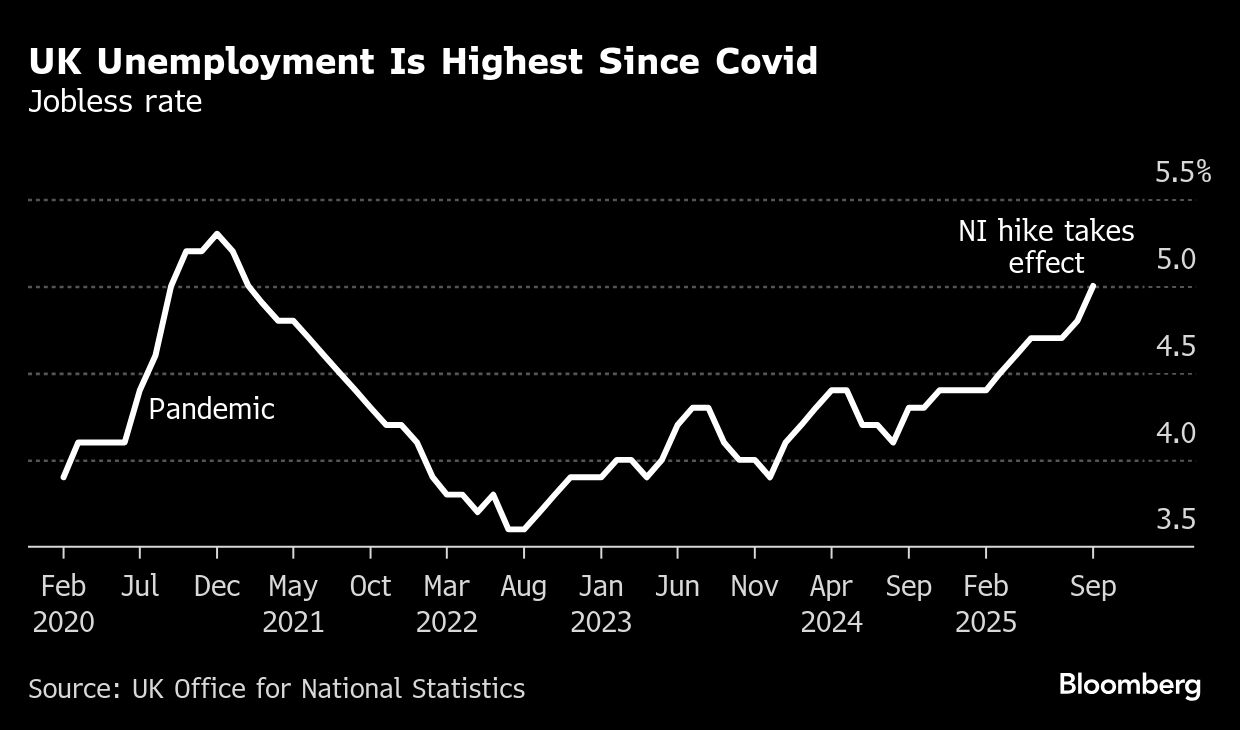

UK unemployment rose more than expected, prompting traders to add to bets on a Bank of England interest-rate cut next month.

