Buildings are seen from Victoria Peak at night in Hong Kong, on Aug 28, 2019. (PAUL YEUNG / BLOOMBERG)

Buildings are seen from Victoria Peak at night in Hong Kong, on Aug 28, 2019. (PAUL YEUNG / BLOOMBERG)

In a year disrupted by a global pandemic and abrupt setbacks for some of Hong Kong’s biggest stocks, investors point to one constant as to why 2021 looks brighter: relentless levels of money coming in.

READ MORE: Many mainland companies to have secondary listing in HK

Mainland investors have bought a net HK$666 billion (US$86 billion) of the city’s shares, easily the most since both of the Hong Kong Special Administrative Region’s trading links with onshore exchanges began operating in 2016. At more than US$51 billion, the amount of capital raised from Hong Kong initial public offerings and secondary listings is the most in a decade, as the city positions itself to be the preferred venue for big Chinese mainland firms. The inflows have been so strong that the Hong Kong Monetary Authority had to repeatedly step in to weaken the local currency.

At more than US$51 billion, the amount of capital raised from Hong Kong initial public offerings and secondary listings is the most in a decade, as the city positions itself to be the preferred venue for big Chinese mainland firms

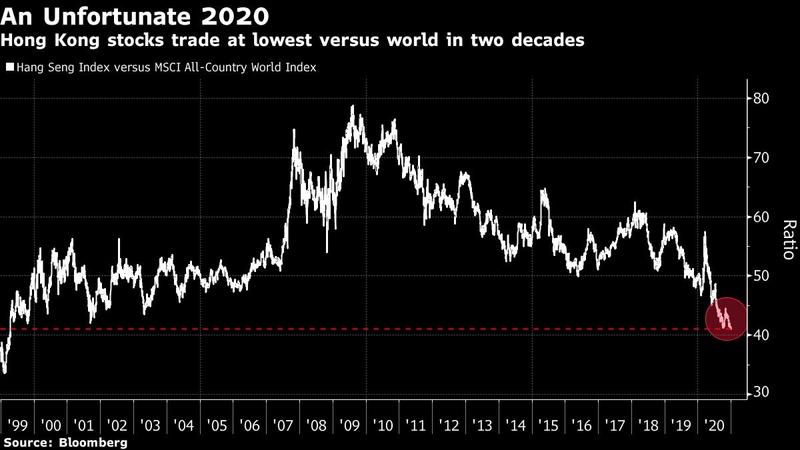

Together, the data explain why despite Hong Kong’s worst stock underperformance in over two decades, some investors want more exposure to the world’s fourth-largest market next year — whether it’s in technology, property or financial services. The confidence comes even as China’s antitrust scrutiny casts a shadow over the nation’s most powerful tech firms, with regulators investigating billionaire Jack Ma’s Ant Group Co.

“We believe the Chinese government is resolved to return stability in Hong Kong and would continue to support Hong Kong as its key financial hub,” said Sean Taylor, Asia Pacific chief investment officer at DWS Group. He added the firm is looking to add more exposure to Hong Kong-listed stocks over mainland firms due to attractive valuations.

A proposal outlined last week by Hang Seng Indexes Co to increase the number of members in the city’s stock benchmark and fast track new listings could also help boost daily turnover.

ALSO READ: Jump in hottest HK IPO makes founder mainland's 2nd richest

Unfettered

The HKSAR has this year been caught in the crossfire of fresh US-China political tensions. The Hang Seng Index has dropped 3.7 percent this year, pared following Wednesday’s 2.2 percent advance to a 10-month high. Only a third of its components have risen in 2020, and earlier this week the benchmark hit its lowest level versus the MSCI All Country World Index since 1999.

But the broader market weakness has done little to quell interest in Hong Kong’s booming IPO market, boosted by Chinese mainland megacaps like JD.com Inc and NetEase Inc choosing to have secondary listings there. The retail euphoria remained unfettered even after Ant’s listing failure left investors in shock — with one deal as much as 422 times oversubscribed. There is expectation the strength carries into 2021.

“Given Hong Kong is a mature market and has no capital controls, it will attract more Chinese (mainland) companies to list there,” said Hao Hong, managing director and head of research at Bocom International.

ALSO READ: Homecoming — a bumper harvest in the making

Further efforts to boost inflows could be coming. Hong Kong Exchanges & Clearing Ltd’s outgoing Chief Executive Officer Charles Li has said a link allowing mainland investors to buy bonds in Hong Kong will likely be unveiled next year. Still, much of that rests on finding the right successor, with a search committee remaining split on whether to prioritize someone who can operate with confidence in the mainland or one with a strong international background.

Beyond IPOs and inflows, market watchers have other areas to be upbeat about. Morgan Stanley analysts turned bullish on Hong Kong property stocks earlier this month, citing cheap valuations, sustainable dividends and volume growth. Hong Kong is also the brokerage’s most preferred market in Asia when it comes to 5G, saying per-user revenue growth has been the highest in the region.

Meanwhile, Credit Suisse Group AG expects the Hang Seng Index to reach 30,000 points next year, 11 percent above current levels and last seen in mid-2019, thanks to strong consumption-driven momentum for China's economy.

Compared with mainland-listed equities, Hong Kong firms “still have a lot of room for growth,” said Feng Zhang, a fund manager at Fullgoal Fund Management Co.

“There are many new companies in Hong Kong with relatively high growth potential. Funds are chasing these good companies.”