Bargain hunters may want to think twice before piling into China’s beaten-down technology stocks.

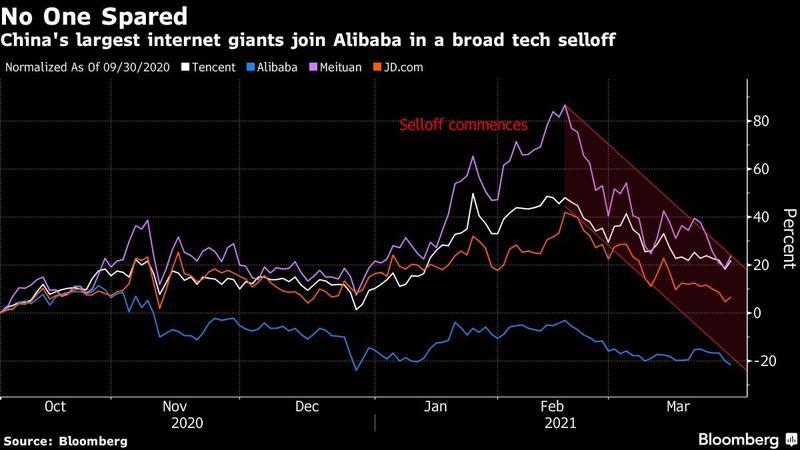

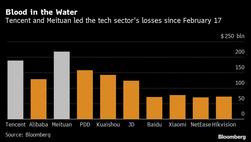

While the industry rallied Friday on bets a US$732 billion selloff in the biggest Chinese tech giants had gone too far, history suggests there’s room for more downside.

READ MORE: Tech selloff seen as removal of froth rather than a warning sign

Tencent Holdings Ltd, Alibaba Group Holding Ltd, Baidu Inc and NetEase Inc - among the earliest Chinese tech companies to enter public markets - still trade at valuations well above levels that marked the bottoms of the last two big downturns. The four stocks fetch an average 23 times projected earnings for the next 12 months, in line with the three-year average, data compiled by Bloomberg show. The ratio dropped to 19 in 2018 and 18 in March 2020.

After soaring to record highs in February, Chinese tech stocks have tumbled in recent weeks due to a combination of rising interest rates and increased regulatory scrutiny in the US.

The Hang Seng Tech Index, whose members include many of the Chinese mainland’s biggest tech giants, has plunged 26% from its February high, versus a 10% drop in the benchmark Hang Seng Index

Earnings season has also done little to revive sentiment. Tencent dropped 2.8 percent on Thursday after its results were broadly in line with expectations, while brokerages including Goldman Sachs, Macquarie and HSBC cut their share-price targets on Asia’s largest company for the first time in at least a year. Xiaomi Corp shares sank even after posting a jump in profit.

GRAPHIC: Taking stock

The Hang Seng Tech Index, whose members include many of the Chinese mainland’s biggest tech giants, has plunged 26 percent from its February high, versus a 10 percent drop in the Hong Kong Special Administrative Region’s benchmark Hang Seng Index. Investors in the Chinese mainland, who accounted for about 40 percent of turnover in Tencent shares this year, have become net sellers of the stock in the past two days. Their purchases of other blue-chip technology stocks, including Xiaomi and Meituan, have also shrunk.

ALSO READ: Hang Seng will retain its appeal, financial secretary says

“I would still be very cautious and selective in buying those technology stocks, since we’ve yet to confirm if it’s a real rally or just short-lived technical rebound,” said Jackson Wong, asset management director at Amber Hill Capital Ltd. “The outlook still looks uncertain.”