A freight train gets loaded at the BEHALA (Berliner Hafen- und Lagerhausbetriebe) container terminal at the west harbour of Berlin, Germany, on Jan 26, 2021. (LIESA JOHANNSSEN-KOPPITZ / BLOOMBERG)

A freight train gets loaded at the BEHALA (Berliner Hafen- und Lagerhausbetriebe) container terminal at the west harbour of Berlin, Germany, on Jan 26, 2021. (LIESA JOHANNSSEN-KOPPITZ / BLOOMBERG)

Soaring freight rates and delivery delays have sparked a global backlash by companies frustrated about the destructive mix of deteriorating service and higher ocean shipping costs.

The European Shippers’ Council in Brussels have petitioned the European Commission to address “outrageous price hikes” by cargo carriers, whereas in Washington, the biggest lobbying group for retailers wants authorities to scrutinize the playing field.

The problems in the US go beyond the cost burdens: Overwhelmed ports and container shortages along key transpacific routes are causing delays and lost business for exporters. Some store chains and manufacturers - reliant on international supply lines - are being forced to cut other expenses or rethink that strategy altogether.

According to a January survey of 901 users of Hong Kong-based Freightos, an online shipping marketplace, 77 percent of small- to medium-sized importers reported supply chain difficulties over the past six months, and of those, 44 percent said they raised product prices as a result

US companies ranging from Colgate-Palmolive Co to Boot Barn Holdings Inc - and others across Europe and Asia - have highlighted the supply strains in recent days. The Federal Maritime Commission launched an inquiry late last year into port congestion, but bottlenecks persist heading into the seasonal peak before Chinese New Year in mid-February.

“Our freight costs will probably be a pressure point for us over the next, I don’t know, three months or six months,” Greg Hackman, chief operating officer at California-based Boot Barn, said last week, citing port pileups that are affecting inventories.

ALSO READ: Western supply chains buckle as coronavirus lockdowns spread

With business already pummeled by the pandemic, the logistical issues may be too much for some firms. That was the blunt take of Stefan Pierer, the CEO of Pierer Mobility AG, the Austrian maker of KTM motorcycles, on a Feb 1 call with analysts.

“If you are active, if you are flexible, if you are brave and you have the right linkages, you can deal with it,” he said. “But not everybody can deal with it - that I can tell you.”

German manufacturers warned this week that shortages in raw materials and shipping containers have led to a spike in costs and lower inventories.

According to a January survey of 901 users of Hong Kong-based Freightos, an online shipping marketplace, 77 percent of small- to medium-sized importers reported supply chain difficulties over the past six months, and of those, 44 percent said they raised product prices as a result. Companies with less than US$5 million in revenue were suffering more and likelier to pass on the costs to customers.

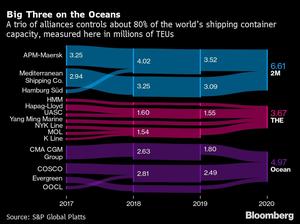

Some blame an industry that’s become more concentrated. In 2017, about a dozen container lines that control 80 percent of the global market formed three main alliances which share ships, cooperate on routes and ultimately try to limit excess capacity.

Complaints about those arrangements are growing louder, and the US National Retail Federation is communicating with regulators, lawmakers and port authorities to try to address them.

“A lot of shippers are extremely frustrated with how the carriers, not only how they’re performing, but the rates as well,” said Jonathan Gold, the retail federation’s vice-president for supply chain and customs policy. “There certainly needs to be a look at how the alliances are operating.”

Few places show the global trading system’s Achilles’ heel better than the ports of Los Angeles and Long Beach, California, where ocean carriers have swamped the port and ground transportation’s ability to handle the influx of goods.

More than 30 container ships were anchored outside the neighboring ports this week, waiting for a week or more to unload. Sick dockworkers are partly to blame, as is a shortage of truckers. But the carriers are catching heat, too, for thriving in the congestion.

“The maritime industry is picking winners and losers in the global economy,” said Weston LaBar, CEO of the Harbor Trucking Association in Long Beach. “Any nation should have an issue with one industry having that kind of say and power to be able to manipulate or dictate the broader economy.”

READ MORE: UK trade groups hit out at new export rules

The container liners counter that they’re doing everything they can to meet unpredictable surges in demand and aren’t withholding capacity as a way to keep rates elevated.

No idle ships

Hapag-Lloyd AG, Germany’s biggest carrier, said this week that it’s working on a “schedule recovery plan to get vessels back in their intended positions” - a move that may mean some routes don’t have sailings for a week or two.

“Vessels will not be idling at any time,” CEO Rolf Habben Jansen said in an email to customers on Monday. “Let me assure you: All our vessels are sailing, and if we can find additional capacity we will secure it, but the charter ship market is at the moment basically sold out.”

The European Commission is in talks with shippers, freight forwarders, port operators and the carriers, but it’s so far stopped short of starting any formal investigation into anti-competitive behavior. It says that many factors could be causing the price hikes, such as demand and port congestion.

In Asia, there’s a different dynamic between shipping companies and governments. Carriers in South Korea, in particular, have received state support or are subject to greater political influence because they’re vital for the exports that drive their economies.

South Korean shipping lines deployed an extra nine vessels last year on the transpacific route to help move goods. HMM Co, the country’s biggest shipping company, also added an extra vessel for exporters last month to Europe.

In response to exporters’ concerns, the country’s Ministry of Oceans and Fisheries said last week that it’s strengthened supervision, and will look closely at freight rates on key transpacific and European routes.

READ MORE: Taking on disruptions caused by pandemic

India was also caught up in the freight-rate issue, but its export lobby group said that the container shortage has eased to some extent on the country’s west coast after the government intervened.

In Vietnam, Deputy Premier Trinh Dinh Dung directed the ministries of transport and trade to inspect and strictly punish any illegal acts regarding possible hikes in shipping and container-renting costs.

‘Price gouging’

In the meantime, the pandemic is leaving many shippers paying record-high rates for sub-standard service. Just 44.6 percent of container vessels arrived on time in December, down from 76.3 percent a year earlier and the lowest level in records dating back to 2011, according to an index by Copenhagen-based Sea-Intelligence.

A separate Sea-Intelligence report last week said it would be hard to make a legal case of “price gouging.”

“What is clear, though, is that carriers in their pricing behavior have prioritized short-term profitability over customer relationships,” Sea-Intelligence CEO Alan Murphy said. “For shippers with low-value commodities, the development is nothing short of a disaster, as they are effectively being priced out of the market.”