A bar tender inspects a bottle of whiskey before dinner service at Crown Super Deluxe restaurant, operated by hospitality group Black Sheep Restaurants, in Hong Kong, China, on Thursday, June 18, 2020. Operating more than 20 outlets popular with expats in the city, Black Sheep returned to make a profit recently after enduring three successive quarters of financial losses caused both by the protests and the virus outbreak. (LAM YIK / BLOOMBERG)

A bar tender inspects a bottle of whiskey before dinner service at Crown Super Deluxe restaurant, operated by hospitality group Black Sheep Restaurants, in Hong Kong, China, on Thursday, June 18, 2020. Operating more than 20 outlets popular with expats in the city, Black Sheep returned to make a profit recently after enduring three successive quarters of financial losses caused both by the protests and the virus outbreak. (LAM YIK / BLOOMBERG)

People walking through the Lan Kwai Fong area of Hong Kong over the weekend might have been surprised to see a truly uncommon sight for 2020: a busy restaurant.

May readings for the outlook among smaller retailers and restaurants in the city rose above the 50 level marking favorable business conditions for the first time since at least 2018 and that for restaurants hit a record at 53.6, according to data from the Census and Statistics Department Hong Kong

The Crown Super Deluxe, a new Japanese Teppanyaki grill restaurant in the centrally located bar district, saw most of its seats filled after the government eased social-distancing restrictions and moved the city another step closer to normality.

“On the one hand, we don’t have people coming in to Hong Kong, but we also don’t have people going out of Hong Kong,” said Christopher Mark, founder of Black Sheep Restaurants, which operates the grill. As virus-beating restrictions lift amid Hong Kong’s low and stable case-count, Mark says he’s “a little bit more optimistic.”

ALSO READ: HK bankruptcy filings at 17-year high amid pandemic, unrest

A captive audience for the Hong Kong Special Administrative Region’s hotels, restaurants and shopping malls has likely sparked a modest uptick in retail sales in May and June, with pent-up demand among the city’s residents for food and entertainment unleashed.

Yet concerns remain that the city’s battered tourism industry will not see business coming back to pre-downturn levels, and many wonder how long this current resurgence can last as unemployment rises and some expats leave the city.

Better Business

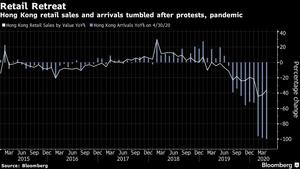

Hong Kong has had three straight months of retail sales declines greater than 35 percent and tourist arrivals fell 99.9 percent in both April and May as strict quarantine orders on the vast majority of arrivals remain in place. The city’s wider economy contracted 8.9 percent in the first quarter from year-ago levels, suffering its worst quarter on record and extending the first recession in a decade.

ALSO READ: HK restaurants to offer discounts in campaign to revive economy

A major obstacle to a real recovery remains worries that the millions of Chinese mainland tourists that used to visit per month won’t return to Hong Kong even after the virus subsides.

“Specifically for hotel accommodation and other tourism activities, they can only experience a turnaround when the quarantine is relaxed, not only in Hong Kong but in most major cities worldwide,” according to Iris Pang, chief economist for the mainland at ING Bank NV.

Some signs are emerging that smaller businesses are more optimistic about their short-term prospects. May readings for the outlook among smaller retailers and restaurants in the city rose above the 50 level marking favorable business conditions for the first time since at least 2018 and that for restaurants hit a record at 53.6, according to data from the Census and Statistics Department Hong Kong.

Back to the Malls

Shoppers in Hong Kong are returning to the malls, said Ada Wong, chief executive officer of the Champion REIT real estate firm.

“We are seeing a very good and encouraging retail sentiment especially after the relaxation of social distancing,” Wong said in an interview on Bloomberg Television Friday. Foot traffic in the Langham Place mall in Mong Kok is almost back to normal -- with just the tourists missing, according to Wong.

Still, retailers -- especially of luxury goods -- are worried that the uptick could be fleeting.

READ MORE: HK readying Chapter 11-style bankruptcy system

The Bluebell Group, Asia’s largest distributor of luxury brands including Versace and Moschino, has seen some recovery in business in Hong Kong, yet it is still in deep contraction.

Sales for the company’s portfolio of luxury brands were still down 50 percent in May and June compared with last year in Hong Kong, an improvement of a 70 percent drop in previous months.

“We are a bit scared that what we’ve seen in May and June might not hold for too long,” said Managing Director Samy Redjeb, “It could be one-off because consumers want to enjoy the promotion and the discount and they might not come back regularly every month.”

He mentioned that this summer will be key for many retailers as they decide whether to keep stores in the city. He said if border restrictions aren’t eased and local consumption slows after the promotions “and rents are back to 100 percent, then many retailers will reconsider their footprint in August, as we will.”

Staycation Boom

In the hospitality sector, Google trends data show that searches in Hong Kong for the word “staycation” recently surged to a record high. Hotels are capturing the demand. A Hyatt hotel in the tourism hotspot Tsim Sha Tsui is promoting its summer staycation package. For a king-bed deluxe room on a Friday night, the rate is HK$1,380 (US$178) including a two-person breakfast and an additional HK$1,000 dining coupon.

“As tourists are virtually zero, hotels are trying to attract local customers by providing promotion packages of stay plus meal,” said Yiu Si-wing, a Hong Kong lawmaker representing the tourism industry. “Hotels can’t charge any higher. Without such a discount, people won’t show up.”

Pedestrians ride on an escalator past banners promoting local tourism in Hong Kong on June 19. (CHAN LONG HEI / BLOOMBERG)

Pedestrians ride on an escalator past banners promoting local tourism in Hong Kong on June 19. (CHAN LONG HEI / BLOOMBERG)

Financial Secretary Paul Chan has urged businesses to offer discounts so residents can make use of a HK$10,000 cash handout currently being readied to help spur the economy.

The structural shift to focus on local demand could affect the city’s luxury industry, as big brands are preparing to reduce their scale.

On a recent Thursday evening, customers filled the two-floor showroom of OnTheList in Central, a flash-sale company that works with luxury brands including LVMH and Kering to offload items from past seasons. Since the end of May store traffic has returned to about 75 percent of pre-virus levels, according to co-founder Diego Dultzin. That’s up from a trough of about 16 percent in previous months.

READ MORE: HK companies have no safety net in fight for survival

“All the brands that we’re working with are now looking at reducing the presence in Hong Kong. Of course the market is going to be smaller and smaller,” said Dultzin, who recently opened in Shanghai. “We know that Hong Kong has a limit.”