Hong Kong will avoid the kind of property market crash that followed previous economic slumps in the finance hub, according to Financial Secretary Paul Chan.

“We do not see the risk of an off-the-grid type of downfall,” Chan said in an interview Monday with Bloomberg Television’s Yvonne Man.

As Hong Kong’s economy reels from the coronavirus outbreak that has compounded months of social unrest, the world’s most expensive property market risks a sharp decline in values as it did following the Asian financial crisis in the 1990s, the SARS outbreak in 2003 and the global recession in 2008.

The Centaline Property Centa-City Leading Index, which tracks existing home prices, as of Feb 23 has dropped 6.5 percent since the end of June

Unlike after SARS, this time Hong Kong has a shortage of supply, flush liquidity and historically low interest rates, Chan said.

“If people can keep their job it will be a little easier for them to ride through this difficulty,” Chan said.

The Centaline Property Centa-City Leading Index, which tracks existing home prices, as of Feb 23 has dropped 6.5 percent since the end of June.

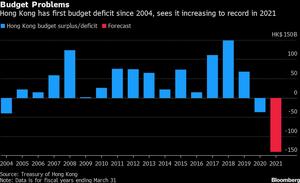

The Hong Kong budget last week unveiled by Chan includes HK$120 billion (US$15.4 billion) in relief spending and ushers in a period of anticipated deficits, including a record HK$139.1 billion forecast for the coming fiscal year.

The centerpiece of Chan’s budget is a HK$10,000 cash handout to permanent residents age 18 and older. Other measures include tax breaks for individuals and businesses, as well as funding for various industries.

Chan expects the cash handouts to start positively affecting the economy this summer as he said he is looking at starting registration for the payments in early July and processing them over the summer months.

ALSO READ: Hong Kong January retail sales tumble for 12th straight month

Still, while Chan forecast a quick rebound for the economy he stopped short of a confident prediction.

“The rebound will be strong but to what extent this rebound compares to the past remains to be seen,” he said.

Economists forecast a second straight year of contraction for Hong Kong’s economy, the first back-to-back annual recessions on record. The government projects growth of -1.5 percent to +0.5 percent.

Economists are skeptical that the cash handout and other measures will make an immediate, meaningful difference with the city mired in recession after months of political unrest and now grappling with the coronavirus crisis. In particular, some question whether the cash dispersal will work as well as targeted, specific spending.

READ MORE: HK coronavirus-hit property market grinds to a halt

In January, Chan had played down expectations for a handout as it would push the deficit past HK$100 billion.

The time lag between announcing and implementing the cash handout also means it likely won’t help spur economic growth until at least the second half of 2020, Goldman Sachs Group Inc. economists said in a report after the budget announcement.