The last time stocks in Tokyo were this high, things were a little different.

Orders now silently processed in milliseconds were shouted across smoky open outcry trading floors. Yuriko Koike, now Tokyo’s Governor, was a fresh-faced TV presenter on the country’s leading business news show. The US fretted over “Japan as number one”.

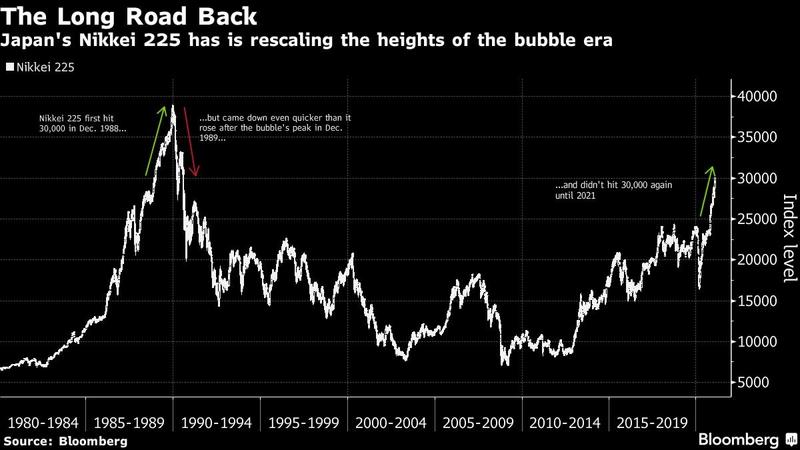

That’s how long it’s been since the Nikkei 225 passed 30,000, an event which first took place in December 1988. With the index crash in 1990 that followed the deflating of the asset-price bubble, it would take more than three decades for the benchmark to regain that height.

“Sometimes it took an hour or two just to execute an order,” Taketsugu Agari, a 51-year-old veteran trader and investor, remembers of those days. He began his career in 1988 as a “batachi” -- the traders who used complex hand gestures to communicate buy and sell orders across deafening trading floors. “Now you can just do it yourself on your phone.”

Since those days, Agari has amassed US$50 million in his investing career, and is no stranger to new trends -- he shares his investing secrets with his nearly 100,000-strong Twitter following. While he sees similarities between today and the bubble era in the floods of money in search of an outlet, he doesn’t expect a repeat of the collapse with less wealth packed in to the market versus the 80s.

That’s how long it’s been since the Nikkei 225 passed 30,000, an event which first took place in December 1988

ALSO READ: Nikkei: Apple plans increase in iPhone production in 2021

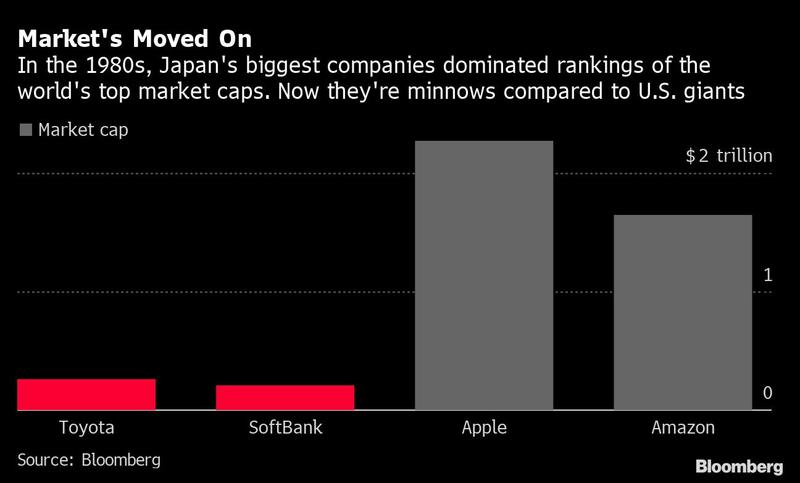

“Japan’s market value is small these days compared to globally,” Agari says, pointing to the order-of-magnitude difference between Japan’s biggest stocks, Toyota Motor Corp. and SoftBank Group Corp., and the likes of Apple Inc and Amazon.com Inc. Unlike the speculative fever of the 1980s that saw builders surge along with land prices -- some like Kumagai Gumi Co. are still down 99 percent from their peak -- investing is more sensible these days, he says.

In the late 80s and early 90s, Japan’s largest companies were Nippon Telegraph & Telephone Corp. and the financial institutions that would eventually merge into today’s three megabanks.

“There was no such thing as calm logic back then. The Nikkei’s price-to-earnings ratio was at 70 at one stage, and people thought that Japan would grow forever,” said Norihito Fujito, 64, chief investment strategist at Mitsubishi UFJ Morgan Stanley Securities Co and was previously a fund manager. “Things are different now globally -- even with all the excess liquidity, investors are still calm.”

READ MORE: Japan's Nikkei 225 tops 30,000 for first time since 1990

While NTT remains among the biggest market cap, and Sony Corp. is still among the best-known names, it’s often less-glamorous but more profitable firms that dominate these days, from industrial robot maker Keyence Corp. to motor manufacturer Nidec Corp. Casual clothing giant Fast Retailing Co., which has the biggest weighting of 12 percent in the Nikkei, is the country’s sixth-largest company. Fast Retailing and SoftBank Group Corp have contributed to about a third of the Nikkei’s gains in since the end of March.

“These days, people are buying good Japan companies that generate profits,” Agari says, pointing to gains in Toyota and SoftBank after their impressive earnings.

The view that this time is different is also shared by other market veterans.

“It might look like the same path once taken when you look at it on a chart,” said Yoshihiro Ito, 77, chief strategist at Okasan Online Securities Co. and a veteran of Tokyo’s markets for almost 60 years. “But comparing then and now, the economy, the market and the sentiment, they’re all completely different.”

Ito says that unlike in the bubble era, when foreign investors pulled money out due to fear over rate hikes, overseas cash is this time helping to support the gains amid hopes that the economy will soon return to normal, even as earnings are improving. There are still similarities, he cautions.