Four of the biggest US technology companies flagged plans this week to accelerate capital spending over the next year but investors were most accepting of Google-parent Alphabet's ability to fund its plans from its cash flow.

Alphabet, Microsoft, Facebook-owner Meta and Amazon all announced plans for higher annual capital expenditures as they pour money into chips and data centers.

Shares of all of those companies, with the exception of Amazon, have risen substantially this year on expectations that they will be winners in the AI race. But investors cheered Alphabet's report while pushing Microsoft and Meta stocks lower, as they calculated the costs to each firm of the investments.

Amazon on the other hand soared nearly 13 percent in extended trading after its earnings report showed that its cloud unit, AWS, handily beat estimates with a 20 percent rise in revenue. Investors took that as a sign that Amazon's hefty investments were paying off and that AWS was weathering competition from rivals better than feared, offsetting worries of over-investing in AI.

ALSO READ: Amazon: AWS cloud service back to normal after outage disrupts businesses worldwide

Shares of Meta sank more than 11 percent on Thursday while Microsoft ended the session 3 percent lower, as investors remain concerned about the timeline for returns on their heavy investments.

Alphabet's shares, however, rose as much as 6 percent before closing about 3 percent higher.

A key reason for the gain, analysts say, is the search giant's ability to balance its soaring expenses with strong cash flow.

"I would think that comes into play - to have capital spending be a lower percentage of revenue and cash flow. That maybe gives investors more comfort. All the players are ramping up spending pretty dramatically, and there’s been a lot of concern about pressure on free cash flow," said Dave Heger, senior equity analyst at brokerage Edward Jones.

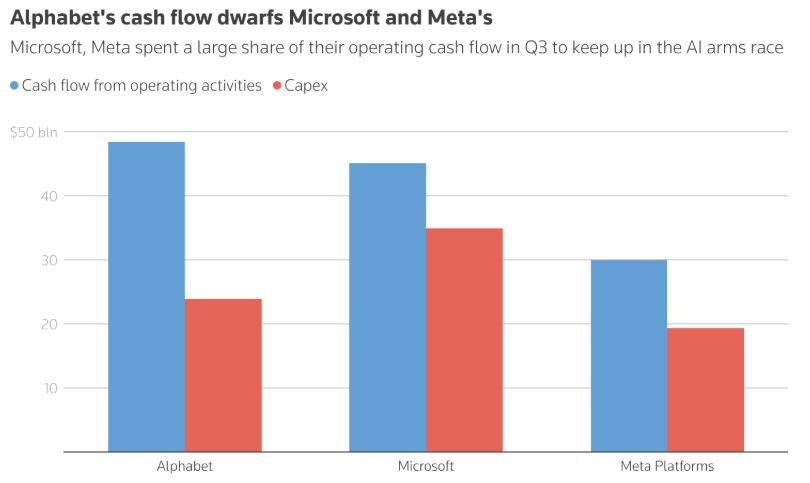

Alphabet's capital expenditure of $23.95 billion in the September quarter was 49 percent of its cash generated from operations. The percentage for Meta, however, is 64.6 percent, with Microsoft even higher at 77.5 percent.

Amazon stands even higher at about 90 percent, but after several quarters of concerns that the company was losing share to Microsoft Azure and Google Cloud, the AWS boost came as an adequate relief.

"Ongoing investments in data centers and AI infrastructure is a theme we've seen across Big Tech this earnings season. But unlike some of its peers, Alphabet is more than covering that spend with cash flow, and it's firing on all cylinders," said Josh Gilbert, market analyst at eToro.

ALSO READ: Alphabet hikes capex again after earnings beat on strong ad, cloud demand

Investors have become wary of AI spending but big tech companies are not detailing exactly how much AI contributes to revenue and profit.

With multi-billion-dollar deals being struck across the AI industry, investors are also growing cautious of a web of circular investments.

Still, executives were adamant that they had to spend to keep up with demand for AI computing power. Meta CEO Mark Zuckerberg said that in the worst-case scenario of over-investing in AI, the company would see "some loss and depreciation, but we'd grow into that and use it over time."

Amazon chief Andy Jassy said on Thursday: "You're going to see us continue to be very aggressive investing in capacity because we see the demand."

Companies with stronger cash flow can afford to invest more aggressively in AI infrastructure because they can tolerate lower returns on those outlays, said Dan Morgan, portfolio manager at Synovus Trust.