In this undated photo, the logo for HSBC Holdings Plc is displayed on the bank's headquarters building in Hong Kong. (ANTHONY KWAN / BLOOMBERG)

In this undated photo, the logo for HSBC Holdings Plc is displayed on the bank's headquarters building in Hong Kong. (ANTHONY KWAN / BLOOMBERG)

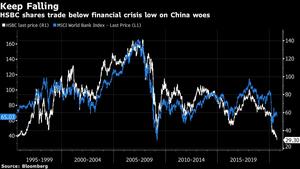

HSBC Holdings Plc’s tumbling stock price is testing the patience of even the bank’s most loyal investors.

Choi Chen Po-sum, a former vice chair of Hong Kong’s exchange who has owned HSBC shares for more than 40 years, now calls her investment a mistake. Simon Yuen, a money manager who has lobbied unsuccessfully for the bank to reinstate its dividend, says the stock’s slump to a 25-year low may have further to go. Ping An Insurance Group Co, HSBC’s biggest shareholder, has passed on opportunities to express confidence in the bank, saying only that its holding is a “long-term financial investment.”

The responses underscore the depth of investor malaise toward HSBC, which has tumbled faster than every other major financial stock globally over the past six months. Even historically upbeat sell-side analysts have mostly turned bearish on the bank amid growing concerns about loan losses

ALSO READ: HSBC, StanC shares slump on reports of illicit money flows

The responses underscore the depth of investor malaise toward HSBC, which has tumbled faster than every other major financial stock globally over the past six months. Even historically upbeat sell-side analysts have mostly turned bearish on the bank amid growing concerns about loan losses.

“I’ve lost faith,” said Choi, 89, who’s chair of National Resources Securities Ltd in Hong Kong, where scores of individual investors have long considered HSBC to be a core holding. “You want the shares to recover? Don’t even think about it.”

HSBC’s Hong Kong shares lost as much as 2.6 percent as of 11:15 am on Thursday. The stock has tumbled more than 9 percent so far this week, bringing the year’s decline to 54 percent and making it the worst performer in the benchmark Hang Seng Index. In London, the shares have fallen about 51 percent. After losing US$83 billion of market value this year, HSBC is now smaller than Commonwealth Bank of Australia and trailing far behind major rivals such as Citigroup Inc.

ALSO READ: HSBC warns loan losses may hit US$13 billion as profit halves

Analysts have never been so downbeat on HSBC, with only 16.7 percent of 30 who follow the stock having a buy recommendation whereas just two years ago the ratio was 47 percent. Even after its slump, the bank is valued at 16.3 times forecast earnings for 2020, a pricier level than some peers. Both Citigroup and smaller rival Standard Chartered Plc trade at multiples of about 13.

Ping An, which has owned a major stake in HSBC since late 2017, has seen the value of those shares tumble by at least US$8.6 billion over the past three years, according to data compiled by Bloomberg.

The depth of HSBC’s slump “means even long-term investors are starting to lose confidence in the stock, which is certainly a bad sign,” said Benny Lee, a director at Plotio Financial Group Ltd.

HSBC declined to comment on its share performance.

The growing disillusion in Hong Kong with the bank’s prospects comes after it earlier this year was among banks forced by UK regulators to scrap its dividend, causing an uproar with the city’s broad base of retail investors.

HSBC Chief Executive Officer Noel Quinn last month warned about tough times ahead while reporting that first-half profit halved and predicting loan losses could swell to US$13 billion this year. Quinn said the bank would attempt to hasten a shakeup of its global operations, accelerating a further pivot into Asia as its European operations lose money.

In Hong Kong’s derivatives market, the second-most traded HSBC stock option on Thursday was a bearish contract betting the shares will drop to HK$18.50 by the end of December. That implies a downside of more than 30 percent from HSBC’s current levels. The most traded option was a bullish call that expires next week at HK$30, with the contract losing three-quarters of its value.

“The share price will hardly recover in the near term and there’s still room for a further decline,” said Yuen, founder of Surich Asset Management. “Hong Kong investors’ love for HSBC is still there, but it’s indeed heartbreaking. The times have changed.”