Once synonymous with mass production and low-cost labor, China's construction machinery sector now leads the world in intelligent manufacturing

At the heart of China's industrial revolution, a quiet yet seismic shift is unfolding. Once synonymous with mass production and low-cost labor, the nation's construction machinery sector now leads the world in intelligent manufacturing, redefining global supply chains amid geopolitical headwinds and technological rivalry.

On a windswept construction site in North China, a towering yellow crane — the XCA4000, the world's largest-tonnage wheeled lifting machine — was being put to work 162 meters above the ground.

"The '4,000' in its name signifies the theoretical maximum lifting capacity of 4,000 metric tons, which is achievable at its shortest boom length and smallest working radius. It has a shortest boom length of 22.5 meters and a minimum working radius of two meters," said Li Changqing, Xuzhou Construction Machinery Group's chief engineer for the XCA4000.

READ MORE: China to promote industrial equipment upgrades

More importantly, the XCA4000 is able to operate efficiently at high altitudes, a crucial feature given its primary role in hoisting wind turbines. Capable of lifting 230 tons — equivalent to the combined weight of over 200 cars — to a height of 170 meters, the XCA4000 is able to keep the crane cab stable while at the same time allowing operators to maneuver the crane with precise movements.

"The machine was developed to meet demand from the wind power markets to address the need of lifting larger wind blades used for generating power with higher efficiency, which is becoming prevalent in the rapidly evolving wind power market," Li said.

Adopting advanced technologies, the XCA4000 has solved problems that are commonly seen with other cranes such as reduced lifting performance at high altitudes and limited space beneath turbine lifting hooks.

Developing the XCA4000 was a complex undertaking and took a team of about 100 researchers around two years to make it a reality. "From lathes to AI, we've built this future with our hands," said Li Ge, a senior engineer.

For over half a century, three generations of Li Ge's family have witnessed China's metamorphosis from a manufacturing novice to a global industrial titan. Their journey mirrors the nation's own: a saga of grit, innovation and unyielding ambition.

Li Ge's grandfather began his career in the 1950s as a lathe operator, a time when China's annual industrial output in 1952 was a mere 12 billion yuan ($1.66 billion).Tools were rudimentary, and precision relied on human skill. He earned the title of "old eighth-grade worker", the highest honor for artisans under the then wage system.

"Grandfather's hands were his instruments," Li Ge recalled. "He could 'feel' metal imperfections others missed." In an era when factories relied on imported blueprints, workers like Li Ge's grandfather laid the groundwork for China's early industrialization, producing everything from screws to locomotive parts.

About two-to-three decades later, Li Ge's father, Li Zongjiu, joined XCMG. His role coincided with China's reform era, as the country pivoted to global integration. His notebooks — now family heirlooms — document sleepless nights troubleshooting problems in production. "He'd wake up at 3 am with a solution and bike to the factory," Li Ge said.

Li Ge's father's career spanned XCMG's rise from a regional player to a national champion. In 2010, China's manufacturing value-added surpassed the US for the first time. "Father's generation bridged the gap between craftsmanship and mechanization," Li Ge said. "They taught us that imitation is a start, but innovation is the finish line."

