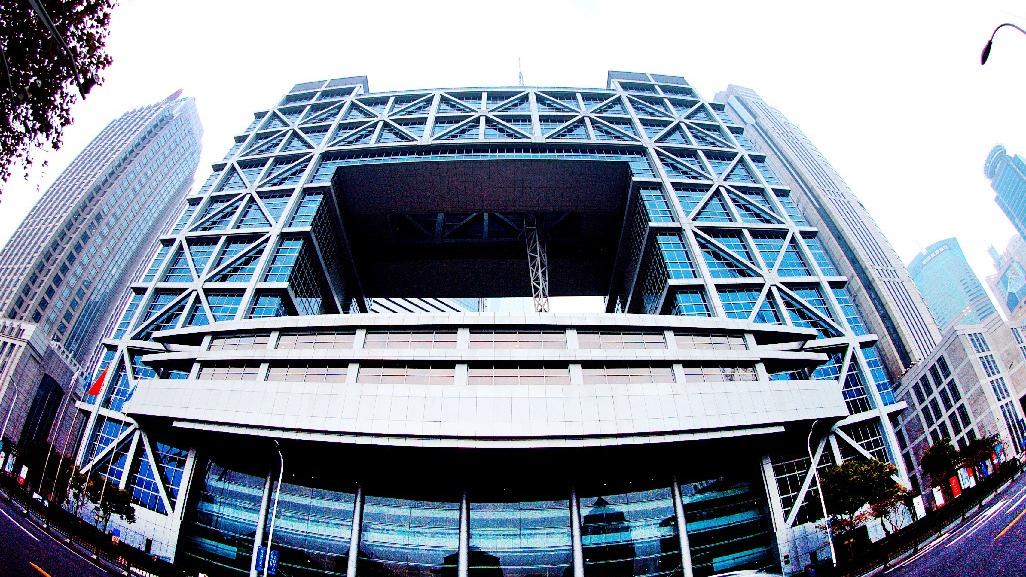

File photo provided by the Shanghai Stock Exchange (SSE) shows an outside view of the SSE in Shanghai, east China. (PHOTO / XINHUA)

Chinese stocks plummeted by the most since 2015 as they resumed trading on Monday amid the novel coronavirus outbreak.

ALSO READ: Asian shares set for rough ride

The CSI 300 Index of companies listed in Shanghai and Shenzhen closed 7.9 percent lower after falling as much as 9.1 percent. The loss was the most since August 2015. Declines were led by telecom, technology and commodity producers. The Shanghai Composite Index slid 7.7 percent.

The CSI 300 Index of companies listed in Shanghai and Shenzhen closed 7.9 percent lower after falling as much as 9.1 percent

China’s benchmark iron ore contract declined by its daily limit of 8 percent, while crude and palm oil also sank by the maximum allowed. The yield on China’s most actively traded 10-year government bonds dropped the most since 2014. The yuan tumbled more than 1 percent to weaken past 7 per dollar.

The central government injected cash into the financial system Monday, with the central bank seeking to ensure ample liquidity as markets plunge. It cut the rates on the funds by 10 basis points. Officials also urged investors to evaluate objectively the impact of the coronavirus.

READ MORE: Impact of coronavirus on real estate market 'won't last long'

The People’s Bank of China (PBOC) added 900 billion yuan (US$129 billion) of funds with seven-day reverse repurchase agreements at 2.4 percent. It will also inject 300 billion yuan with 14-day contracts at 2.55 percent. While the total is the largest single-day addition of its kind in data going back to 2004, it implies a net injection of just 150 billion yuan as more than 1 trillion yuan of short-term funds mature.

The PBOC said it would continue to pay close attention to the liquidity situation and maintain macro liquidity at a reasonably ample level.