An autonomous logistics robot moves boxes of merchandise to manned order packing stations at a Cainiao warehouse, the logistics subsidiary of Alibaba Group Holding Ltd, ahead of the company's annual Singles' Day shopping extravaganza in Wuxi, Jiangsu province, China, on Nov 9, 2020. (QILAI SHEN/BLOOMBERG)

An autonomous logistics robot moves boxes of merchandise to manned order packing stations at a Cainiao warehouse, the logistics subsidiary of Alibaba Group Holding Ltd, ahead of the company's annual Singles' Day shopping extravaganza in Wuxi, Jiangsu province, China, on Nov 9, 2020. (QILAI SHEN/BLOOMBERG)

Southeast Asia’s sizzling-hot internet economy cooled during the pandemic but spending online should bounce back rapidly and triple to more than US$300 billion by 2025, research from Google, Temasek Holdings Pte and Bain and Co shows.

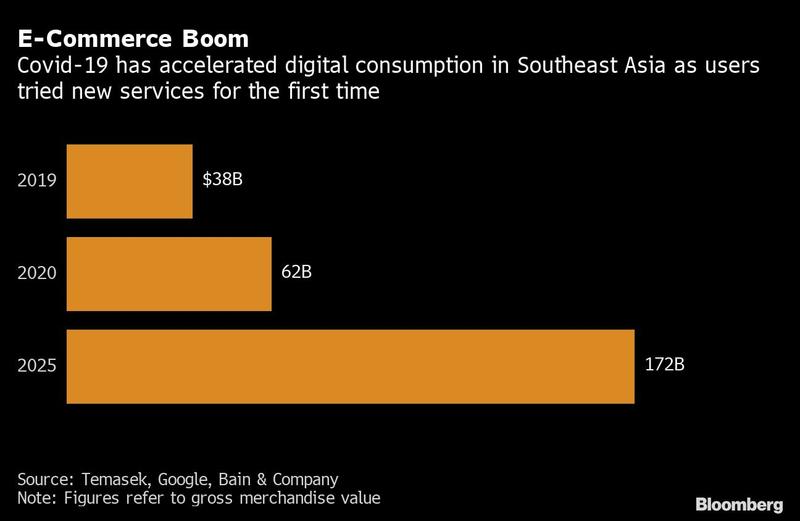

The value of transactions in four key areas — e-commerce, travel, media and transport and food — should grow just US$5 billion to about US$105 billion in 2020, when many consumers turned to mobile shopping for the first time but lockdowns hammered spending on trips.

READ MORE: More consumers using digital payments due to coronavirus

The region, home to Alibaba Group Holding Ltd’s Lazada and Tencent Holdings Ltd-backed Sea Ltd, will see a 63 percent increase in e-commerce gross merchandise value from 2019 as home-bound consumers picked up groceries and essentials from the likes of Lazada’s RedMart and Sea’s Shopee. Online shopping is now forecast to hit US$172 billion by 2025 versus a previous US$153 billion estimate, the research showed.

It’s “a clear indication that momentum has not been derailed by the year’s challenging environment,” according to the study, a closely watched annual review that covers six countries and serves as a benchmark for the region’s fast-growing internet industry.

ALSO READ: E-commerce culture clash tests foreign online retailers

Unsurprisingly, online travel was the worst-hit. The value of business transactions plunged 58 percent to just US$14 billion this year. Still, the industry’s eventual recovery could boost the market to US$60 billion by 2025, the study showed. Transport and food delivery — a sector dominated by car-hailing leaders Grab Holdings Inc and Gojek — also took a hit, dropping 11 percent to US$11 billion in 2020.

Demand for ride-hailing services collapsed globally, prompting the region’s two most valuable startups to cut jobs.

Overall, this year’s “seismic” shifts in consumer behavior have advanced the internet sector, the report said. Southeast Asia added 40 million new internet users in 2020, while one in three digital service users came online for the first time due to COVID-19.

E-commerce is driving growth in Indonesia, despite the devastating impact the pandemic has had on its overall economy. Southeast Asia’s largest economy fell into its first recession since the Asian financial crisis more than two decades ago in the third quarter. But Google, Temasek and Bain expect Indonesia’s digital economy to almost triple to US$124 billion by 2025, though down from a previous estimate of US$133 billion.

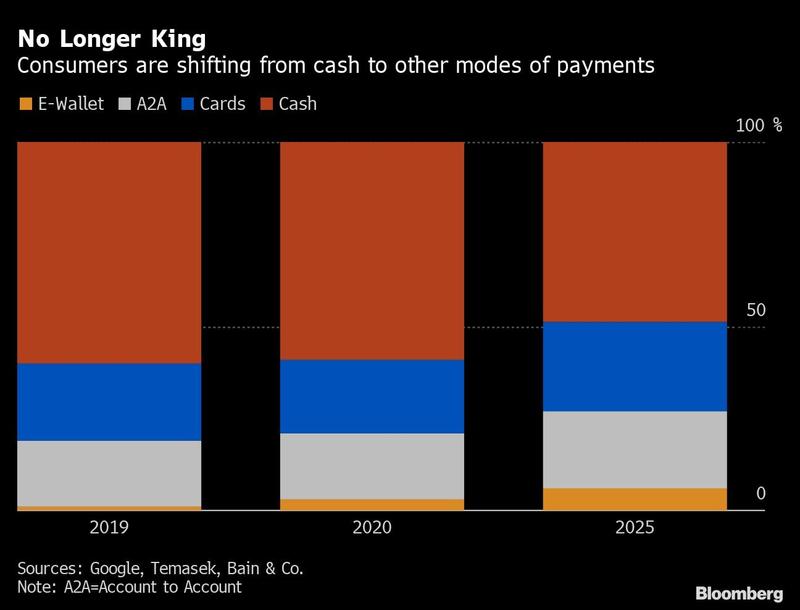

The pandemic has also accelerated adoption of online financial services as more consumers rely on contactless ways to pay and transfer money, shunning cash. Digital lending, however, stood unchanged from last year at US$23 billion, reflecting concerns over non-performing loans.

“Untested peer-to-peer lenders targeting riskier payday loans and some smaller traditional lenders will face difficulties in the coming quarters,” the report said.

Tech investment in Southeast Asia has declined since 2018, primarily driven by a slowdown in big-ticket unicorn funding. The region’s tech companies raised US$6.3 billion in the first six months of this year, down from US$7.7 billion a year earlier. Non-unicorn investments are on the rise, the study showed.