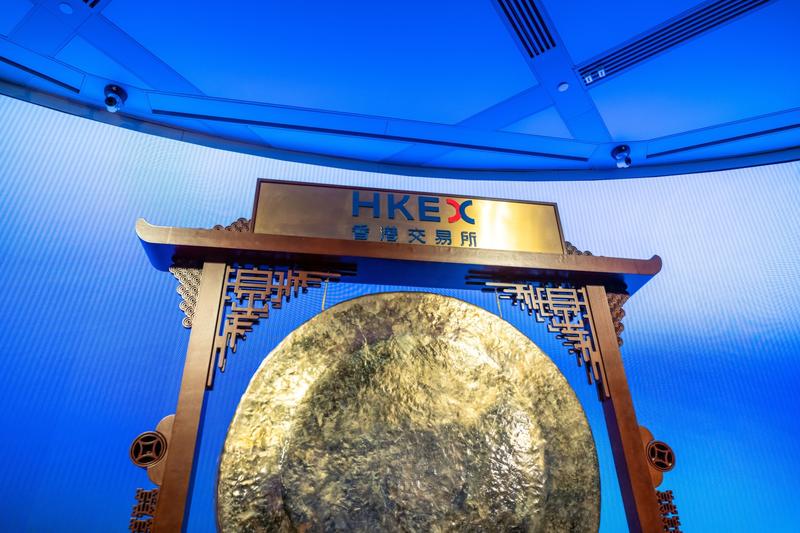

This undated photo shows Hong Kong Exchanges & Clearing Ltd. in Hong Kong, China. (BILLY H.C. KWOK / BLOOMBERG)

This undated photo shows Hong Kong Exchanges & Clearing Ltd. in Hong Kong, China. (BILLY H.C. KWOK / BLOOMBERG)

Companies are lining up to list in Hong Kong as a dry spell for initial public offerings comes to an abrupt end with two multi-billion dollar listings.

At least three firms began gauging investor demand for their IPOs on Monday, a week after Asia had its biggest week for listings all year

At least three firms began gauging investor demand for their IPOs on Monday, a week after Asia had its biggest week for listings all year. E-cigarette device maker Smoore International Holdings Ltd. and the property management arm of Zhenro Properties Group are among those testing appetites. Shenzhen Hepalink Pharmaceutical Group Co. is also meeting investors, according to people with knowledge of the matter. Another, medical device maker Kangji Medical Medical Holdings Ltd., kicked off a roadshow for an IPO that could raise as much as US$404 million.

ALSO READ: Li: Mainland firms to make beeline for HK second listing

Activity is finally picking up after a hiatus in IPOs caused by a spike in volatility as markets slumped earlier this year on concerns about the economic impact of the coronavirus. While Hong Kong stocks have not fully recovered from their March low, two successful listings by Chinese tech giants NetEase Inc. and JD.com Inc. to raise a combined US$6.6 billion in the past two weeks - almost double what had been raised all year - have injected some vitality into the city’s IPO market.

With US$10.12 billion raised so far, Hong Kong is still not back among the top three exchanges worldwide for IPOs after it dropped to fifth place earlier this year, but with the upcoming deals it has a fighting chance at pushing ahead of rival exchanges in Shanghai and New York. Smoore could raise at least US$800 million, while China Bohai Bank Co. is planning to gauge investor demand later this month for an IPO that could raise at least US$2 billion, Bloomberg News has reported.

READ MORE: JD.com, NetEase 'win Hong Kong approval for listings'