Chinese mainland aluminum smelter Chuangxin Industries Holdings Ltd gained in its Hong Kong trading debut after an initial public offering that raised HK$5.5 billion ($707 million).

The stock opened 38 percent higher at HK$15.20 on Monday. Its shares were sold at HK$10.99 during its IPO, attracting big investors including Swiss commodity giant Glencore Plc and asset managers Hillhouse Investment Management and Millennium Management LLC.

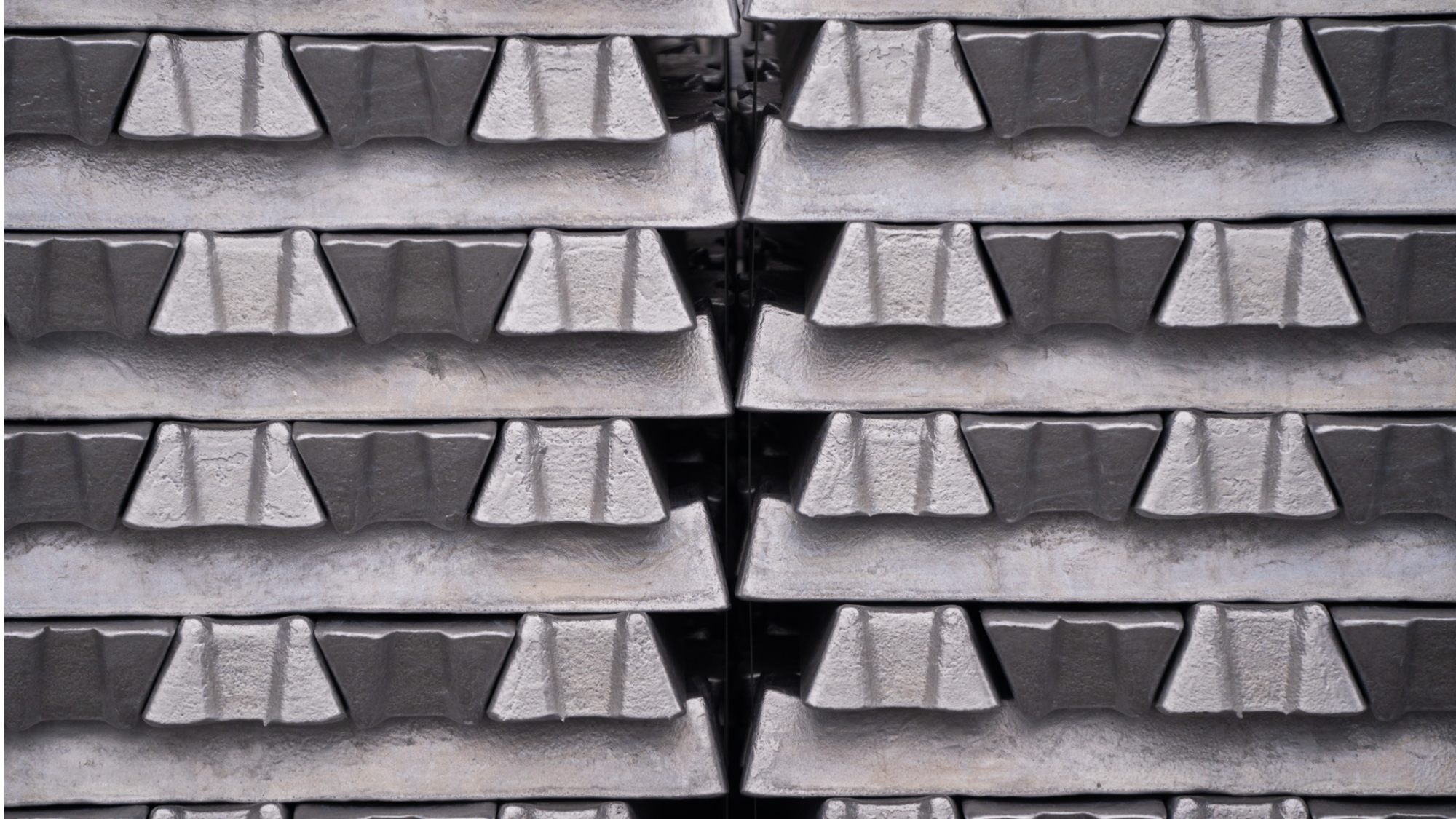

The Inner Mongolia autonomous region-based company, which mainly engages in the production of primary aluminum and alumina, said it plans to use about half of net proceeds for expanding overseas production. The rest will be put toward green-energy projects, working capital and general corporate uses.

ALSO READ: Expert: Hong Kong IPO momentum to carry into 2026

The offering comes amid a buoyant market for aluminum, which is trading near a three-year high as construction of AI data centers helps fuel demand. There has also been a recent comeback for Hong Kong’s share-sale market — Hillhouse, Millennium and Jane Street have participated as cornerstone investors in other Hong Kong IPOs this year.