This Jan 21, 2015 photo shows people walking at the lobby of Singapore Exchange Ltd (SGX) headquarters in Singapore. (BRYAN VAN DER BEEK / BLOOMBERG)

This Jan 21, 2015 photo shows people walking at the lobby of Singapore Exchange Ltd (SGX) headquarters in Singapore. (BRYAN VAN DER BEEK / BLOOMBERG)

Singapore Exchange Ltd and Nasdaq Inc will extend their partnership to help companies access capital in both jurisdictions.

The increased cooperation will include a streamlined framework for issuers seeking a secondary listing on Singapore Exchange, SGX said in a statement.

Cooperation will further enable monitoring and assessment of issuers, and the enforcement of regulatory actions, including referrals of cases to the authorities of the respective jurisdictions

The framework allows documents required for the SGX listing to be based on information contained in the US listing and subsequent filing documents to the US Securities and Exchange Commission and/or Nasdaq, together with additional disclosure in compliance with Singapore’s rules.

ALSO READ: MSCI Singapore deletions shave US$613m off market value

Shares of SGX slipped 2.3 percent on Wednesday, the most in almost two months.

“A dual-listing tie up with Nasdaq will significantly bring up SGX’s profile” as an important destination for technology listings in Asia, said Margaret Yang, a strategist at DailyFX in Singapore. “This is significant for SGX, which has suffered from delistings and lack of technology firm IPOs in the past years.”

Cooperation will further enable monitoring and assessment of issuers, and the enforcement of regulatory actions, including referrals of cases to the authorities of the respective jurisdictions.

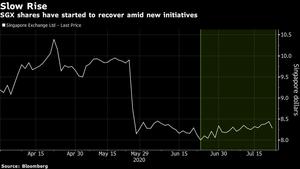

SGX saw its stock price tumble in May after MSCI Inc announced it would move licensing for derivatives products on some gauges to Hong Kong from Singapore.

ALSO READ: SGX plunges most in 17 years as MSCI signs pact with Hong Kong

It hasn’t stayed still -- the bourse said last month it would launch single-stock futures on some companies listed in the city-state, and announced it will acquire the remaining 80 percent stake in BidFX, a foreign exchange trading platform.

The move also comes after US President Donald Trump ordered an end to Hong Kong’s special status with the US.

Nirgunan Tiruchelvam at Tellimer sees the move as a positive for the Singapore bourse.

“This is a shot in the arm for the SGX,” he said. “It is an opportunity for the SGX to gain lost ground from a string of delistings.”

READ MORE: Singapore's key prices fall for first time in a decade