In this March 6, 2020 file photo, Cathay Pacific Airways aircraft line up on the tarmac at the Hong Kong International Airport. (KIN CHEUNG / AP)

In this March 6, 2020 file photo, Cathay Pacific Airways aircraft line up on the tarmac at the Hong Kong International Airport. (KIN CHEUNG / AP)

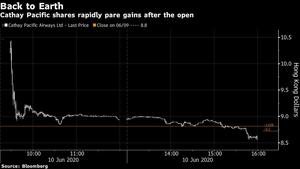

After surging the most in more than a decade, Cathay Pacific Airways Ltd shares reversed course and closed down one percent, a day after the carrier unveiled a US$5 billion government-backed plan to rescue it from collapse.

Cathay soared 19 percent in pre-market trading in Hong Kong, but then faltered almost as soon as the regular session began

Cathay soared 19 percent in pre-market trading in Hong Kong, but then faltered almost as soon as the regular session began. Traders said a rush to cover short positions was behind the biggest move in company shares since 2008. Trading was halted Tuesday before the HK$39 billion lifeline from the Hong Kong government, Swire Pacific Ltd and Air China Ltd was made public.

Analysts welcomed the proposed recapitalization--which includes the issuance of preference shares, rights and the extension of a bridge loan--but warned that longer-term challenges remain for the Hong Kong carrier as it continues to hemorrhage as much as HK$3 billion a month because of COVID-19 travel curbs.

Traders said a rush to cover short positions was behind the 19 percent pre-market move, which faltered almost as soon as the regular session began. Trading in Cathay was suspended Tuesday ahead of an announcement on the recapitalization, which includes the issuance of preference shares, warrants, rights and the extension of a bridge loan.

While the plan eases concerns over Cathay’s liquidity, the recovery outlook is “dim” and its monthly cash burn is likely to remain high, Credit Suisse Group AG said as it downgraded the stock to the equivalent of sell. Daiwa Securities Group Inc also lowered its rating to sell, saying minority shareholders will be diluted by Cathay’s issuance plans.

ALSO READ: HK govt to bail out Cathay with HK$39 billion rescue package

Cathay has dropped 24 percent this year, just outperforming a Bloomberg gauge of Asia Pacific airlines, which is down 25 percent after the coronavirus pandemic destroyed travel demand. Short interest in Cathay shares was about 13 percent of free float as of Monday, according to IHS Markit Ltd data.

The International Air Transport Association (IATA) said Tuesday airlines are expected to lose US$84.3 billion this year, with a 50 percent slump in revenue to US$419 billion.

“Financially, 2020 will go down as the worst year in the history of aviation,” the industry group’s Director General Alexandre de Juniac said. “On average, every day of this year will add US$230 million to industry losses.”

ALSO READ: Cathay to keep greatly reduced schedule through June 20

Cathay said its plan is designed to provide sufficient funds to survive the industry downturn and set a platform from which to review and transform its business, which Chairman Patrick Healy warned would collapse without the US$5 billion recapitalization.

“Cathay’s recapitalization plan will secure its survival but dilute earnings per share by up to 43 percent,” Bloomberg Intelligence analysts James Teo and Chris Muckensturm said. “Shareholders subscribing to its rights issue face six percent dilution if warrants are fully exercised. An offering of preferred shares may result in a HK$585 million annual dividend paid to the Hong Kong government, leaving less for other shareholders.”

Cathay said it expects to repay the Hong Kong government for HK$19.5 billion (US$2.52 billion) of preference shares under the plan over a three to five year period.

READ MORE: Cathay Pacific loses HK$2 billion in February due to virus

“We would certainly be expecting to repay that over a 3-5 year period,” Chief Financial Officer Martin Murray said in an analyst briefing posted to the airline’s website late Tuesday.

Murray said the package, which also includes a HK$11.7 billion rights issue to current shareholders including Swire Pacific Ltd, Air China Ltd and Qatar Airways, would more than halve the airline’s gearing levels.

“That in turn restores access to both the equity and debt market and allows us to tap that market later in the year or next year for equity and debt,” he said.

The Hong Kong government could gain a six percent stake in Cathay via HK$1.95 billion of warrants convertible to shares. Finance Secretary Paul Chan said on Tuesday it was not the goverment’s intention to remain a long-term shareholder in Cathay.

Swire, which owns 45 percent of Cathay, has agreed to remain a controlling shareholder for as long as the government owns preference shares or any amount of a HK$7.8 billion bridging loan remains outstanding.

Prior to the pandemic, Cathay was already under enormous financial strain due to Hong Kong’s anti-government protests, which affected traffic numbers and led to the exit of the company’s former chief executive officer. Passenger revenue is only about 1 percent of prior year levels.

The airline posted an unaudited loss of more than HK$2 billion in February alone, and since then it has been losing HK$2.5 billion to HK$3 billion a month.

“Financially this gives them probably enough for a year to two years,” Sobie Aviation’s Brendan Sobie told Bloomberg Television on Wednesday. “This is just one step to survive the crisis.”

He said the plan was the best scenario for those involved and maintains the shareholding balance for Swire Pacific, Air China and Qatar Airways. It also helps preserve Hong Kong’s position as an aviation hub. Next, Cathay will have to make strategic decisions on fleet size, capacity and other areas to align with an international market that will take time to recover.

Cathay’s Healy said “tough decisions” would need to be made in fourth quarter to get the airline to the right size and shape to compete effectively, and that “nothing is off the table” in terms of what needed to be done.

Cathay’s Healy said “tough decisions” would need to be made in fourth quarter to get the airline to the right size and shape to compete effectively, and that “nothing is off the table” in terms of what needed to be done

The company may access equity and debt capital markets again to strengthen its balance sheet if conditions are right, Healy said.

“The fund-raising gives Cathay about 13 to 16 months of liquidity,” said Paul Yong, an analyst at DBS Group Holdings Ltd in Singapore. “But short-term profitability remains highly challenged because the rate of the international travel market opening is happening slowly and cautiously. Also there is social unrest in Hong Kong.”

Coronavirus-related travel restrictions have put enormous pressure on airlines globally, and none are certain about how the future will pan out as new travel requirements come into force and travelers’ attitudes change.

Cathay and its Cathay Dragon unit have been operating a “bare skeleton” passenger service since April after slashing capacity by 96 percent and cutting their route networks. Hong Kong Express, the budget carrier Cathay acquired last year, said Wednesday it will gradually resume flight operations from July 12.

"Cathay’s dominance in Hong Kong was strengthened by its acquisition of HK Express last year, which should serve it well as the city remains a key Asian financial and trade hub,” Bloomberg Intelligence’s Teo and Muckensturm wrote in a note.

IATA said air traffic is likely beyond the worst of its collapse, provided there isn’t a second, more damaging wave of the virus. At its lowest point in April, global air travel was about 95 percent below 2019 levels, and passenger numbers this year will likely slide to 2.25 billion, which is roughly the same as 2006 levels, it said. Costs, meanwhile, aren’t falling as fast as demand.

“That’s why government financial relief was and remains crucial as airlines burn through cash,” IATA’s de Juniac said. “The challenge for 2022 will be turning reduced losses of 2021 into the profits that airlines will need to pay off their debts from this terrible crisis.”