Hong Kong is sharpening its edge as a global IPO venue as the Chinese mainland tightens the screws on tech companies seeking overseas listings, but competition is fierce. Chai Hua reports from Shenzhen.

Chinese mainland and Hong Kong stock exchanges are going all out to attract the mainland’s data-rich unicorns (tech private startups valued at more than US$1 billion) that are mulling listings as mainland authorities step up cybersecurity checks on internet-based companies aiming to raise funds abroad.

Financial experts expect Hong Kong to join in the race to lure unicorns as the mainland’s reviews of companies that launch initial public offerings in Hong Kong may be relaxed. But the experts noted that most of these companies are adopting a wait-and-see attitude as alternative IPO venues still appeal and details of the review regulations are yet to be finalized.

They believe that Hong Kong’s core competitiveness in coaxing more “new economy” firms and enhancing its role as a world financial center lies in digitalizing the financial sector and building up a data hub.

Mainland regulators intensified cybersecurity reviews of internet platforms last month, following several tech companies’ stock debuts in New York. These companies include ride-hailing giant Didi Global, online recruitment podium Boss Zhipin and truck-hailing company Yunmanman.

The Cyberspace Administration of China unveiled draft laws that require internet-based firms with over 1 million users’ personal information to be scrutinized by the administration before they list overseas. The requirement made medical data group LinkDoc Technology, China’s largest mobile sports platform Keep and podcasting platform Himalaya shelve their IPO plans in the United States recently.

The US has long been a favored IPO destination for Chinese firms seeking to “go out”. According to financial provider Eastmoney, 37 mainland companies went public on US bourses in the first half of this year — just two less than the total in 2020.

Other data-rich enterprises which intend to list in the US may also be affected by the latest moves. Now they might consider shifting to other destinations that are also striving to lure technology unicorns.

Luring the unicorns

The Shanghai Stock Exchange’s STAR Market and the Shenzhen Stock Exchange’s Growth Enterprise Market implemented a registration-based IPO system in mid-2019 and early 2020, respectively, making them more appealing to mainland unicorns. The system is aimed at making the listing process more transparent than the approval-based structure under which companies were strictly screened.

China Telecom — the nation’s largest fixed-line and the third-largest mobile telecommunication services provider — went public on the New York and Hong Kong stock exchanges in 2002, but decided to delist in the US in May, citing investment restrictions there. The telecoms giant listed on the Shanghai Stock Exchange today. The step is seen as a trend indicator, with more Chinese industry leaders returning to the mainland market.

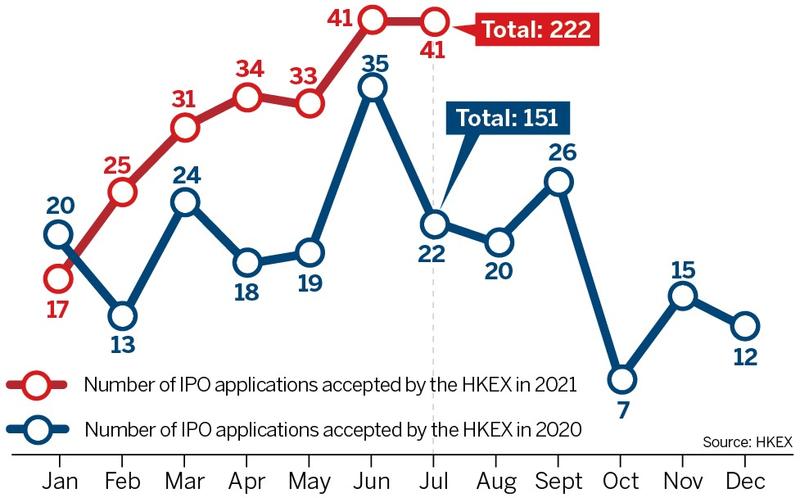

Hong Kong is viewed as one of the world’s favorite IPO venues. About 96 percent of IPO funds raised on the Hong Kong Stock Exchange in the first half of this year involved mainland companies.

Industry pundits said that the trend offers an opportunity for Hong Kong, but reckoned that barriers like a high IPO threshold and less market liquidity need to be considered.

Hong Kong Exchanges and Clearing said last month it has set up a Mainland China Advisory Group and a Mainland Markets Panel to “further elevate HKEX’s role and that of Hong Kong as a key facilitator in China’s connectivity with international markets”.

An HKEX spokesperson stressed that the bourse’s strategy is firmly focused on the mainland. “It is mainland anchored, but the new panel has nothing to do with data review policies,” the person told China Daily. All prospective IPO issuers, regardless of which jurisdiction they are from, must comply with their domestic laws and regulations before going public, the person added.

The HKEX has been ramping up efforts to become more technology-savvy to add muscle to the city’s financial and data development, strengthening its competitiveness in the arena.

Hong Kong introduced a new listing regime in 2018 that supports the listings of innovative companies, including tech firms and those with weighted voting right structures. Edward Au Chun-hing, southern region managing partner at Deloitte China, said this also covers firms that run a lot of data.

HKEX’s most recent initiative was to set in motion an upcoming platform aimed at streamlining and shortening the IPO subscription and settlement cycle. The entire process of the Fast Interface for New Issuance will be seamless and digital, reducing risks for issuers going public during stock market volatility, and enabling investors to make more timely decisions on new offerings.

Au said he believes the platform, which is expected to roll out in the fourth quarter of next year, will help facilitate companies’ flotations in Hong Kong.

Other initiatives taken in support of Hong Kong’s technology goals include the launch of Client Connect, the establishment of the Innovation and Data Lab, and a planned Data Marketplace for sharing data and analytics via a commercial pricing mechanism to mobilize and monetize the vast amount of data being produced.

Expanding services

Au said the regulatory authorities could start preliminary studies and research to explore cross-border data transfers to help “new economy” businesses in Hong Kong and on the mainland expand their services and enhance customers’ experience beyond their borders. This could, in turn, attract more data-rich firms to list in the city. Such measures, he said, will boost Hong Kong’s position as an international financial center.

However, he pointed out that many technology companies remain in a “holding pattern” and have yet to make a final decision on their listing plans as the mainland’s revised regulations have yet to become law and still could be amended.

In Au’s opinion, some tech companies may not be able to meet HKEX’s listing requirements for weighted voting rights arrangements, financial performance or the vetting-focused regime, which is different from a disclosure-based regime in the US.

Furthermore, tech companies with innovative business models that fail to identify comparable peers in Hong Kong’s stock market might still like to seek public offerings elsewhere, he said.

The US market attracts a greater variety of innovative IPO issuers from various countries and has more investment funds and institutions.

Alvin Ngan, an analyst at Hong Kong-based Zhongtai Financial International, said he thinks that some companies will wait and see before making a final decision.

But he is optimistic that the reviews and approval process could be “relatively relaxed” if internet-based firms choose to list in Hong Kong. This would benefit HKEX in the long run if companies find fewer channels elsewhere for listings.

The number of mainland companies inquiring about going public in Hong Kong, or shifting from the US to Hong Kong, has gone up recently, according to a report by online financial news platform 21jingji, citing a lawyer involved in IPO consultations.

Pan Helin, executive dean of the Institute of Digital Economy at Zhongnan University of Economics and Law, said, however, the mainland’s data review regulations would not completely hinder Chinese companies from raising funds in the US.

He reckoned there could be a short-term effect on the operations of data-rich, internet-based software enterprises as the rules have yet to be finalized, but the impact on hardware producers in the manufacturing, medical and electronics sectors would be negligible.

Contact the writer at grace@chinadailyhk.com