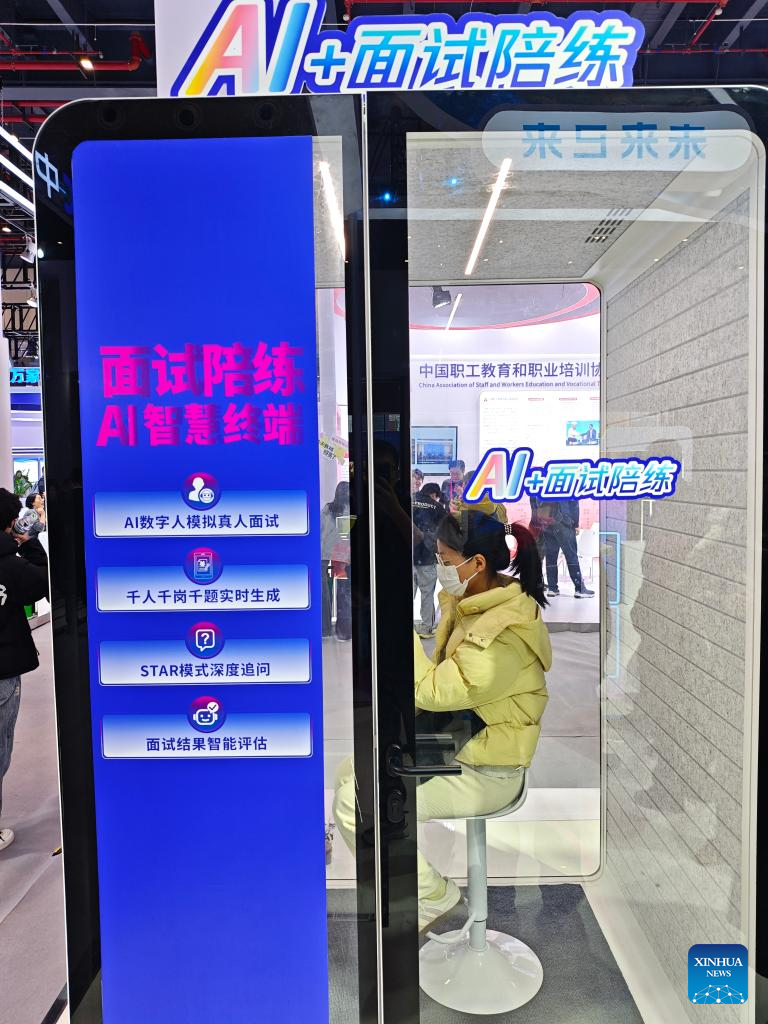

China’s artificial-intelligence and robotics industries are entering a phase of accelerated development, helping to build the AI industry chain and support economic recovery.

Members of HSBC Asset Management said on Monday in their 2026 investment market outlook that a moderate reflationary momentum is expected to emerge in China in the second half of 2026.

READ MORE: China to unveil plans to integrate AI with manufacturing

According to HSBC’s report, significant growth in domestic production of graphics processing units and AI computing self-sufficiency is expected over the next 12 to 18 months. In the coming six to 12 months, a large number of companies related to domestic GPUs and AI computing power are set to list on the A-share and H-share markets. The domestic GPU substitution rate is projected to rapidly increase to over 50 percent in the coming years, potentially reaching 79 percent, greatly advancing the development of AI applications in China.

Caroline Yu Maurer, head of China and core Asia equities at HSBC asset management, said, “China is probably the only country that has invested so much in human development, and the number of companies unveiling all the new models is actually more in China than any other country in the world, and actually taking real orders.”

Maurer said the report shows that the global investment markets in 2026 will undergo a “role reversal”, with performance increasingly driven by fundamental factors such as profit growth rather than market sentiment. Earnings in traditional industries like real estate are on a downward trend, whereas the tech and healthcare sectors tied to emerging industries are seeing stronger profitability, leading to a divergence in sector performance currently observed in Hong Kong and on the Chinese mainland, she said.

The report also said that proactive measures against excessive competition in China’s upstream industries have achieved notable results. Stimulating consumption has been elevated to the top priority of economic work for the first time in over a decade. The National People’s Congress has placed a strong emphasis on consumption, indicating a more supportive fiscal stance and significantly restoring investor confidence. A moderate reflationary momentum is anticipated in the second half of 2026.

READ MORE: AI giving China edge in business

Promoting industry consolidation, facilitating the exit of inefficient enterprises, and encouraging mergers and acquisitions, coupled with further consumer support on the demand side, “I think in combined mission of two, we are hoping to see China’s producer price index continue to narrate,” Maurer said.

“China is paving the way for sustainable economic growth. The elevation of consumption as a top economic priority marks a pivotal shift, fostering a more sustainable fiscal environment and bolstering investor confidence.”

Maurer said that the Chinese equities remain attractive compared to other markets, mainly driven by opportunities emerging across key sectors like AI and robotics, offering compelling opportunities for long-term investors.

Contact the writer at akirawang@chinadailyhk.com