Chip designer OmniVision Integrated Circuits Group Inc gained in its trading debut in the Hong Kong Special Administrative Region after raising HK$4.8 billion ($616 million) in an offering.

The shares closed 16 percent higher on Monday at HK$121.80, compared with an offer price of HK$104.8 apiece. The company’s Shanghai-listed stock added 1.5 percent.

The shares’ double-digit gains are still modest compared with the frenzied debuts of recent chip IPOs, underscoring how global investors are differentiating among likely winners in the artificial-intelligence sector. Hardware maker from the Chinese mainland Shanghai Biren Technology Co jumped more than 70 percent in its first trading session while mainland-listed Moore Threads Technology Co rose multifold as investors bet on Beijing’s support for the local semiconductor industry.

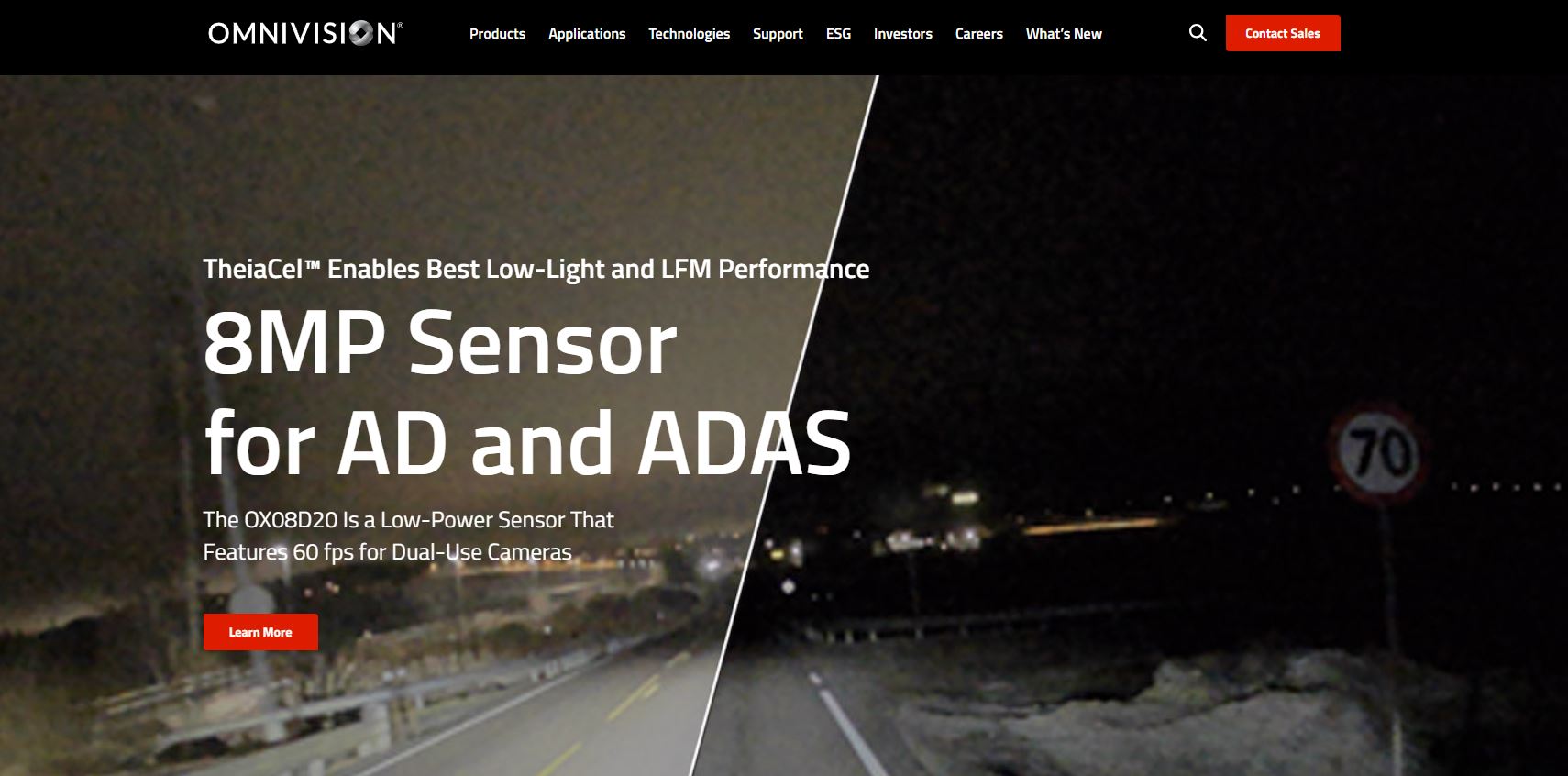

OmniVision, formerly known as Will Semiconductor, is a provider of CMOS image sensors — chips that turn incoming light into electrical signals — used in smartphones, automobiles and emerging technologies such as smart glasses and Edge AI. The company was listed as one of the world’s top ten fabless chip designers in 2024 along with global giants including Nvidia Corp, according to a report from research firm TrendForce in 2025.

“OmniVision is already listed in Shanghai, making its Hong Kong debut less novel,” said Xiang Xiaotian, director at Shanghai Chengzhou Investment Management Co. The company also “lacks strong ties to AI — currently the most sought-after sector for global investors,” he said.

ALSO READ: Mainland AI chip firm Biren ‘to launch Hong Kong IPO in coming weeks’

OmniVision’s offering has drawn support from sovereign wealth funds, including Qatar Investment Authority and GIC, according to IFR. Proceeds raised from the HKSAR listing will be mainly used in research and development of key technologies, including sensing and display technology as well as analog solutions.

The offer price represented a 29 percent discount to the Shanghai-listed stock’s Friday close, compared with an average 19 percent discount for HKSAR–listed shares relative to their mainland peers.

The chip designer in 2019 acquired Silicon Valley-based OmniVision Technologies, which rivals Sony Group Corp and Samsung Electronics Co on image sensors. OmniVision Technologies, a former Apple Inc supplier, was delisted from Nasdaq in 2016 with a buyout deal from a group of mainland investors.

OmniVision reported revenues of 25.7 billion yuan ($3.7 billion) in 2024 and 13.9 billion yuan in the first half of 2025, representing an increase of 23 percent and 15 percent from the previous corresponding periods, respectively, according to its prospectus. The growth is driven by a recovery in consumer electronics demand.

READ MORE: China’s Baidu is said to weigh Hong Kong IPO for AI chip unit Kunlunxin

The pipeline of listings in the HKSAR is robust, with 11 companies having laid plans to debut in the city this month. About half of those firms are mainland AI companies. The next one due to trade in the HKSAR is GigaDevice Semiconductor Inc, which is scheduled to list on Tuesday.