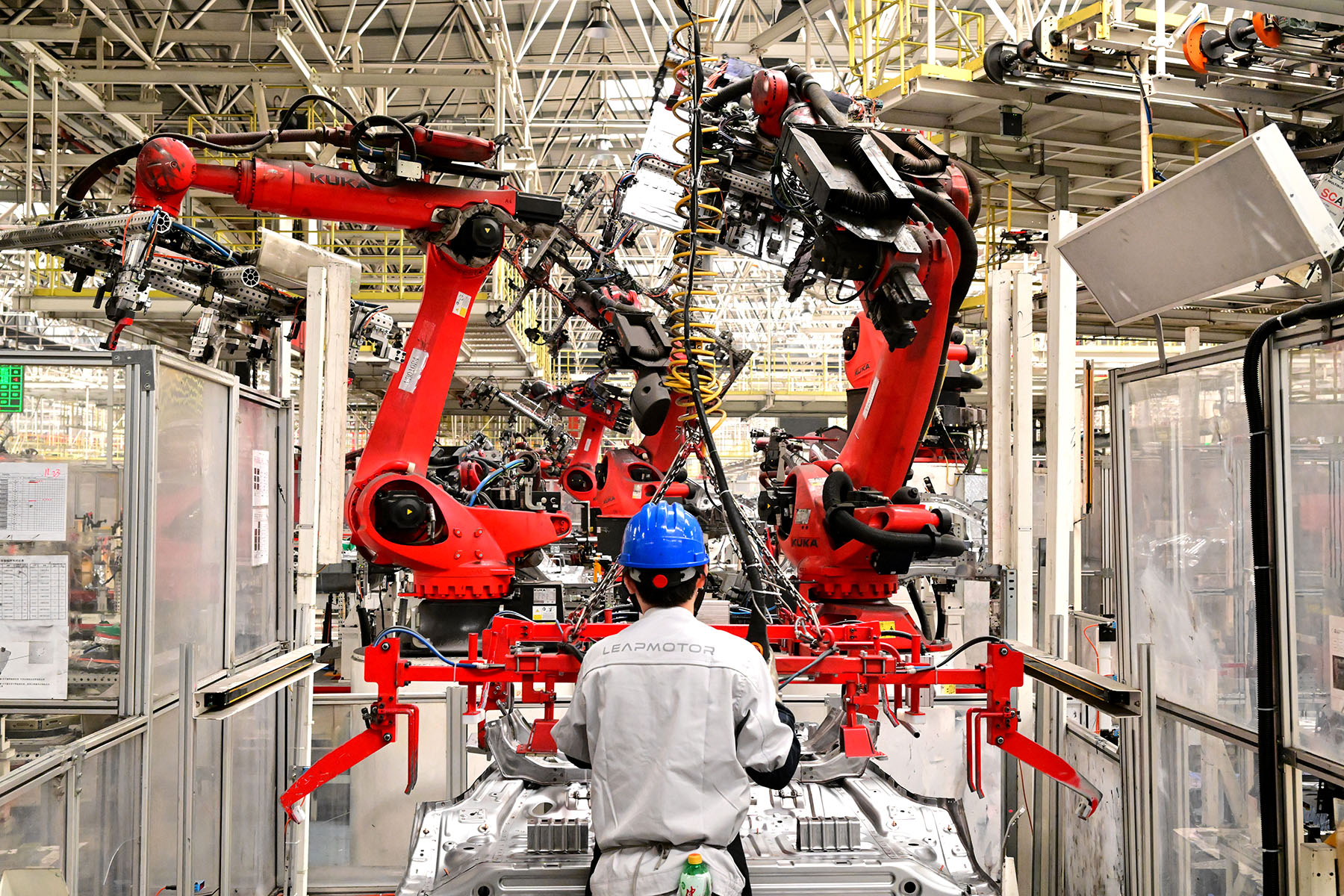

For decades, China's manufacturing dominance was built on scale. Today, fueled by artificial intelligence, 5G networks and an unrelenting policy push, the nation is redefining its role in the global supply chain.

According to the Ministry of Industry and Information Technology, China's intelligent manufacturing equipment industry reached a scale of over 3.2 trillion yuan last year. Thus far, 421 national-level intelligent manufacturing demonstration factories, tens of thousands of provincial-level digital workshops and smart factories have been nurtured. Artificial intelligence, digital twins and other technologies are being applied in over 90 percent of the demonstration factories.

Emerging industries such as artificial intelligence, biomedicine, high-end equipment, new energy and smart cars, have risen rapidly, becoming important forces driving the upgrade of industrial structure and enhancing manufacturing competitiveness, said experts.

