Commuters wait for the train to arrive at Central station in Hong Kong, Oct 16, 2018. (SANJIT DAS / BLOOMBERG)

Commuters wait for the train to arrive at Central station in Hong Kong, Oct 16, 2018. (SANJIT DAS / BLOOMBERG)

For a global financial hub, Hong Kong has been a notable laggard in pushing its investment industry to adopt environmental, social and governance (ESG) criteria.

Now, a key operator in the city’s US$125 billion pension system is helping change that. BCT Group will screen new fund managers based on socially responsible criteria for the money it allocates in its Mandatory Provident Fund (MPF) schemes. It’s also tightened its annual reviews of the existing eight fund managers to emphasize ESG principles.

BCT Group, a key operator in the city's pension system, said it will screen new fund managers based on socially responsible criteria for the money it allocates in its MPF schemes

While BCT allocates only HK$55.8 billion (US$7.2 billion) of funds within Hong Kong’s mandatory retirement savings program, it has wider influence in the industry by serving as a trustee for more than 100 pension funds. BCT itself is owned by eight local banks.

“Hong Kong is still in the initial stage” of promoting ESG principles, Ka Shi Lau, BCT’s chief executive, said in an interview. “We’re finally catching up,” she said.

ALSO READ: HK seeing more emphasis on sustainable investment

The MPF Authority, which oversees Hong Kong’s compulsory retirement program, for its part says it “recognizes the importance of” ESG issues. “Trustees and their investment managers are encouraged to consider taking into account the relevant international ESG standards into their decision-making process and disclosing to MPF scheme members their approach to ESG factors,” it said in a statement.

BCT is acting “before the regulator asks us to do it,” Lau said. Chloe Kiosk, a corporate communications manager at the company, said that if any of the group’s existing fund-management picks were replaced, the new firms would need to have an ESG framework, among other requisites.

Asia and the US have lagged behind Europe on the ESG focus. That’s beginning to change, sometimes thanks to external events: the recent wildfires in Australia, which torched an area the size of England, put fund managers in the country under increasing pressure take account of climate change.

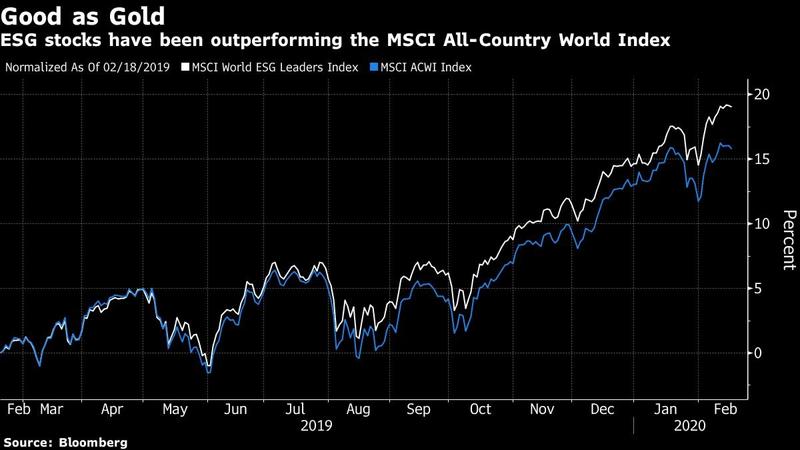

READ MORE: MSCI says ESG indexes will be bigger than traditional gauges

For BCT’s part, it’s studying supervisory guidelines issued last year by the International Organization of Pension Supervisors, an umbrella organization backed by the Organization for Economic Co-operation and Development.