The euro area economy is for once set for a sprightlier recovery from crisis than the United States, thanks to starkly different responses to the coronavirus.

America’s failure to get a grip on the pandemic is putting the brakes on its rebound compared with Europe, where many former virus hot spots managed to resume economic activity without causing a similar surge in infections.

Crucial for a sustainable recovery is confidence that the virus is no longer out of control, and Europe’s relative success may help encourage shoppers to spend and businesses to invest, further propelling demand and growth.

The region has also done a better job of protecting jobs and incomes, at least for now, with furlough programs keeping millions of workers on payrolls.

According to JPMorgan Chase & Co, Europe will do better because it has “broken the chain” that links mobility and the virus.

Goldman Sachs Group Inc has cited effective virus control as one reason it expects a “steeper and smoother rebound in the euro area than elsewhere.”

“It’s very clear that the euro area turned down more sharply but we also expect it to bounce back more sharply,” said Jari Stehn, chief European economist at Goldman Sachs. “It’s pretty rare that the euro area would outgrow the US over a horizon of one to two years.”

Since 1992, the US has outperformed the euro area in all but eight years, according to IMF data. Although the euro area managed to grow when the financial crisis hit in 2008 and the US shrank, in 2009 the US contraction of 2.5 percent was far shallower than the euro area’s 4.5 percent.

READ MORE: UK defends Spanish quarantine move as travelers react with anger

Aggressive lockdowns mean the euro area is set for a sharper second-quarter contraction than the US, something that will be seen in GDP figures due this week.

Having been hit hardest it’s pretty impressive that we think that Europe will recover more fully.

Bruce Kasman, Chief economist, JPMorgan

The euro-area economy probably shrank 12 percent in the three months through June, according to a Bloomberg survey. The US contraction, on an annualized basis, is forecast to be 35 percent, or a roughly 10 percent decline quarter-over-quarter.

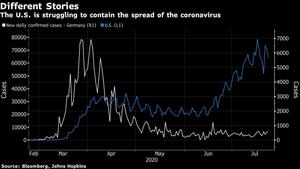

The US is struggling to contain the spread of the coronavirus. But high-frequency data suggest Europe is on the mend faster, and Bloomberg Economics estimates that the lead has widened recently.

“Having been hit hardest it’s pretty impressive that we think that Europe will recover more fully,” said Bruce Kasman, chief economist at JPMorgan.

“They’ve broken that link -- the mobility numbers are going up” without a resurgence of the virus, thanks to better contract tracing, mask-wearing and social distancing measures, he said.

JPMorgan expects the euro area’s economy to shrink 6.4 percent this year, slightly worse than the 5.1 percent contraction seen for the US. But for 2021, the bank forecasts a 6.2 percent rebound for the euro area, more than double America’s 2.8 percent growth.

ALSO READ: Fearing second COVID-19 wave, Europe to train 'army' of medics

In the US, a jump in cases across the South and West has led several states to halt or even reverse reopening plans. Measures of mobility and restaurant bookings have plateaued, and more than 1 million applications for unemployment benefits continue to be filed each week.

Meanwhile, euro-area purchasing managers indexes jumped more than forecast in July, while numbers for the US came in lower than expected, especially for services, which make up a much larger part of the economy than manufacturing.

The US economic situation could worsen if lawmakers don’t extend – in some form – the extra US$600 per week in unemployment benefits that have supported incomes and spending in recent months.

The divergence is reflected in markets. European stocks and bonds have benefited from renewed investor popularity, thanks to the bloc’s agreement on a historic 750 billion-euro (US$860 billion) accord. The euro has risen more than 6 percent against the dollar in the past two months, and could have further to run.

In Europe, generous loan and furlough programs prevented an immediate surge in unemployment, which is also helping the near term. Many were modeled on Germany’s renowned Kurzarbeit and largely proved efficient at getting aid to workers.

READ MORE: Von der Leyen says EU grateful for China's support

But it’s early in the recovery phase, and countries can’t keep funding support indefinitely. If demand doesn’t come back strong enough, companies may eventually have to cut costs, meaning Europe may only have delayed a damaging increase in joblessness.

Just because Europe is in a relatively better position to come out of this in the second half of the year, “doesn’t mean the US can’t catch up,” said Michael Gapen, chief US economist at Barclays Plc.

In the US, the US$2 trillion rescue package that Congress passed in March ranks among the most aggressive in history, but the distribution has been patchy and uneven. Unemployment offices were overwhelmed with claims, and many jobless Americans have still yet to receive the unemployment benefits they’re owed.

At the same time, the allocation of loans to small and medium-sized businesses had its own challenges, resulting in a chaotic scramble among business owners to get government assistance. Even so, the Paycheck Protection Program helped save as many as 3.2 million jobs, according to a study by Massachusetts Institute of Technology and Federal Reserve researchers.

High-frequency data suggests “things have stalled out, either because there’s exhaustion of initial pent-up demand or because of the virus creating a change in consumer behavior,” said Michelle Meyer, head of US economics at Bank of America Corp. While the third quarter will get a boost from initial state reopenings, “now the question is, how sustainable is that bounce?”