According to data from the China Association of Automobile Manufacturers, cumulative production and sales of new energy vehicles in 2024 reached 12.888 million and 12.866 million units, respectively, representing year-on-year increases of 34.4 percent and 35.5 percent. NEV accounted for 40.9 percent of total new vehicle sales. In the same year, China exported 1.284 million NEV, a 6.7 percent increase compared to the previous year.

Citing calculations from trade bodies, financial media outlet Yicai reported that 2024 national lithium battery production totaled 1,170 gigawatt-hours, marking a 24 percent year-on-year growth. The industry's total output exceeded 1.2 trillion yuan. In the list of rankings released by South Korean battery research institution SNE Research, six out of the top 10 global battery manufacturers in terms of output in 2024 were Chinese companies.

China's development of new energy equipment manufacturing has also made huge progress. According to data from the National Energy Administration, China's new energy industry has honed its skills in open competition, establishing an internationally competitive full industry chain system. China now contributes over 80 percent of the world's photovoltaic modules and 70 percent of wind power equipment. Over the past decade, China has successfully reduced the average electricity-generation costs of global wind and photovoltaic power projects by more than 60 percent and 80 percent, respectively.

Zhang Jianhua, former head of the NEA, said that China's wind and photovoltaic products are present in over 200 countries and regions globally. This not only enriches global supply and alleviates global inflation pressures, but also makes a significant contribution to green energy transformation and maintaining stability in the global energy market.

Huang Qifan, the academic consultant of the Finance 40 Forum, said in a bylined article that the foundation of China's modern industrial system is its manufacturing sector, and the completeness of China's industrial chain is unparalleled globally. He cited the United Nations, noting there are 41 major categories, 207 subcategories and 666 minor categories in the industrial chain. China is the only country with complete coverage of all industrial chain categories, with 40 percent of these categories being the world's top producers.

Simultaneously, the advancements in China's manufacturing industry have brought fundamental, structural and trend-changing effects to its exported products. In 2010, China's exports exceeded $1.6 trillion, with 70 percent being labor-intensive products and 30 percent being technology-intensive electronics and equipment. By 2024, China's exports had surged to over $3.4 trillion, with 90 percent being technology-intensive products and labor-intensive products dwindling to 10 percent.

"Most remarkable is the semiconductor industry. In 2016, the global chip production value exceeded $500 billion, with China importing $300 billion, of which over $100 billion was for domestic consumption and the rest was used for producing export products for foreign and domestic companies. After US President Donald Trump took office in 2017, there was a blockade on chip exports to China. Now, China has dozens of chip manufacturing enterprises, producing chips worth $250 billion in 2024, with exports exceeding $150 billion, making it a major global supplier," Huang wrote.

"The US blockade has spurred China's chip companies to enhance their manufacturing capabilities in mature-process chip production, covering the entire process including mask aligner, chip design, packaging and testing, at half the cost of chips made in the US, Europe and Japan," he said.

ALSO READ: Nearly 50% of surveyed firms to reduce business with US

This is echoed in a recent report by the Cheung Kong Graduate School of Business, which said that a majority of Chinese investors who were surveyed view tariffs imposed by the United States as catalysts for domestic economic restructuring despite short-term pressures.

The survey discovered that 45.8 percent of participants were optimistic about the long-term positive effects of trade disputes on China's economy, while 27.5 percent anticipated negative outcomes. Around 20 percent foresaw no significant impact.

Liu Jing, a professor specializing in accounting and finance at the CKGSB, said: "Although the current US tariff policies pose immediate challenges, they could potentially expedite China's vital economic restructuring and solidify its dominance in key technological sectors."

The study, conducted with approximately 2,100 investors, also revealed that 58.2 percent of respondents viewed enhancing domestic consumption as a crucial strategy to mitigate the challenges posed by trade tensions.

Contact the writer at liuyukun@chinadaily.com.cn