Japan’s Nikkei 225 Stock Average topped 30,000 yen for the first time since August 1990, as it continued its charge back up through levels not seen since the collapse of the bubble economy.

The gauge rose 1.9 percent to close at 30,084.15 on Monday, amid signs an economic recovery is intact at home and hopes of progress in US stimulus talks. While equities globally have hit new heights in recent months, the Nikkei 225 still needs to gain almost 30 percent to surpass its record of 38,915.87. That was reached in the final trading session of 1989, before the index went on to lose more than half its value in three years after the economic bubble burst.

Japanese equities have been staging a recovery after hitting a low in 2012 in the wake of the earthquake disaster in the previous year

Japanese equities have been staging a recovery after hitting a low in 2012 in the wake of the earthquake disaster in the previous year. Former Prime Minister Shinzo Abe’s efforts to revitalize the economy and boost corporate value through better governance since he took office in 2012 have backed share price gains prior to this year’s rally.

The brief breach of the 30,000 shows that “all sorts of investors are jumping in to buy Japanese equities with a totally bullish view,” said Shoji Hirakawa, chief global strategist at Tokai Tokyo Research Institute Co.

That view was affirmed Monday when Japan announced that gross domestic product grew an annualized 12.7 percent from the prior quarter in the three months through December, as exports continued to rebound and government stimulus fueled consumer spending despite the coronavirus.

READ MORE: Japan's double-digit expansion signals resilience in economy

The continued economic growth is one factor contributing to the strength in Japanese equities, according to Nikko Asset Management Co. chief global strategist John Vail, who hailed strong export and private capex data. Japan’s reasonable valuations compared to those during the bubble era, as well as improved profits and shareholder returns, are also strengths, he said.

“There are always doubters who perennially point to demographics,” said Vail, “but such has not prevented tremendous growth in corporate earnings, including such from Japan’s extensive global manufacturing bases.”

Foreign buyers

Foreign investors turned net buyers in cash and futures equities for the first time in four weeks, purchasing about 856 billion yen (US$8.2 billion) during the week ended Feb 5, according to data from Japan Exchange Group. Foreigners, who offloaded more than US$59 billion of local stocks last year, are expected to turn net buyers in 2021 as the economic recovery picks up globally, making export-reliant Japan attractive.

ALSO READ: Japan's Topix surges to highest in 30 years as SoftBank gains

“We’re in a globally risk-on environment, but the particular strength in Japanese equities speaks to appetite for stocks sensitive to business cycles and value stocks,” said Shogo Maekawa, a strategist at JPMorgan Asset Management in Tokyo. “Foreigners may be re-evaluating Japanese equities.”

Daiwa Securities Group Inc. CEO Seiji Nakata called the breach of the 30,000 mark a “symbolic” event that signals the Japanese economy is back on its feet. The Nikkei 225 is likely head for the 33,000 mark next, he said in an emailed statement.

Like the Dow Jones Industrial Average, the Nikkei 225 is a price-weighted measure. The two highest-weighted stocks, Uniqlo operator Fast Retailing Co. and SoftBank Group Corp., make up almost 19 percent of the gauge and as such have an outsized impact on its movements. Both of those stocks have surged in the past year, benefiting from the pandemic and the latter from Masayoshi Son’s record-breaking buybacks.

The price-weighted nature of the index has attracted criticism over the years for failing to accurately reflect the state of Japan’s equity market. It is also notable for its lack of some of Japan’s biggest stocks, including gaming giant Nintendo Co. and robotic automation specialist Keyence Corp.

READ MORE: IPOs in Japan haven't been this hot since the dot-com bubble

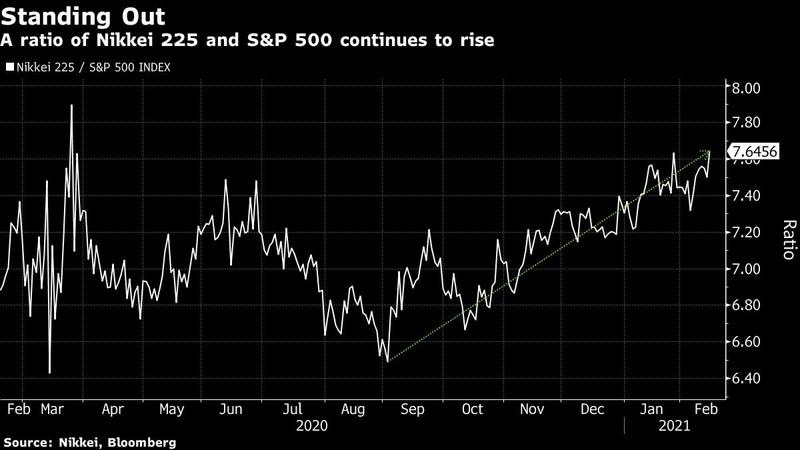

The S&P 500 ended last week at an all-time high ahead of a three-day weekend, adding more than 1 percent for the week. Still, Japanese stocks have been outperforming their US peers so far this year, with the Nikkei 225 up 9.6 percent, doubling the gain in the S&P 500.