People shop at a grocery store in Monterey Park, California, on April 12, 2022. (FREDERIC J. BROWN / AFP)

People shop at a grocery store in Monterey Park, California, on April 12, 2022. (FREDERIC J. BROWN / AFP)

WASHINGTON - US consumer inflation in March continued to rise at the fastest annual pace in four decades, the US Labor Department reported on Tuesday.

The latest data is another reminder that inflation has been persistently high, which would warrant the US Federal Reserve's more aggressive rate hikes on its upcoming policy meetings.

The March CPI surged 8.5 percent from a year earlier, the largest 12-month increase since the period ending December 1981. That compared with a 7.9 percent year-on-year gain in February, the US Labor Department reported

The consumer price index last month rose 1.2 percent from the previous month after increasing 0.8 percent in February, according to the Labor Department's Bureau of Labor Statistics (BLS).

The March CPI surged 8.5 percent from a year earlier, the largest 12-month increase since the period ending December 1981. That compared with a 7.9 percent year-on-year gain in February, the report showed.

The so-called core CPI, which excludes food and energy, rose 0.3 percent in March following a 0.5-percent growth the prior month. Core CPI jumped 6.5 percent over the last 12 months, after climbing 6.4 percent in February.

ALSO READ: BIS: World may be on cusp of new inflationary era

The report noted that increases in the indexes for gasoline, shelter (the service that housing units provide their occupants), and food were the largest contributors to the seasonally adjusted all items increase.

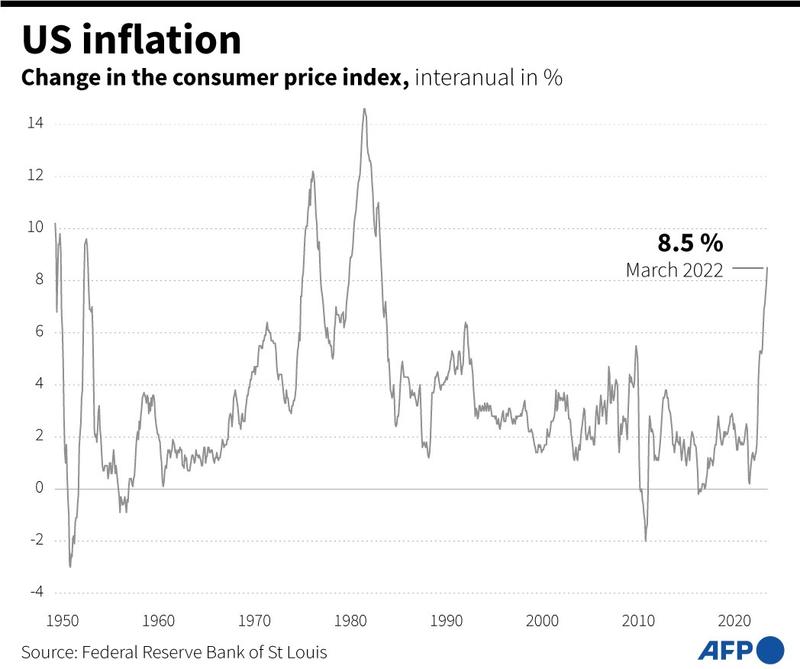

This AFP graphic dated April 12, 2022 shows the evolution of consumer price index in US since 1948.

This AFP graphic dated April 12, 2022 shows the evolution of consumer price index in US since 1948.

The so-called core CPI, which excludes food and energy, rose 0.3 percent in March following a 0.5-percent growth the prior month. Core CPI jumped 6.5 percent over the last 12 months, after climbing 6.4 percent in February

The gasoline index rose 18.3 percent in March and accounted for over half of the all items monthly increase. The food index rose 1.0 percent.

US Federal Reserve Governor Lael Brainard recently said it is "of paramount importance" to get inflation down, noting that the central bank is "prepared to take stronger action" if inflation indicators show such action is warranted.

According to the minutes of the Fed's March policy meeting released last week, many participants noted that one or more 50 basis point increases in the target range could be appropriate at future meetings, particularly if inflation pressures remained elevated or intensified.

READ MORE: US inflation hits fresh 40-year high ahead of Fed rate hike

The central bank could begin reducing the size of its balance sheet as soon as May, with officials signaling their support for a monthly caps of $95 billion, a much faster pace of decline in securities holdings than over the 2017-19 period.