The Chinese mainland’s fast-growing US$157 billion market for exchange-traded funds (ETFs) became directly accessible to overseas investors Friday, at least four years since the plan was first hatched.

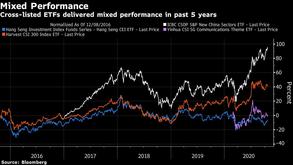

Four so-called “feeder” ETFs began trading in Shenzhen and Hong Kong, the first batch in a project aimed at connecting the two markets. The Shenzhen funds track the Hang Seng China Enterprises Index and the S&P New China Sectors Index, while the Hong Kong-listed ETFs follow the benchmark CSI 300 Index and a gauge of China’s 5G companies.

Four so-called “feeder” exchange-traded funds began trading in Shenzhen and Hong Kong, the first batch in a project aimed at connecting the two markets

ALSO READ: China ETFs give retail investors access to soaring tech, Ant

The investment vehicles, popular with retail traders around the world because they’re among the cheapest way to trade an index, collect capital locally and settle trades across the border. Some 900 million yuan (US$135 million) of funds was gathered in a pre-sale of the ICBC CSOP S&P New China Sectors ETF, said Melody He, managing director at provider CSOP Asset Management Ltd.

Regulators in Hong Kong have been mulling broadening trading links with the mainland to include ETFs since at least 2016. The plan was delayed partly due to complex clearing and settlement issues. At US$40 billion, Hong Kong’s ETF market is smaller than the mainland’s even though its first fund was launched five years before the mainland's in 1999. ETFs on the mainland nearly doubled in value in the first half of this year.

"This development is the result of our ongoing commitment to make Hong Kong Asia's leading ETF marketplace, and represents an important step forward in our continued work with the onshore Chinese exchanges, and our regulators, to deliver a successful ETF Connect," chief executive of Hong Kong stock exchange Charles Li said.

“This is the very start of ETF connectivity,” said Bloomberg Intelligence analyst Sharnie Wong.

Turnover for the two feeder ETFs tracking Hong Kong assets, Yinhua ICBC CSOP S and P New China Sectors ETF and Harvest Hang Seng China Enterprises Index ETF, saw a combined 97 million yuan as of 11:49 am local time., while the two ETFs tracking mainland stocks attracted about HK$1.9 million of turnover in total, according to data compiled by Bloomberg.

While there are ETFs in Hong Kong, London or New York following the mainland's onshore equity market, the tracking error can be as high as 15 percent, partly due to limits on foreign ownership. The feeder ETFs can better replicate mainland benchmarks because their providers are local and won’t be subject to caps. Overseas investors are currently permitted to own no more than 30 percent in yuan-denominated shares.

The mainland's ETFs started to gain traction on the mainland after MSCI Inc added yuan-denominated shares to its benchmarks in 2018

Unlike other major stock markets in the US or Japan, the mainland -- the world’s second largest -- isn’t overrun by ETFs. Individual investors haven’t caught on to the products even though costs can be a lot lower than with mutual funds, partly due to little demand for individual stock research.

ETFs can be traded in real time and in the US are growing increasingly complex and diverse since the first one came about in 1993. The mainland's first ETF was launched by China Asset Management Co. in 2004. They only started to gain traction on the mainland after MSCI Inc added yuan-denominated shares to its benchmarks in 2018.

READ MORE: China's ETFs fast gaining popularity

It could take "six years for northbound trading to contribute 5 percent" to the mainland's ETF turnover, assuming participation of international investors in ETFs is similar to that of A-shares, according to Wong.

“It may take only two years for southbound trading to contribute 5 percent to Hong Kong’s ETF turnover, if mainland investors appetite for Hong Kong-listed ETFs is similar to that of stocks.”

With Xinhua inputs