A pedestrian wearing a protective mask walks past a stock ticker at the Exchange Square complex, which houses the Hong Kong Stock Exchange in Hong Kong on May 29, 2020. (PHOTO / BLOOMBERG)

A pedestrian wearing a protective mask walks past a stock ticker at the Exchange Square complex, which houses the Hong Kong Stock Exchange in Hong Kong on May 29, 2020. (PHOTO / BLOOMBERG)

The days of the massive first-day pop in the Hong Kong Special Administrative Region’s initial public offering frenzy may be nearing an end.

Even as the pandemic spread for most of 2020, the city’s IPOs and new listings were in hot demand from both institutional and mom-and-pop investors. With the bulk of new share sales posting large gains on their first-day of trading, investor euphoria was justified.

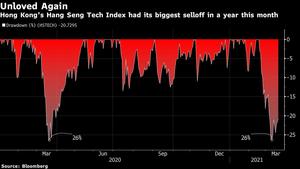

Volatility sparked by the great rotation into previously unloved stocks sensitive to economic fluctuations from loftily valued tech and health-care plays is to blame, according to investors

That was then. Last year’s largely winning investor play of piling into IPOs and exiting after they debuted is no longer a slam dunk: 31 percent of thirteen IPOs raising more than US$100 million posted losses on day one this year, almost double the 17 percent in 2020. A median first-day move showed gains of 2.1 percent in 2021 from 5.7 percent last year, according to data compiled by Bloomberg.

ALSO READ: Bilibili eyes up to US$3.2b in HK second listing

Volatility sparked by the great rotation into previously unloved stocks sensitive to economic fluctuations from loftily valued tech and health-care plays is to blame, according to investors.

“Most IPOs performed really, really strongly last year, but I’m not expecting that kind of movement this year,” said Joohee An, a fund manager at Mirae Asset Global Invest (HK) Ltd. Investors will be “more prudent” as market liquidity “won’t be as abundant as it used to be”, she added.

Wobbly Performance

To be clear, listings by Kuaishou Technology and New Horizon Health Ltd still did unusually well in February, with shares more than doubling on the first day.

But lukewarm post-listing performances are increasing. Chinese mainland household insecticide company Cheerwin Group Ltd slumped as much as 20 percent on its first trading day last week. Biopharmaceutical company SciClone Pharmaceuticals Holdings Ltd ended its March 3 debut flat and is now trading 8.6 percent below its offer price.

ALSO READ: IPOs: This year could be better than last, HKEX's Chan says

The secondary listing wave of US-listed mainland companies hasn’t always had glowing debuts in the HKSAR. Autohome Inc, a mainland online car-sales website with its primary listing in New York, ended its HKSAR debut on Monday with a modest 2 percent rise.

The increasingly muted performances during debuts by HKSAR-listed companies is part of a global trend where investors are getting pickier about deals they invest in. For instance, while special purpose acquisition companies, or SPACs, are still going public at a frenzied pace in the US, the shine is starting to wear off. Some recent listings traded as low as their IPO prices on day one of trading.

That said, not everyone is concerned.

“When you have these deals that don’t do well, it actually tells you that people are still being cautious about what they’re investing in and what they’re not, which is a good sign,” said Sumeet Singh, head of research at Aequitas Research in Singapore, who publishes on Smartkarma. “It means the market is doing OK.”

Reality Check

The upcoming multi-billion dollar listings of Baidu Inc and Bilibili Inc will be closely watched to see if the HKSAR’s IPO market still has steam, given their size and high profile as tech companies.

Baidu, which priced at an almost 3 percent discount to its US-traded shares, will start trading March 23. Investor demand for its offering was strong, with retail investors putting in orders for almost 100 times the stock made available to them, according to a person familiar with the matter. Bilibili, the video streaming platform that is looking to raise as much as US$3.2 billion in a second listing, plans to debut on March 29.

READ MORE: HKEX interim chief: Bullish IPO market seen in Year of the Ox

“I am definitely not concerned,” said Oliver Cox, a top-performing fund manager at JP Morgan Asset Management, In general, “the quality and long-term earnings growth prospects of the companies we see coming to market is still very high indeed and pricing of IPOs does not affect that” he said.