Hong Kong signed a comprehensive avoidance of double taxation agreement (CDTA), which is the 52nd that the city has concluded, with the Maldives on Monday, setting out the allocation of taxing rights between the two places.

The agreement, signed on the sidelines of the 8th High-level meeting of the Asia Initiative hosted by the Maldives, will help investors better assess their potential tax liabilities from cross-border economic activities, the special administrative region government said in a notification.

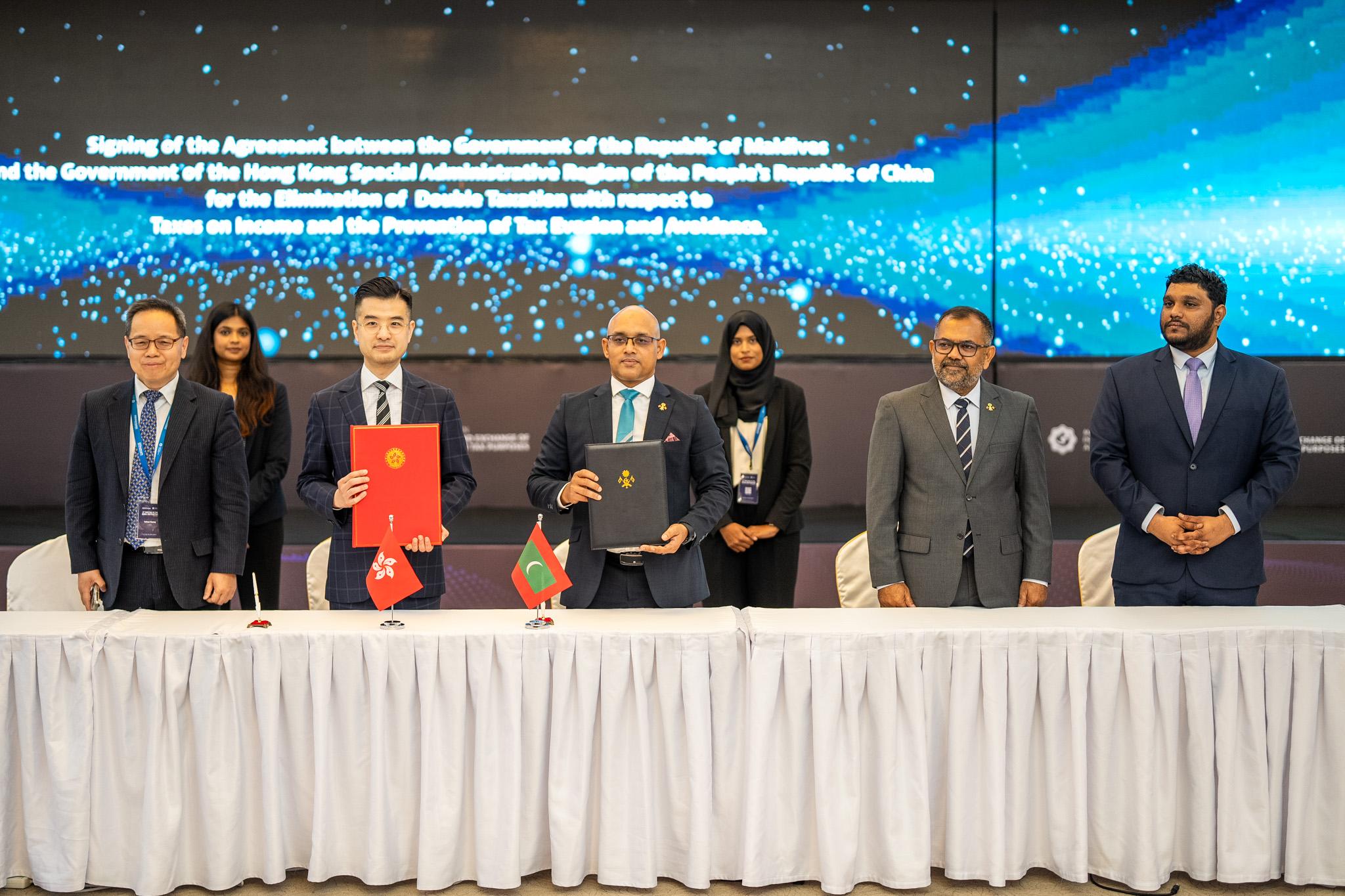

Commissioner of Inland Revenue Benjamin Chan Sze-wai signed the CDTA on behalf of the Hong Kong Special Administrative Region government with representative of the Maldives government, Commissioner General of Taxation of the Inland Revenue Authority Hassan Zareer.

READ MORE: Maldives eyes more FDI inflow

Secretary for Financial Services and the Treasury Christopher Hui Ching-yu said signing of the CDTA with the Maldives, which is a participant in the Belt and Road Initiative, signifies the ongoing achievements of the HKSAR government in expanding the city’s CDTA network, in particular with tax jurisdictions participating in the Belt-Road initiative.

“I have every confidence that this CDTA will further promote economic and trade connections between Hong Kong and the Maldives.”

In accordance with the Hong Kong-Maldives CDTA, Hong Kong companies can enjoy double taxation relief in that any tax paid in the Maldives, whether directly or by deduction, will be allowed as a credit against the tax payable in Hong Kong in respect of the same income under the tax laws of Hong Kong.

ALSO READ: BRI forum calls for closer tax cooperation for smoother trade

The agreement also provides tax relief arrangements.

It will come into force after completion of ratification procedures by both jurisdictions. In Hong Kong, the Chief Executive-in-Council will make an order under the Inland Revenue Ordinance, which will be tabled at the Legislative Council for negative vetting.