Hong Kong’s usually booming property market has virtually ground to a halt as the fear of coronavirus impacts life in the city.

Just 13 homes were sold in the first three weekends after Chinese New Year at the city’s 10 largest housing estates, according to Centaline Property Agency Ltd data.

Owners believe the disease can be contained, therefore their outlook on the property market isn’t very bleak.

Benny Wan, Branch manager, Centaline Property Agency Ltd

“Buyers are adopting a wait-and-see attitude,” said Sammy Po, chief executive officer of Midland Realty International Ltd’s residential department. “They will act only if they find bargains.”

ALSO READ: HK home prices prove resilient amid protests

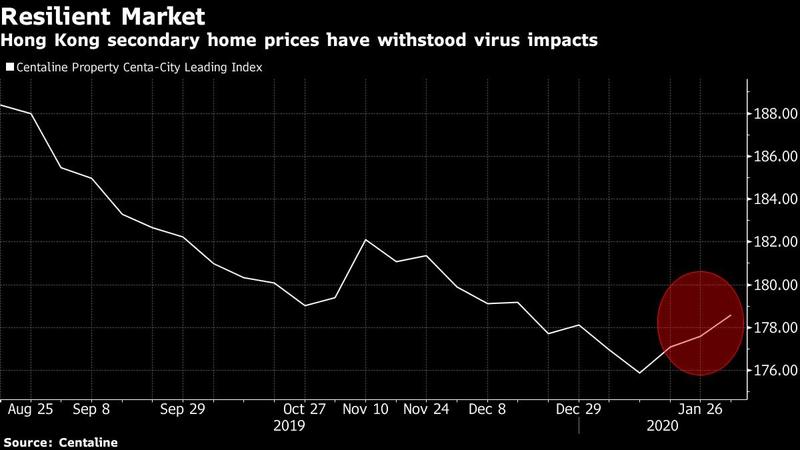

However, sellers aren’t willing to budge much, betting the outbreak of the virus will be short-lived and demand in the world’s least-affordable housing market will soon rebound. Prices in the secondary market rose 0.8 percent between Jan 19 to Feb 2, according to Centaline.

“Owners believe the disease can be contained, therefore their outlook on the property market isn’t very bleak,” said Benny Wan, a branch manager at Centaline. “This is unlike SARS, when people had to slash prices drastically because they had never witnessed anything like that. The market condition isn’t that severe now.”

ALSO READ: Bubble burst unlikely in HK's resilient property market

The number of diagnosed coronavirus cases in Hong Kong climbed to 49 as of 8 pm on Tuesday, Hong Kong health authorities said. Fear of catching the disease has also deterred people from visiting showrooms, while would-be sellers are reluctant to open their homes for inspection.

Meanwhile, Midland Realty, one of the largest property agencies in Hong Kong, started to offer front-line staff unpaid leave for “health concerns” on Tuesday. Po expects property prices to drop by 5 percent to 10 percent this year as a result of the outbreak.

READ MORE: HK home prices see sharpest decline in 3 months in December