the Global Financial Centers Index published by British think tank Z/Yen Group and China Development Institute in Shenzhen, Hong Kong maintained its third place in overall ranking.

In March, HKEX announced that it will deliver on its vision by building on three strategic pillars: connecting China and the world, connecting capital with opportunities, and connecting today with tomorrow.

"It's very important. You want to make sure that Hong Kong is vibrant and it helps connect the world with China," Aguzin said. "The more connectivity, the better."

We are in a very unique position. We have a market that is growing very fast, and at the same time in Hong Kong, we have today a situation where you have a free flow of capital and you have institutions that have been operating here for so many years.

Nicolas Aguzin, CEO, HKEX

Building on its unique strength, HKEX will continue to both bring the mainland growth story to international investors and help Chinese mainland capital access global opportunities.

ALSO READ: HKEX keeps serving as bridge linking mainland, global markets

"We are in a very unique position. We have a market that is growing very fast, and at the same time in Hong Kong, we have today a situation where you have a free flow of capital and you have institutions that have been operating here for so many years," he noted. "We have a great partnership with a lot of stakeholders in the mainland that allows us to have this very easy interaction."

Aguzin joined HKEX as its CEO on May 24 last year from JP Morgan, where he was most recently CEO of JP Morgan's International Private Bank. He has been based in Hong Kong since 2012.

Over the past 25 years, Hong Kong has become Asia's most vibrant market and remained a leading international finance center. HKEX's markets reflect Hong Kong's further growth as a global financial center with the nation’s economic rise.

The market cap of Hong Kong's stock markets has grown from HK$3.2 trillion ($407.8 billion) at the end of 1997 to HK$42.1 trillion ($5.37 trillion) at the end of 2021, data from the bourse showed.

Average daily turnover on HKEX's cash market reached HK$166.7 billion ($21.25 billion) at the end of 2021, compared with HK$15 billion ($1.91 billion) in 1997.

Hong Kong has been one of the top initial public offering venues globally for much of the last decade. The listing reforms in 2018 have propelled Hong Kong to become a major new economy marketplace, and in particular, Asia's largest and the world's second-largest biotech capital raising hub.

Looking ahead, Aguzin said he believes it is crucial that Hong Kong continues to expand its unique position as a connector between the mainland and the rest of the world.

"I am very optimistic about both China's continued growth and Hong Kong's continued unique position supporting the ongoing growth of the region's capital markets and the companies of tomorrow. I am convinced the best years are ahead of us," he said.