International investors are becoming more confident of increasing their asset allocations on the Chinese mainland and across Asia, with Hong Kong as a gateway amid global market volatility, which has buoyed Hong Kong’s stock market and attracted more domestic and international companies to establish headquarters in the city, Hong Kong Financial Secretary Paul Chan Mo-po said on Sunday.

Writing in his weekly blog, he said Hong Kong’s initial public offering market has raised over HK$76 billion ($9.7 billion) so far this year — a more than sevenfold increase over the same period in 2024. The funds secured so far are nearly 90 percent of last year’s total.

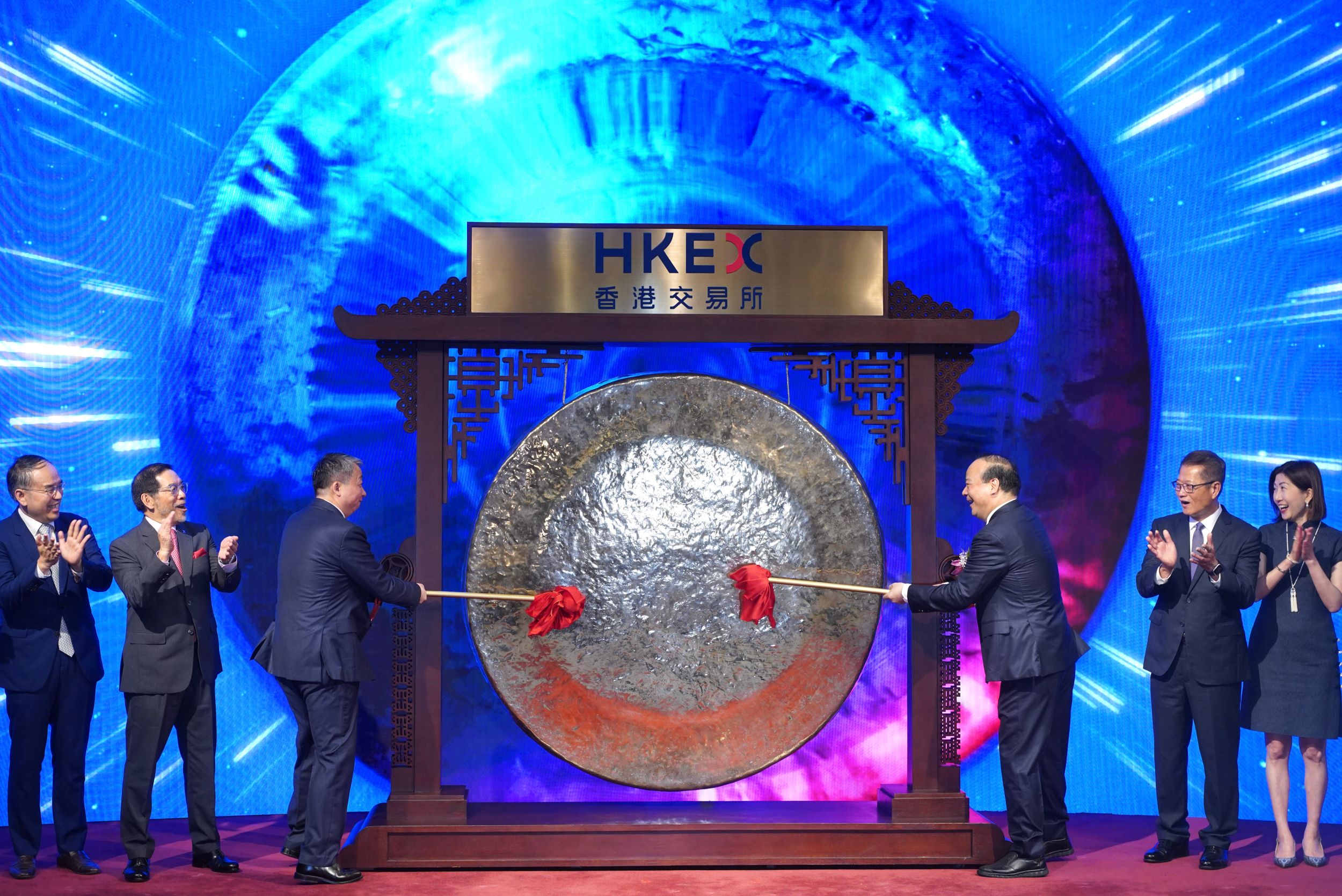

The special administrative region’s IPO market has been active in recent days. Jiangsu Hengrui Pharmaceuticals — one of the mainland’s largest drugmakers — and Singapore-based cancer diagnostics firm Mirxes Holding Co made a strong debut on the Hong Kong Stock Exchange on Friday, with their shares surging by 25 percent and nearly 30 percent, respectively.

Earlier in the week, Hong Kong welcomed the world’s largest IPO this year, with Contemporary Amperex Technology — a leading global electric vehicle battery maker — raising more than HK$35.6 billion.

ALSO READ: Fitch affirms Hong Kong’s ‘AA-’ credit rating, ‘stable outlook’

Beyond the thriving IPO activities, the signing ceremony of the Convention on the Establishment of the International Organization for Mediation will be held in the SAR on May 30, marking a further step in enhancing the city’s international profile.

The new institute’s headquarters will be located at the Old Wan Chai Police Station, which is being renovated and expected to open by year-end.

The ceremony will be attended by Foreign Minister Wang Yi and representatives of 60 countries and regions, as well as 20 international organizations, including the United Nations. An international mediation forum will be held the same day, focusing on topics like mediation of international investment and commercial disputes.

ALSO READ: Chinese firms’ stellar HK debuts spur hopes of valuation shift

Chan said locating such a world organization’s base in Hong Kong will “enhance the city’s appeal as a hub for global trade and commerce”. It will also support economic and trade cooperation among Belt and Road participants, further cementing the SAR’s position as an international trade center, he added.

As part of efforts to consolidate this role, the Companies (Amendment) (No 2) Ordinance 2025 took effect on Friday, enabling enterprises incorporated outside Hong Kong to redomicile to the city more easily and cost-effectively.

Chan said more companies, particularly those engaged in shipping, will relocate to Hong Kong in the near future, after major insurance company AXA Hong Kong and Macao announced plans to redomicile AXA China Region Insurance Co (Bermuda) from Bermuda to Hong Kong on the day the ordinance came into force.

READ MORE: SAR’s redomiciliation regime to consolidate superconnector and super value-adder role

The finance chief said Hong Kong’s strong stock market performance this year and a growing number of firms choosing to establish headquarters and offices in the city reflect the growing confidence global investors and firms have in Hong Kong.

Global market volatility remains following the United States’ credit rating downgrade, raising doubts over the stability of dollar-denominated assets and triggering the need to diversify risk, Chan said.

Despite external uncertainties, the mainland and Hong Kong still provide a stable and predictable environment for international investors, he added.