By 2030, Wuxi National High-tech District aims to grow cosmetics and wellness sector to 10b yuan, attract 30 leading firms

Can you believe that an entire industry chain operates inside a single building in Wuxi, Jiangsu province?

In Wuxi National High-tech District, this is exactly how the beauty and wellness industry works.

At Jiangnan Beauty Bay, an industrial park dedicated to the beauty and wellness sector, raw materials travel upstairs and return as finished products, while livestreamers next door sell them to consumers worldwide. Here, "upstairs and downstairs" is literally "upstream and downstream".

Research and development are at the earliest stage of this industry chain.

Inside the R&D lab of the Jiangnan Institute of Beauty Research, a new facility established with help from Jiangnan University, scientists are creating the ideas that will shape tomorrow's beauty brands.

"Scientific innovation is the 'brain' and 'engine' of the modern beauty and wellness industry. It has shifted from a supporting role to the core driving force behind industrial upgrading and value creation," said Li Jinhua, a professor at Jiangnan University and head of the institute.

Li said the institute's technological capabilities also play a vital role in optimizing production processes, supporting industrialization and bridging laboratories with brand owners.

"R&D is no longer an optional link in the beauty supply chain — it is the lifeline running through the entire process. It determines whether products can stand out from homogenized competition, whether brands can build long-term trust and whether the whole industry can move toward higher efficiency, scientific rigor and sustainability," he said.

Focusing on innovative raw material development, formulation technologies, efficacy evaluation and more, the institute has served more than 100 leading domestic and international cosmetics and personal care companies.

Inside the Jiangnan Beauty Bay building, innovation upstairs is quickly translated into commercial products downstairs.

On the production line of Rayting Biotechnology, rows of fermentation tanks have helped turn lab inspirations into tangible ingredients.

"Take fermentation technology as an example: once a promising strain is identified in the lab, it can come to us immediately for pilot-scale amplification and verification. If successful, it moves straight into production as a commercial ingredient," said Du Yangbiao, chairman of Rayting Biotechnology.

"This seamless handoff reduces the risks of innovation and accelerates the entire process," Du said.

Fermentation essentially creates the ideal growth environment for microorganisms, Du explained. The process begins with an original strain stored at minus 80 C and expands step-by-step until it reaches multi-ton fermentation tanks — a process that demands precise control.

After years of collaboration with Jiangnan University, the producer has built its own strain library and proprietary fermentation technologies, breaking the long-standing dominance of overseas suppliers in active raw materials.

"Raw materials are the core technology inside beauty products — they are the 'chips' of the cosmetics industry. Our job is to reliably scale up lab discoveries into ingredients that downstream manufacturers can use," Du said.

The building's "vertical ecosystem" has rapidly attracted beauty and wellness companies to the industrial park. Since its opening in April, Jiangnan Beauty Bay has brought in 58 enterprises, achieved an occupancy rate of over 70 percent and created over 400 jobs, said Guo Zhilong, general manager of the park.

In terms of this year's development goals, Jiangnan Beauty Bay is expected to exceed 3 billion yuan ($422 million) in revenue with more than 100 million yuan in tax contributions, Guo said.

Once ingredients are ready, it's time for manufacturers inside the building to turn formulas into mass-market products.

"Scaling up a lab sample into industrial production isn't simply multiplying the quantities. It is a complex, rigorous process involving shifts in physical, chemical and engineering conditions," said Michael Jungho Kim, president of Kolmar Cosmetics (Wuxi).

To ensure quality, the manufacturer runs comprehensive inspections and validation throughout the entire process, with six stages of testing from raw materials entry to final shipment, Kim added.

As someone who has lived in China for 18 years, Kim said he has witnessed the rise and rapid growth of China's beauty and wellness industry.

"Chinese beauty ODMs (original design manufacturers) are increasingly competitive — not only in efficiency and cost, but also in rapid learning, technological accumulation and alignment with global market needs," he said.

As a bridge connecting Chinese and global beauty technologies and markets, Kolmar will continue advancing open innovation and integrating high-quality resources worldwide, helping Chinese ODMs shift from "serving China" to "serving the world", Kim noted.

What's built upstream and midstream eventually comes to life as brands that win over consumers.

As one of the first companies to settle in Jiangnan Beauty Bay, Dexter, a homegrown Wuxi brand, has grown into China's first infant and child personal care company with revenue surpassing 1 billion yuan.

