The Maersk Eindhoven container ship, operated by Maersk Line Ltd., sits moored next to gantry cranes at a shipping terminal in Yokohama, Japan, on July 19, 2020. (TORU HANAI / BLOOMBERG)

The Maersk Eindhoven container ship, operated by Maersk Line Ltd., sits moored next to gantry cranes at a shipping terminal in Yokohama, Japan, on July 19, 2020. (TORU HANAI / BLOOMBERG)

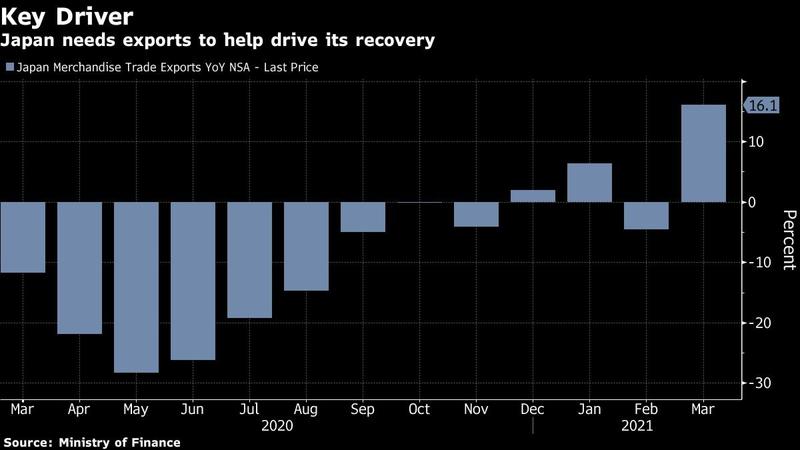

Japanese exports posted a double-digit gain for the first time in more than three years in March, offering another indication that a recovery in global trade is gaining strength.

The value of overseas shipments jumped 16.1 percent from a year ago, for the biggest increase since November 2017, led by exports of cars, plastics, semi-conductors and chip-making equipment, the finance ministry reported Monday. Economists had forecast a rise of 11.4 percent. Exports to China surged by more than a third.

Rising exports provide key support for Japan’s economy at a time when vaccination delays and an emerging fourth wave of virus infections are weighing on domestic activity

While the stronger-than-expected figures were boosted by comparison with data from 2020 when the coronavirus was slamming global trade, the value of exports was also the highest in three years, indicating solid improvement. Month-on-month, exports rose 4.3 percent after seasonal adjustment.

“China’s economy has completely normalized, so it’s true that exports to China are doing well,” said economist Yuichi Kodama at Meiji Yasuda Research Institute. “The same goes for the US. The Biden administration’s fiscal package has meant that personal consumption has been rising steadily, so I expect exports to also keep doing well next month and onwards.”

READ MORE: Japan households amass record assets as virus crimps spending

Rising exports provide key support for Japan’s economy at a time when vaccination delays and an emerging fourth wave of virus infections are weighing on domestic activity, with speculation of a renewed state of emergency in Tokyo gaining traction.

The March jump helps lift exports gains to 6 percent for the first quarter, compared with a year earlier. Quarterly imports were up 1.9 percent. Economists flagged the difficulty of capturing the true strength of the trend with year-on-year figures.

Looking ahead, climbing US retail sales and demand from China, where on-year growth jumped by a record last quarter, are likely to keep driving Japan’s exports.

A drop in the yen’s value gives exporters another tailwind. The currency fell roughly 4 percent versus the dollar last month, increasing the value of repatriated profits.

ALSO READ: Japan's double-digit expansion signals resilience in economy

Imports rose 5.7 percent from the previous year, compared with a 4.7 percent increase forecast by analysts.

Exports to China surged 37.2 percent from a year earlier, with chip-related gear and automobiles among the largest gainers. Shipments to the US rose 4.9 percent. Exports to the EU gained 12.8 percent, the largest increase in nearly three years.

The trade balance was 663.7 billion yen in the black. Analysts had expected a 493.2 billion yen surplus.