In this Oct 1, 2019 photo, an employee works on a section of fuselage inside the new Airbus SE A320 passenger aircraft family assembly line hangar in Hamburg, Germany. (KRISZTIAN BOCSI / BLOOMBERG)

In this Oct 1, 2019 photo, an employee works on a section of fuselage inside the new Airbus SE A320 passenger aircraft family assembly line hangar in Hamburg, Germany. (KRISZTIAN BOCSI / BLOOMBERG)

Airbus customer British Airways said Tuesday it will cut as many as 12,000 jobs, or close to 30 percent of the total, to help survive a downturn in travel that could last for years, while Deutsche Lufthansa AG is locked in talks with the German government over a multibillion-euro bailout and could seek court protection if it can’t reach a deal.

Airbus is looking to furlough staff in Germany, and will put more French workers on leave

Boeing Co, Airbus’s arch rival, is due to report earnings later Wednesday. Both companies have suffered a 60 percent share-price decline this year, though Boeing has also been roiled by the long-term grounding of is 737 Max model.

ALSO READ: Coronavirus travel: What happens to planes grounded by COVID-19

Faury said measures taken by Airbus so far, which include cutting annual production by slightly over one-third and temporarily laying off more than 6,000 workers, may be just the start, and the company will review the situation in June when there may be more visibility into the direction the crisis is headed.

Airbus is looking to furlough staff in Germany, and will put more French workers on leave. “The resizing of the company will be made not only looking at the minus 35 percent adaptation we’ve done recently but also the likely scenario moving forward,” Faury said.

Agency Partners analyst Sash Tusa said the cash outflow was worse than the 6.3 billion euros he’d predicted and leaves Airbus with just 3.6 billion euros in net cash.

The Toulouse, France-based manufacturer said it has reduced anticipated capital spending this year by about 700 million euros to ease demands on its sources. The company had already extended credit lines and clamped down on expenses to give it access to 30 billion euros.

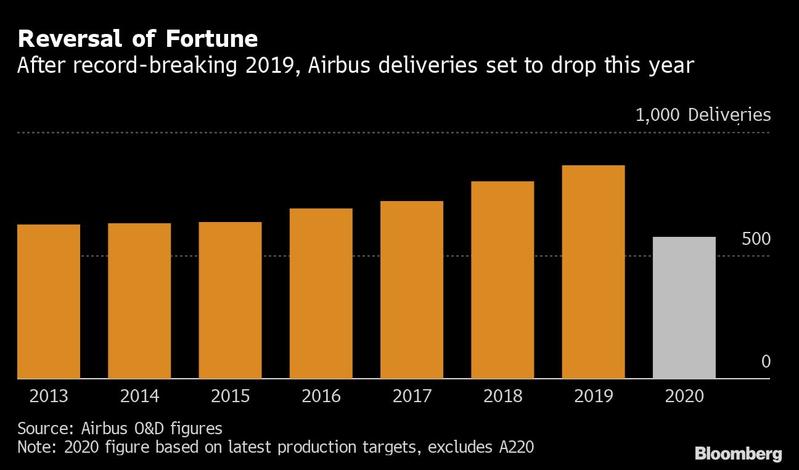

While Airbus delivered 122 aircraft in the first quarter, the full impact of the coronavirus wasn’t initially felt, Faury said, though 60 planes couldn’t be handed over because of the outbreak. Deliveries in the second quarter “will be very low,” he said. The company plans to ship about 600 jets during the year, down from a record 863 in 2019, though the tally may be slashed further.

READ MORE: Testing times for global aviation firms

Suppliers will feel a squeeze in the second quarter when cash payments drop, and will then need support, the CEO said, especially since many are already under pressure after the idling of the Max reduced revenue from Boeing.

First-quarter adjusted earnings before interest and tax fell 49 percent to 281 million euros and the company swung to a net loss. Faury said the company is still assessing the implications of Covid-19 and can’t yet provide a financial outlook for the full year.