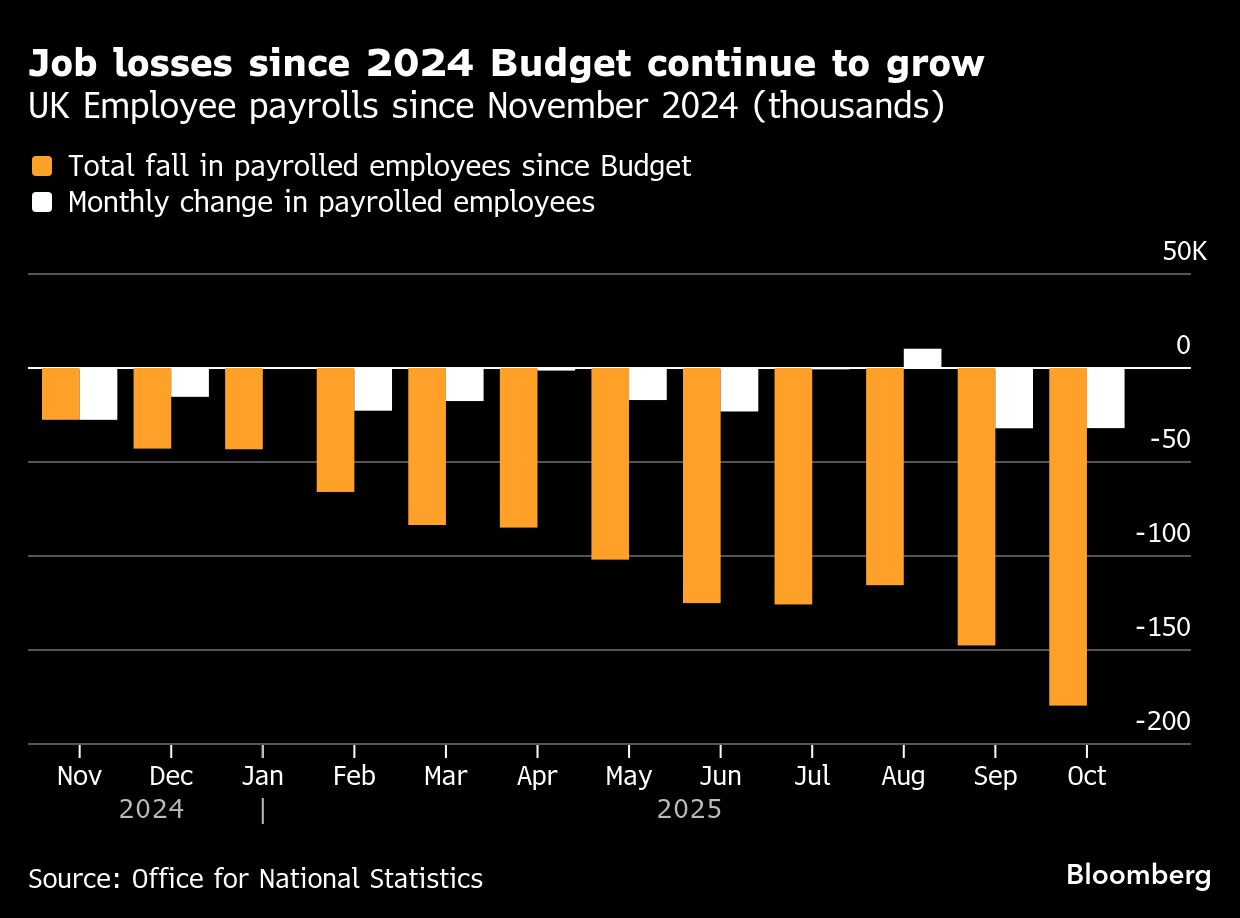

The jobless rate climbed to 5 percent in the three months through September, up from 4.8 percent the month before and the highest since early 2021 when the economy was under COVID-19 restrictions, the Office for National Statistics said Tuesday. Economists had forecast a rise to 4.9 percent. Separate tax-based data showed the number of employees on payroll fell 32,000 in October following a downwardly revised 32,000 in September.

Private-sector pay growth slowed to 4.2 percent from 4.4 percent. It was the weakest reading since early 2021 and in line with the median expectation of economists.

ALSO READ: UK business warns against ‘Death by a thousand taxes’ at Budget

Traders increased wagers on BOE rate cuts after the data, and are now pricing in more than an 80 percent chance of a move at the next meeting in December. That’s up from 68 percent on Monday. The pound extended declines, falling as much as 0.4 percent to $1.3121.

The report provides further evidence that the labor market is weakening. Policymakers voted to hold interest rates at 4 percent last week in a tight 5-4 decision that appeared to set the stage for a reduction in December.

Governor Andrew Bailey, who voted to keep rates unchanged, signaled he could be persuaded to cut in December if data in coming weeks confirm his view that inflationary pressures are easing. Citing a weakening labor market, he said downside risks were more likely to materialize than upside risks.

“Taken together these figures point to a weakening labor market,” said ONS director of economic statistics Liz McKeown.

READ MORE: Reeves’ efforts to blame Brexit for UK budget woes face pushback

Crucial to the December rates decision will be the Nov 26 budget, when Chancellor of the Exchequer Rachel Reeves is expected to lift taxes on households to fill a fresh hole in the public finances. That could hit growth and bear down on inflation, unlike her first budget when hikes to employer payroll taxes prompted many firms to raise prices.

Rising unemployment is likely to provide ammunition to doves like Deputy BOE Governors Dave Ramsden and Sarah Breeden who favored a cut at the last meeting. The fall in payrolls last month bring to 180,000 the number of employees lost since Reeves’ first tax-raising budget in October last year.

The number of vacancies in the three months to October was up 2,000 from the previous quarter but still below their pre-pandemic level. The number of unemployed people per vacancy — a key measure of slack — was 2.5 in July to September 2025, an increase from last quarter and the highest since 2015.

However, others including Chief BOE Economist Huw Pill believe there is more to do to stop inflation getting stuck above the 2 percent target. Bailey said he’s taking a wait-and-see approach.

The jobs report is the first in a series of data over the next few weeks that will determine whether the BOE will cut interest rates at its last meeting of the year on Dec 18. Next in line are GDP figures out Thursday which will provide the first snapshot of the economy in the third quarter.

Meanwhile, Labour’s first budget is still weighing on the jobs market and fueling pay pressures. Almost half of the firms surveyed by the BOE said they decreased employment in response to the government’s increase in employment taxes, with only 17 percent turning to lowering wages. At the same time, businesses expect to increase wages in the year-ahead by 3.7 percent in the three months to October, an increase from the month before.

Tomasz Wieladek, chief European economist at T. Rowe Price, said the jobs figures “surprised already weak expectations.”

“The labor market works like an on-off switch: it is either tight or loose. The developments are in line with the stagnation in UK employment in recent months.”