South Korea’s economy contracted in the first quarter, underscoring the fragile state of business activity even before exporters absorbed the full force of Donald Trump’s punitive import duties, and raising fears over the potential for further damage in the region.

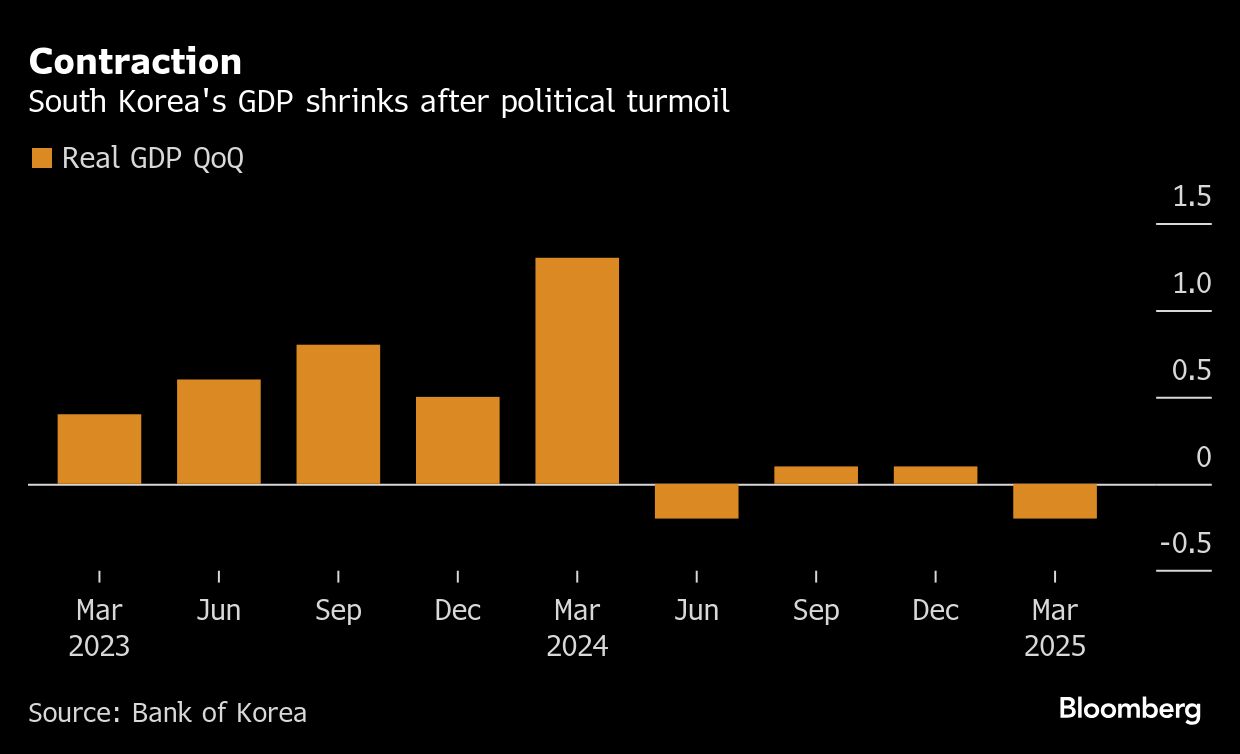

In one of Asia’s first gross domestic product reports for the three months ended in March, South Korea’s economy shrank 0.2 percent versus the prior quarter, according to Bank of Korea data released Thursday, missing economists’ median forecast of 0.1 percent growth. The economy contracted 0.1 percent year-on-year, below the forecast of zero growth.

Prolonged political uncertainties coupled with fears over Trump’s tariffs sapped economic activities, a BOK official said. He added that a clearer picture of the fresh levies’ impact will be available by May or June, considering the time it takes for companies to sign deals and deliver shipments.

ALSO READ: South Korea to seek speedy solution on auto tariffs in US trade talks

South Korean government bond yields declined marginally on the data, while the South Korean won traded mostly flat versus the dollar.

South Korea’s disappointing numbers follow the International Monetary Fund’s downgrade of global growth forecast for this year to 2.8 percent, down from the 3.3 percent predicted in January. South Korea’s growth outlook was slashed to 1 percent from 2 percent projected in January.

The World Trade Organization also drastically revised its projections for global commerce last week, saying it now expects the volume of world merchandise trade to decline by 0.2 percent in 2025 — almost three percentage points lower than it would have been without the US-led trade war.

Early trade data for South Korea released this week showed shipments to the US fell 14.3 percent in the first 20 days of April.

There are other indicators that are flashing warning signals for Asia. A leading index of Asia ex-Japan’s aggregate exports created by Nomura is pointing to weak Asian export growth, with economist Rob Subbaraman saying this week that there is a risk it is underestimating the weakness ahead.

“After all, the US effective tariff rate is currently at levels not seen in a century, with Asia likely to be hardest hit,” Subbaraman wrote in a note, saying early signals from Korea’s first 20-day exports for April suggest a “notable deceleration in Asia’s export growth is on the horizon.”

Thursday’s data back the case for the Bank of Korea to resume rate cuts when it next sets policy on May 29 as policymakers seek to sustain growth at a time when rising trade tensions threaten to hit export-oriented economies such as Korea’s especially hard.

ALSO READ: South Korea's acting president expects positive outcome from US trade talks

Thursday’s data showed that private consumption and government spending were down 0.1 percent, respectively, while facilities investment declined 2.1 percent. Exports dropped 1.1 percent on reduced shipments of chemical products and other equipment. Construction investment fell 3.2 percent.

South Korea, a key US ally, was slapped with a 25 percent across-the-board tariff that has been temporarily reduced to 10 percent for 90 days. As with other nations, South Korea also faces a 25 percent levy on shipments of cars, steel and aluminum. South Korean officials are currently in Washington in an attempt to persuade the Trump administration to lower the duties.

With former president Yoon Suk-yeol now permanently removed from office after his failed martial law decree in December, a snap presidential election on June 3 is seen as a key opportunity to restore political stability and shore up consumer and business confidence in Asia’s fourth-biggest economy. Markets are betting that a new administration will have more firepower and a clearer mandate to take effective actions to revive economic activity.

Economists reckon Asia will likely to be the worst hit from US tariffs, which will drag on regional growth through weaker business investment and sentiment, requiring central banks to step in with looser policy settings.

READ MORE: US, South Korea set for trade negotiation as tariffs hit economy

Last week, the BOK warned the economy faced considerable downside risks from Trump’s trade agenda, but a wobbly won and a surprise pick up in inflation in March helped convince the central to hold interest rates steady at 2.75 percent.

Even as the BOK moved cautiously, the government announced a 12 trillion won ($8.4 billion) supplementary budget plan as it seeks to spur the economy by front-loading fiscal spending.

The central bank had previously projected GDP would grow 0.2 percent in the first quarter. Only two out of the 16 economists surveyed by Bloomberg in April predicted negative growth, while six predicted zero growth. Further out, they cut their forecasts for growth in 2025 to 1.4 percent from 1.6 percent in the previous survey, while the 2026 outlook was trimmed to 1.9 percent from 2 percent.

The Trump administration’s tariffs come at a time when Asian economies are already grappling with tepid growth, with sticky inflation keeping some central banks on high alert. Earlier this month, economists at Goldman Sachs Group Inc cut growth forecasts for Asia, predicting an easier monetary policy stance in India, South Korea and several Southeast Asian economies including Indonesia and Malaysia.