Australian unemployment jumped to a four-year high as the economy added fewer jobs and more people sought work, signaling the labor market is loosening and adding to the case for the Reserve Bank to resume lowering interest rates as soon as next month.

The currency and yields on policy-sensitive three-year government bonds slid as the jobless rate climbed to 4.5 percent in September from an upwardly revised 4.3 percent, government data showed Thursday. Employment advanced 14,900 — compared with an expected 20,000 gain — while the participation rate climbed to 67 percent.

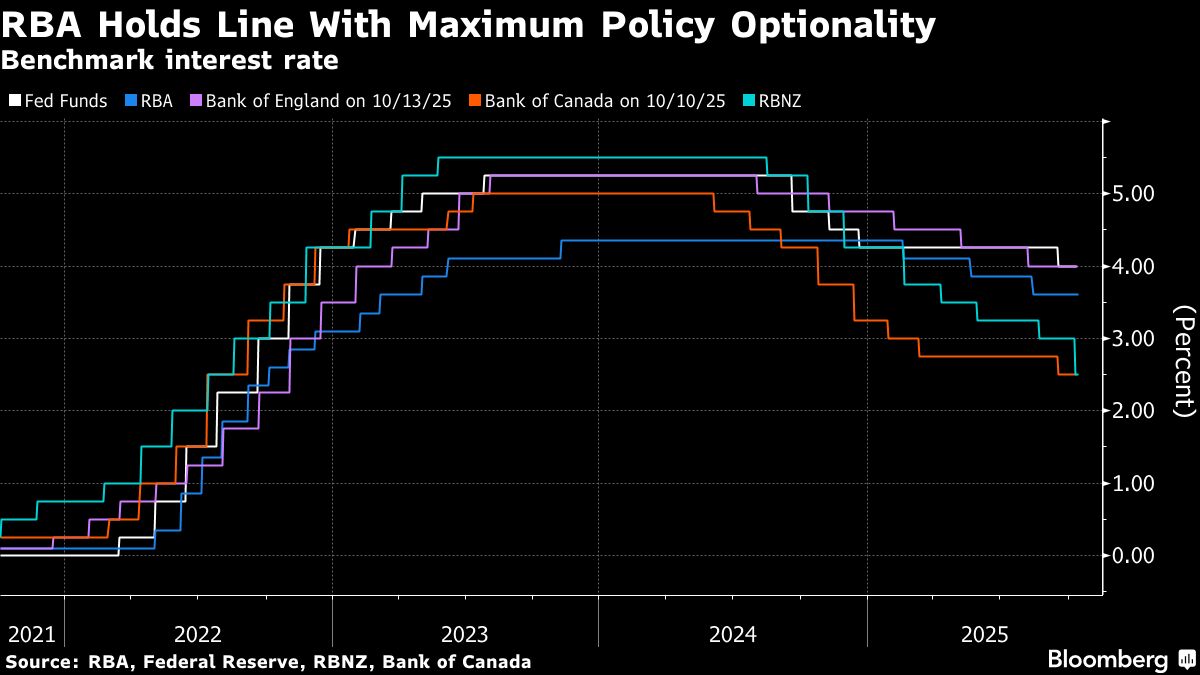

Jobs data are crucial for the RBA’s rate-setting board as the resilience of the labor market, and worries about its tightness potentially rekindling price pressures, have been among factors driving a cautious approach in the current easing cycle. The central bank kept rates unchanged at 3.6 percent last month and officials this week have been highlighting the risk of faster inflation in the quarter just gone.

“All the anecdotal evidence about job losses is now materializing,” said Brendan Rynne, chief economist at KPMG. “At its upcoming meeting, the RBA should be looking to bring the cash rate down to a more accommodating level to help businesses invest and encourage households to spend which should collectively help underpin the labor market.”

RBA officials have repeatedly said they want to preserve gains in the labor market and keep unemployment in the low-4s as they rein in inflation. Last week, Governor Michele Bullock told a parliamentary committee that Australia’s economy is in a “pretty good spot” with inflation inside the 2-3 percent target and the labor market still tight.

At a forum in Washington on Wednesday, the governor characterized policy settings as “marginally tight” at present.

ALSO READ: Australia, New Zealand to boost efforts to integrate economies

“The RBA is increasingly caught between a rock and a hard place. Its dual mandate – price stability and full employment – is now pulling in opposite directions,” said Harry Murphy Cruise, head of economic research for Oxford Economics Australia. “Inflation looks set to come in hotter than the bank’s latest forecasts, while the labor market is weaker than expected. Each development warrant different policy responses.”

Third-quarter consumer price data due out in just under two weeks may make or break expectations for the November board meeting. Traders see a more than 70 percent chance of an easing next month, while most economists in a Bloomberg survey predict the RBA will lower its benchmark to 3.35 percent.

In response to the data, government bond yields tumbled as much as 13 basis points, the most since May, while the currency dropped as much as 0.5 percent.

Australia’s labor market has been a bright spot in the economy, though it has gradually cooled since the start of the year. A widening range of AI tools are causing an undercurrent of job losses with some economists warning that the impact on the global labor market, while only around the fringes for now, is set to get bigger.

AI “already appears to be putting downward pressure on hiring”, James Pomeroy, global economist at HSBC Holdings Plc wrote in a note. “In any cyclical downturn, we could see firms accelerate cost-cutting more quickly – meaning that the impact of AI on the broader labor market could continue to grow as a result.”

Pomeroy warned that firms will be able to operate with fewer staff, either from cuts or by not needing to hire as many people in their growth phase.

“The impact of AI across the global economy continues to build – and although direct signs of labor market stress are limited for now, there are a growing number of jobs at risk.”

READ MORE: Australia cuts interest rates, signals more to come as inflation slows

At the same time, global uncertainty is elevated with the outlook clouded by the Trump administration’s tariff policies and heightened geopolitical tension.