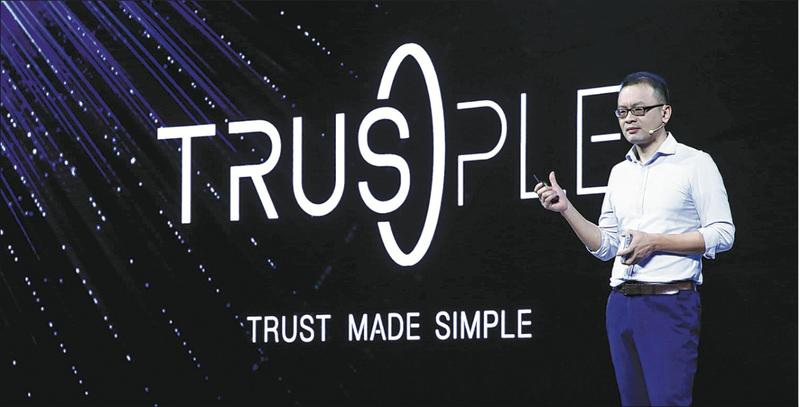

In this late September 2020 file photo, Ant Group unveils Trusple, an international trade and financial service digital platform powered by AntChain, the company's blockchain-based technology solutions, at the Inclusion Fintech Conference. (PHOTO / CHINA DAILY)

In this late September 2020 file photo, Ant Group unveils Trusple, an international trade and financial service digital platform powered by AntChain, the company's blockchain-based technology solutions, at the Inclusion Fintech Conference. (PHOTO / CHINA DAILY)

Global banking giant Standard Chartered continues to focus on working with leading industry partners to deliver its strategy of disrupting traditional trade through digitalization.

Standard Chartered recently announced the successful completion of the first cross-border live transaction on Trusple, the newly launched international trade and financial service digital platform of AntChain -- the blockchain-based technology solution of Ant Group

The bank recently announced the successful completion of the first cross-border live transaction on Trusple, the newly launched international trade and financial service digital platform of AntChain -- the blockchain-based technology solution of Ant Group.

According to Standard Chartered, the bank is the first international banking partner for the trading platform in Asia, as well as the only advising bank to have completed a transaction on the platform on Sept 25 prior to Trusple's official launch.

Trusple was launched at the Blockchain Industry Summit of the Inclusion Fintech Conference, organized by Ant Group and Alipay in late September.

ALSO READ: Ant launches blockchain-based cross-border trade platform

By integrating its financial services with Trusple, Standard Chartered can offer buyers and sellers -- who are typically small and medium-sized enterprises -- improved access to trade finance.

The use of blockchain, which will be enabled in due course, also means enhanced transparency and traceability for all transactions across the entire supply chain, which reduces fraud risk and provides greater assurance, resulting in increased trust among all trade participants, according to Standard Chartered.

Specific to sellers, the ability to track and trace every successful transaction creates a "chain credit", from which financial institutions can make use of this data to determine a seller's credit worthiness when meeting its financing needs.

In addition, the automation of all trade processes combined with seamless connectivity to Standard Chartered's Straight2Bank digital banking platform creates a closed-loop ecosystem, leading to faster turnaround times and greater cost efficiencies for businesses.

As a strategic partner of Trusple, Standard Chartered was the first company to complete the first cross-border live transaction on the platform and offered financing services to the buyer, said the bank, which added that it will provide more cross-border trade channels to clients.

In this August 2, 2017 file photo, pedestrians walk past Standard Chartered signage in the Central district of Hong Kong. (ISAAC LAWRENCE / AFP)

In this August 2, 2017 file photo, pedestrians walk past Standard Chartered signage in the Central district of Hong Kong. (ISAAC LAWRENCE / AFP)

Through collaboration with Ant Group, Standard Chartered will make further efforts to aid exports for SMEs, helping them integrate with the global market.

Neil Daswani, global head for SME financing service and corporate partnerships at Standard Chartered Bank, said:"We are happy to have deepened our partnership with Ant Group as we have the same vision and commitment, with regard to promoting global trade with innovative digital products."

The executive noted SMEs worldwide have contributed about 40 percent of global GDP and made great contributions to creating employment.

"Integrating Standard Chartered's strength in the financial industry with the Trusple platform, we are expecting to forge a sustainable supply chain for SMEs in Asia and beyond," Daswani said.

Ben Hung, regional CEO for Greater China and North Asia at Standard Chartered, said: "With supply chains around the world impacted by COVID-19, now more than ever, it is critical that SMEs get the support they need to recover, grow and reignite economic growth. This partnership with Trusple helps us further enhance connectivity in the supply chain in Asia and provide financing to SMEs when they need it most."

ALSO READ: Ant 'plans US$17.5 billion Hong Kong IPO, no cornerstones'

Jiang Guofei, vice-president of Ant Group, said Ant Group's collaboration with Standard Chartered, especially its first deal made on Trusple, shows that blockchain technology can help to forge a new partnership of trustworthiness and improve operational efficiency for all stakeholders.

Standard Chartered is a founding member of Contour, a blockchain-based open industry platform focusing on digitizing trade finance.

In May, the bank issued the first blockchain-based, renminbi-denominated letter of credit to facilitate the deal between Chinese steelmaker China Baowu and Australian mining giant Rio Tinto through Contour. The use of blockchain technology helped the trade be done in a paperless way and reduced costs for all parties involved in the transaction.

ALSO READ: Standard Chartered shrugs off trade row blues

In August 2019, it also announced a strategic collaboration with SAP Ariba to make its financial supply chain solutions accessible to businesses in the Asia-Pacific region through the Ariba network, one of the world's largest digital business networks connecting more than 4.2 million companies in 190 countries.

Standard Chartered Bank is a multinational banking and financial service company headquartered in London, the United Kingdom.

It is a leading international banking group, with a presence in 60 of the world's most dynamic markets, and serving clients in a further 85.

The bank is devoted to promoting economic prosperity and the well-being of humans with its brand promise of "Here for good".

In China, the bank set up its first branch in Shanghai in 1858. It currently has one of the largest foreign bank networks in the country.

zhaoshijun@chinadaily.com.cn