Finance chiefs from the world’s top industrial and emerging nations committed to “take further actions” to aid the world economy amid mounting fears the coronavirus is dragging it toward a recession.

At the end of a week in which the virus spread and an emergency Federal Reserve rate cut failed to calm investors, Group of 20 finance ministers and central bankers said they would use “fiscal and monetary measures, as appropriate, to aid in the response to the virus, support the economy during this phase and maintain the resilience of the financial system.”

The statement echoed one released Tuesday by the Group of Seven nations, which ultimately disappointed investors as it was followed by limited action

The statement echoed one released Tuesday by the Group of Seven nations, which ultimately disappointed investors as it was followed by limited action. The test will be whether the broder group backs its latest words with action.

READ MORE: Rebound rumbles on as G7 send support signal

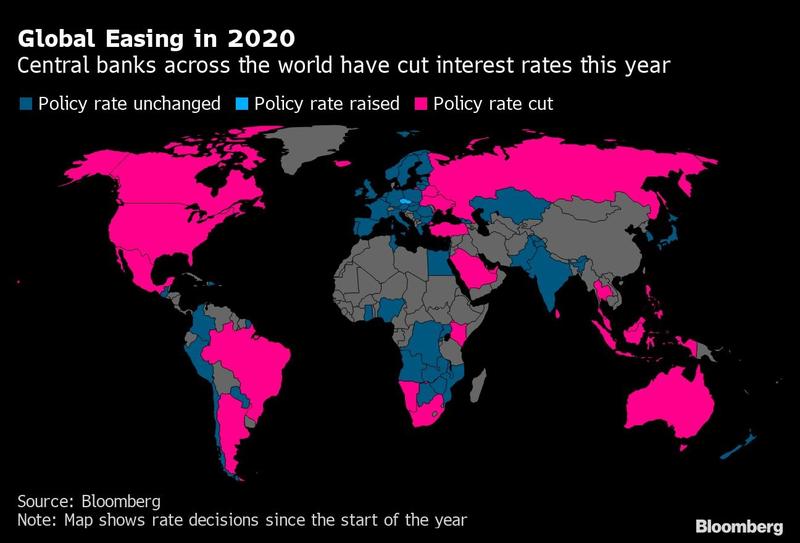

The Fed and Bank of Canada already cut interest rates this week and some countries hit by the virus began crafting fiscal packages, but most others have so far held back. Pressure is now mounting for a broader response as economists predict the worst year for global growth since 2009 and some market indicators signal the potential for recession.

The G20 is responsible for about 90% of global gross domestic product and better reflects the modern world economy than the G7 because it includes emerging markets including China and Russia as well as traditional powerhouses such as the US. It emerged as the forum for steering international policy during the financial crisis of just over a decade ago.

ALSO READ: G7 to deploy all policy tools to combat coronavirus

“The G20 is an important forum for driving a global response during times of uncertainty,” the statement said. “We reiterate our commitment to use all available policy tools to achieve strong, sustainable, balanced and inclusive growth, and safeguard against downside risks.”

The focus is now on the European Central Bank and potentially the Bank of England to loosen monetary policy in coming days. As for governments, some such as China, South Korea and Italy have already taken steps to help their economies, but those of US President Donald Trump and German Chancellor Angela Merkel have shown limited willingness to boost spending or cut taxes.

One challenge facing policy makers is the suspicion that traditional stimulus will fail to buoy economies so long as the virus is still spreading. Lower interest rates or taxes won’t reopen closed factories or encourage consumers to shop or travel if they’re scared of being infected.

That’s prompting calls for authorities to target the measures they take on providing health care, supporting cash-strapped companies and laying the ground for a recovery in demand once the health emergency passes.