Buildings are seen from Victoria Peak in Hong Kong, China, on Aug 28, 2019. (PHOTO / BLOOMBERG)

Buildings are seen from Victoria Peak in Hong Kong, China, on Aug 28, 2019. (PHOTO / BLOOMBERG)

Hong Kong has shortlisted finalists to digitize its retirement funds system, according to people familiar with the matter, paving the way to lower fees for more than 4 million savers.

The shortlist pits a consortium led by Oneconnect Financial Technology Co. -- backed by Chinese giant Ping An Insurance Group Co. -- against a group led by Hong Kong billionaire Richard Li’s PCCW Ltd., the people said. A winner could be picked as soon as this month, said the people, who asked not to be named because the matter is private.

The Mandatory Provident Fund Schemes Authority is seeking to update its systems by creating an electronic platform that will centralize the data of its 4.3 million members by 2022

The Mandatory Provident Fund Schemes Authority is seeking to update its systems by creating an electronic platform that will centralize the data of its 4.3 million members by 2022. The goal is to make it easier for people to consolidate multiple accounts, switch between plans and lower fees, which have been criticized for being too high.

READ MORE: MPF records large losses amid pandemic

The winner stands to reap about HK$37 billion (US$4.8 billion) in revenue over the next decade based on the current pool under management, the people said. The government is allocating HK$3.3 billion to the program, and the platform operator will take a fee based on the system’s total assets.

Current bids are in the range of 20-to-35 basis points, the people said. Based on MPF’s asset pool of HK$968 billion as of June, that works out to about HK$2 billion to HK$3.4 billion a year.

Under Hong Kong’s mandatory retirement savings system, 5% of staff salary needs to be contributed to the MPF, capped at HK$1,500 a month. There are 30 MPF plans managed by 14 trustees, most using their own administration services.

The system had 9.8 million accounts as of April 2019 -- more than two for each member -- with many people having new ones created when they change jobs. The centralized platform will replace an inefficient paper-based system, making it easier for people to access and consolidate their accounts. Members will be able to switch providers, which the MPFA hopes will promote more competition and boost returns.

Current bids are in the range of 20-to-35 basis points, the people said. Based on MPF’s asset pool of HK$968 billion as of June

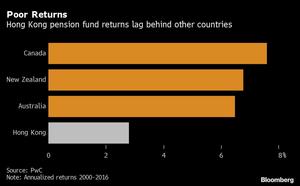

“A competitive landscape resulting from efficiency gains and lower fees means better net investment returns for members,” said Francis Chung, the executive chairman of consultancy MPF Ratings Ltd.

Oneconnect is working with France’s Atos SE, which is a technology partner for the International Olympics Committee, the people said. Oneconnect is backed by Chinese financial conglomerate Ping An, which held a 36.3% stake as of March.

ALSO READ: Hong Kong pension industry takes step to do-good investing

Telecommunications provider PCCW is working with Singapore-based iFAST Corp. as part of its bid, one of the people said.

Oneconnect, iFast and Atos declined to comment in emailed statements. The MPFA said it’s assessing the proposals received, without elaborating further.