"With labs upstairs and production lines downstairs, we compete on product development speed while others still compete on traffic," said Zhang Xiaojun, founder and CEO of Dexter.

"Fast R&D, fast iteration — sometimes our upgraded version launches before consumer feedback cools down."

Zhang, who once worked as an overseas shipping agent while studying abroad, is now taking his own brand global — a "reverse export", as he describes it.

"Not long ago, we were chasing international brands. Now they're studying our ingredient lists. This upstairs-downstairs model lets us integrate resources, test quickly, iterate quickly and innovate quickly," he said.

But how do brands know whether their products truly deliver results to end consumers?

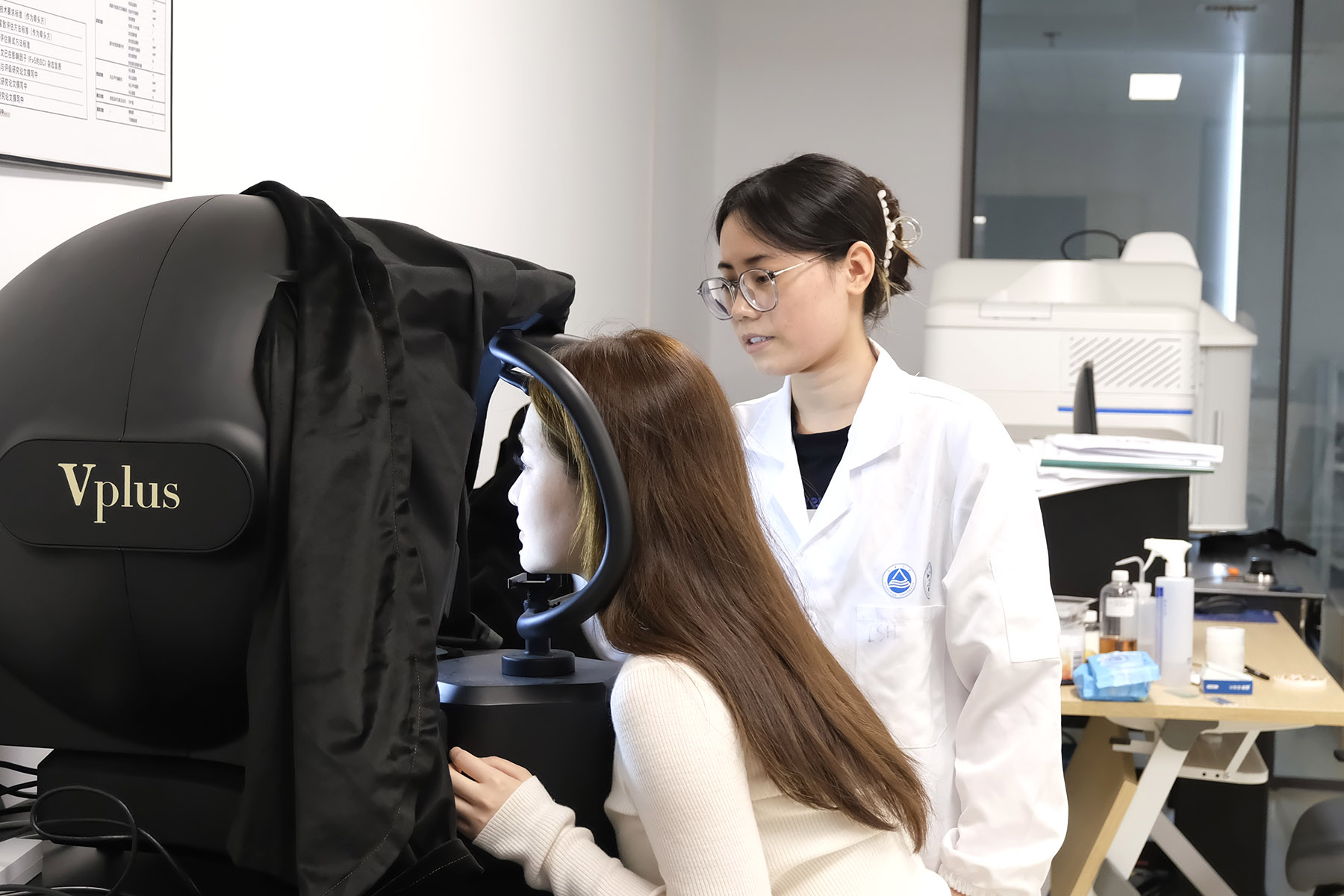

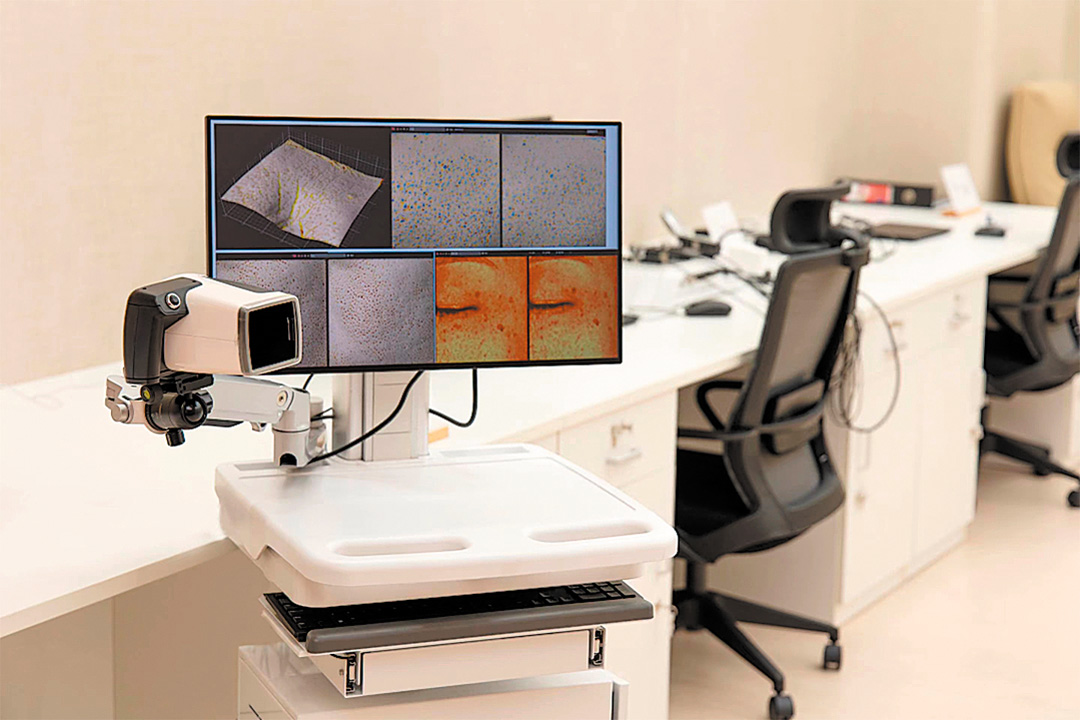

Inside the same building, Yiwei Testing & Evaluation provides one-stop services from formulation design and consumer insights to efficacy verification and sensory evaluation.

For example, advanced sensory evaluation technologies help address a major industry challenge — the heavy reliance on subjective human perception in assessing product texture and makeup performance, which makes it difficult to quantify results, said Li Mingyuan, founder and CEO of Yiwei.

"Objective, quantifiable assessments of usage experience are provided by trained panelists. These sensory data can then be modeled with rheology, consumer behavior preferences and other indicators to generate measurable feedback," Li said.

The niche evaluation player now operates 4,000 square meters of labs covering efficacy testing, cell studies, skin-on-a-chip platforms and more, spanning skincare, makeup, scalp care and haircare sectors in the beauty and wellness industry.

ALSO READ: Electric motorbike firms rev up overseas production

The coordinated growth of R&D institutions and testing providers is a key pillar of Wuxi National High-tech District's strategy to develop the beauty and wellness sector — now one of its three signature biomedicine tracks.

By 2030, the district aims to grow the industry to 10 billion yuan and attract 30 leading enterprises, according to the administrative committee of the high-tech zone.

Future plans include building a full-chain ecosystem integrating R&D, manufacturing and marketing through Jiangnan Beauty Bay; developing specialized facilities such as collaborative aesthetic medicine centers; and strengthening platform-based innovation — including advancing synthetic biology and active ingredient encapsulation platforms — to chart a distinctive development path for the industry.

Contact the writers at lijiaying@chinadaily.com.cn