Chinese mainland electronics manufacturer Anker Innovations Technology Co is considering listing shares in the Hong Kong Special Administrative Region as soon as next year, according to people familiar with the matter.

The Changsha, Hunan-based firm is working with investment banks on a plan, the people said, asking not to be identified because the discussions are private.

Anker already trades on the Shenzhen stock exchange, where it has climbed more than 50 percent this year, compared with a 20 percent gain by the Shenzhen Composite Index. The company, which is trading at the highest since early 2021, has a market capitalization of about 79 billion yuan ($11 billion).

Deliberations are ongoing and details such as the size of the potential share sale in the HKSAR have not been decided yet, the people said.

ALSO READ: Netflix-style iQiyi seeks $300 million for Hong Kong listing

Anker did not respond to requests for comment.

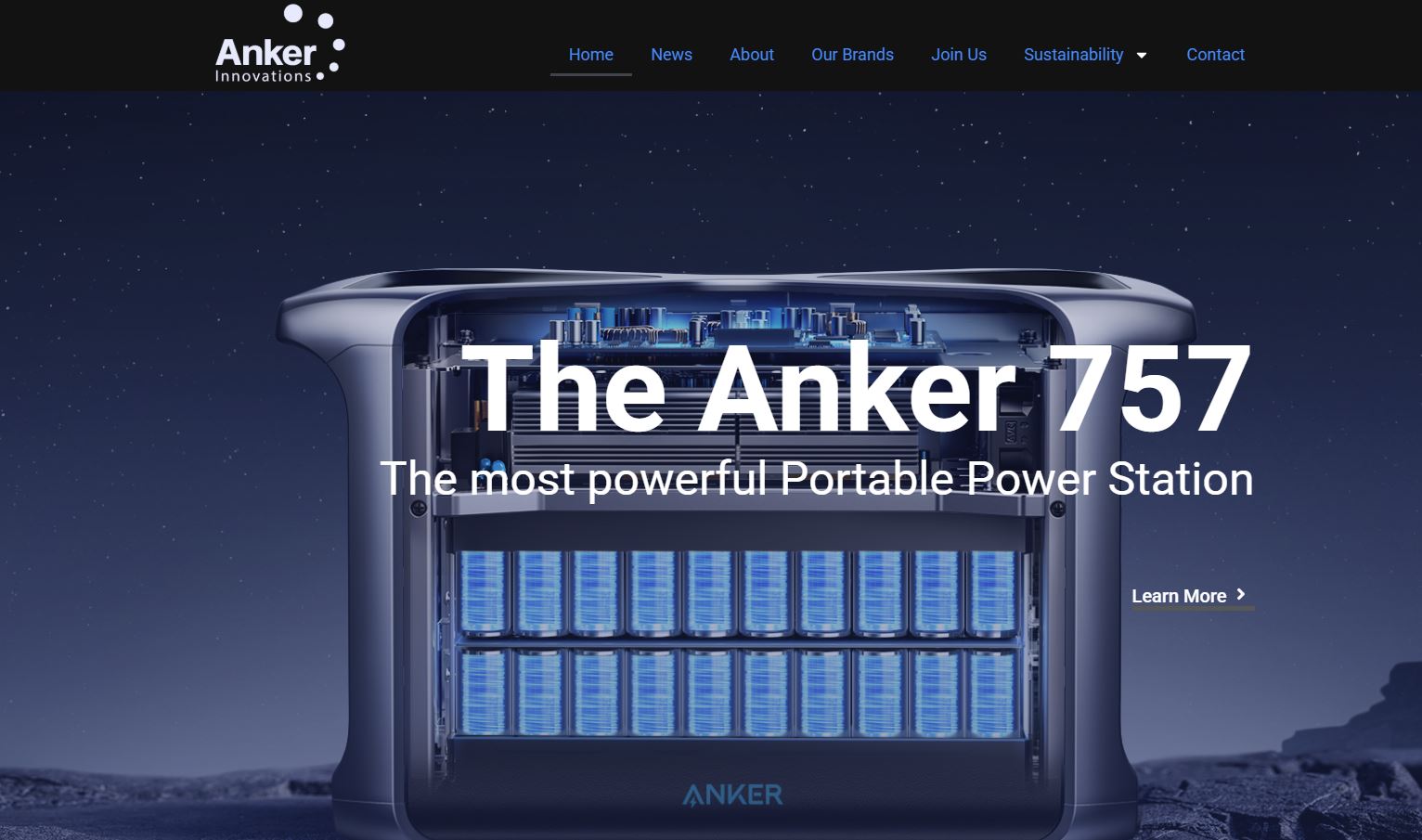

Founded in 2011 primarily as a mobile charging brand, Anker has since branched out into other products, including home entertainment and security systems, 3D printers and robotic appliances. Its revenue last year was 24.7 billion yuan and net income totaled 2.1 billion yuan.

Several mainland-listed companies are considering share sales in the HKSAR, or have already done so, including one of 2025’s global blockbusters — Contemporary Amperex Technology Co Ltd raising more than $5 billion. Overall, first-time share sales in the city have topped $16 billion in 2025, which PwC says puts it on track to be the world’s biggest listings venue this year.

READ MORE: Buoyed by blockbuster HK sale, CATL earnings beat estimates

The Hang Seng Index has rallied over 26 percent since the start of January.